How to Minimize Risks and Maximize Gains

By Rick Tobin

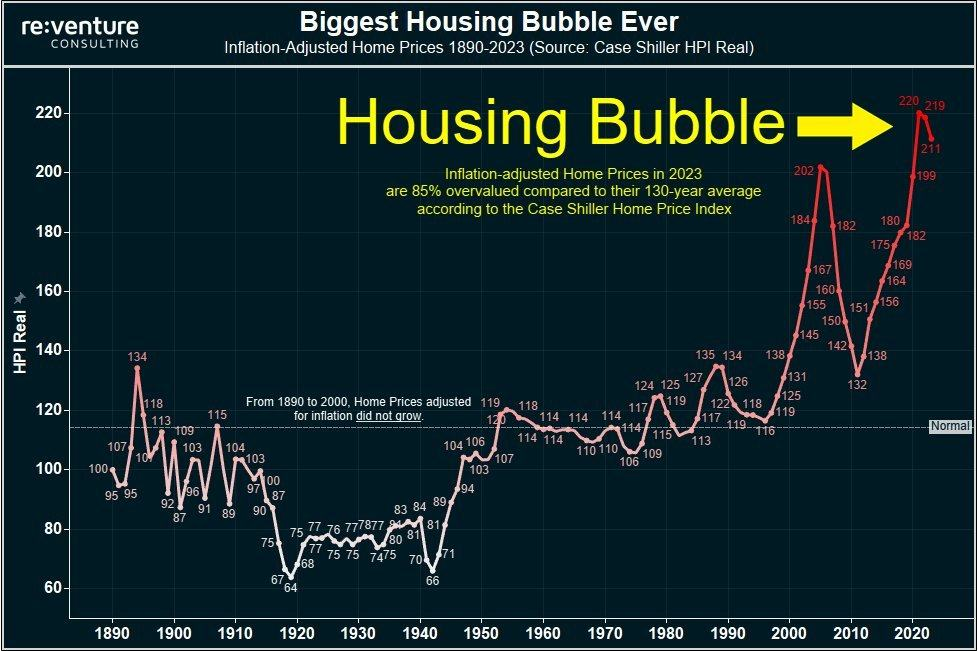

Between January 2020 and present day, U.S. home prices rose a staggering +47%, per S&P CoreLogic Case-Shiller. Are these price trends likely to keep rising at the same pace or not?

How is it possible that the reported published inflation rates are declining while home prices and home unaffordability rates are increasing at the same time?

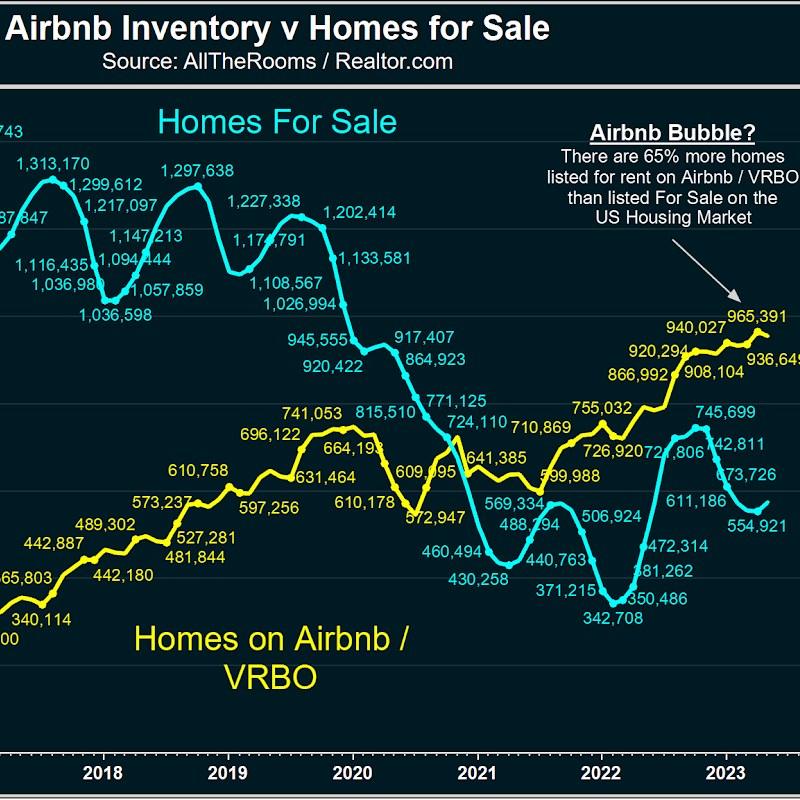

Will home prices decrease, flatten, or increase later here in 2024? The answer partly depends on whether the home listing inventory supply rapidly increases or decreases. It’s all supply and demand economics at the true core.

article continues after advertisement

Let’s take a closer look at some eye-opening housing, inflation, and jobs numbers:

- Before the Fed started raising rates in 2022, a $2,000 monthly housing budget would have bought a home costing more than $400,000. Today, a $2,000 monthly household budget gets $295,000 or less.

- Existing home sales between 1998 and 2007 averaged 6 million per year. Through October 2023, the annual home selling pace was closer to 3.79 million housing units.

- Over the past 50 years (1973 – 2023), home prices rose by nearly 1,300% as compared with a 610% gain in the CPI (Consumer Price Index).

- The inflation-adjusted hourly work wage has increased by just a measly 1% over the past 50 years (not an annual 1% increase, but just a 1% total gain over and above 1973’s wages in 2023 at a 1/50th of 1% increase per year average).

- By comparison, the inflation-adjusted median home price has gained 100% over the past 50 years. As a result, real home prices have increased by more than 100 times (or 100x) the real wage gains.

Sources: CPI, Federal Reserve, and ZeroHedge

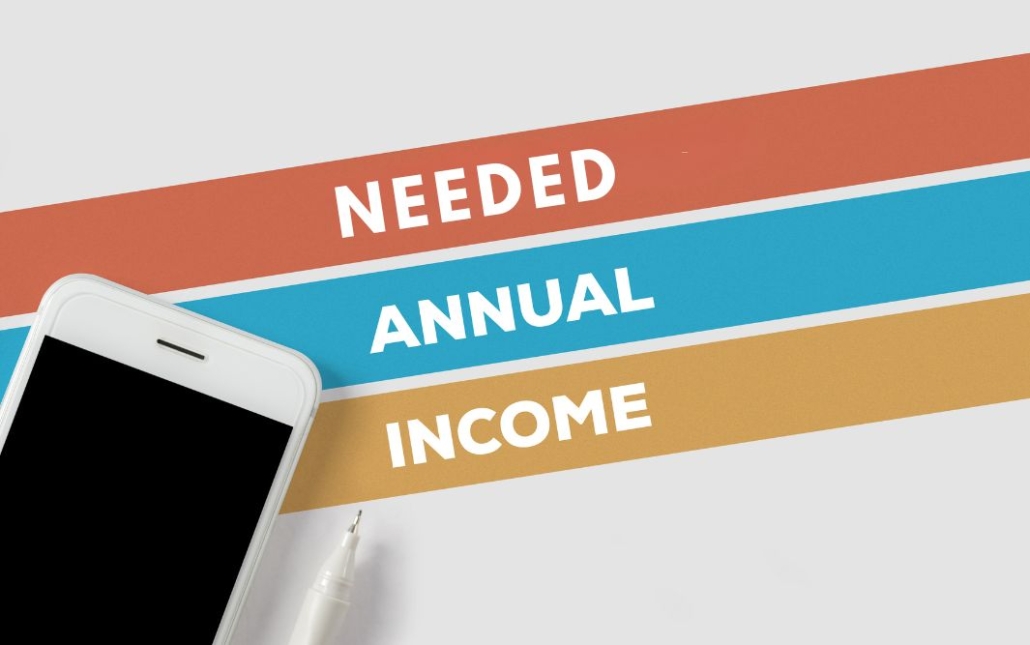

To be able to afford the median-priced home of $433,100 in late 2023, a household needed an annual income of roughly $166,600. However, the median household nationwide earns just $74,580, which is only 45% of the recommended amount.

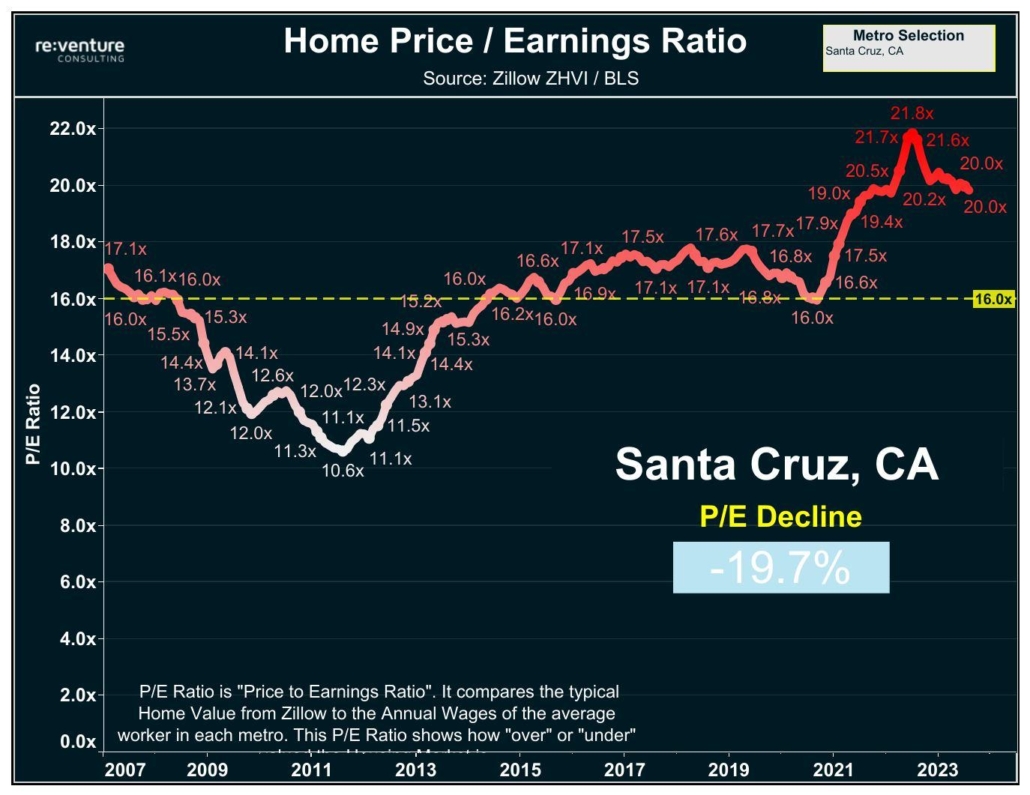

By comparison, the median-priced home in California reached almost $860,000 in recent months. This is almost double the national median-priced home average.

As it relates to the lock-in effect, it does not matter too much if the homeowner’s mortgage rate is 6%, 4%, or 2% if they lose their job and main source of income. Foreclosures will likely rapidly increase this year as the true unemployment numbers skyrocket, sadly. It then creates a downward spiral for the neighboring homeowners as future foreclosures become the latest sales comps while creating more upside-down homes with negative equity. Later, more underwater homeowners will walk away if they have no equity to protect.

The latest house payment ($62,165) as a percentage of household income ($94,964) number ratio is 65.46% here in California ($62,165/$94,964 = 65.46%).

Approximately 60% of all homes owned in America are owned by people over the age of 50. Average home prices across the nation have increased 45%+ since the pandemic declaration back in March 2020. At some point, more older Americans will likely list their homes for sale to take their gains and to downsize at the same time while pushing the home listing inventory numbers higher.

If you have cash or access to third-party loans or equity partners, there will be some incredible buying opportunities this year and beyond.

Water Damage and Extreme Weather Swings

It’s getting increasingly difficult to obtain insurance for both owner-occupied and rental properties. A mortgaged residential or commercial real estate property is required to have sufficient amounts of insurance coverage, or the lender may consider it to be the equivalent of a mortgage default that would later lead to a foreclosure filing.

The #1 cause of damage to homes is usually excess water from rainstorms, heavy snowfall, floods, leaky roofs, or broken pipes. Fewer than 2% of Californians have flood insurance coverage for their homes. The horrific flooding in San Diego last month will likely cause significant losses for residential and commercial real estate properties as well as push insurance premiums skywards for local San Diego County and statewide residents.

Florida is #1 for the highest annual homeowners insurance premiums that are near $9,270. How much worse will it get after hurricane season begins?

Please make sure that you have multiple insurance coverage options from your preferred insurance broker just in case you receive a cancellation notice in your mailbox in the near future.

Commercial Real Estate

Upwards of 44% of office buildings nationwide with a mortgage are now claimed to be upside-down with negative equity here near the start of 2024. Later this year, the negative equity numbers should keep rising. How will this potentially impact banks and the overall US economy later this year and next?

CNBC recently published this article entilted vacant office spaces on the rise, with over 100 million square feet available in Manhattan.

This 100 million square foot number is equivalent to 40 vacant Empire State Buildings. Occupancy rates for office buildings in that region continue to remain under 50%. How many of these empty offices will later be converted to residential units?

Blackstone, the world’s largest owner of commercial real estate and a spinoff of BlackRock, is walking away from some of their distressed and upside-down commercial properties.

Year-over-year office building price percentage losses (’22 – ’23)

1. San Francisco: -58.9%

2. Chicago: -48.3%

3. San Jose: -48.0%

4. Philadelphia: -45.1%

5. Los Angeles: -44.6%

6. Orange County, CA: -38.4%

7. Dallas/Ft. Worth: -37.6%

8. New York: -37.3%

9. Austin: -31.5%

10. Boston: -24.2%

Source: Green Street News (data for all office sales, not just for Blackstone deals)

There are another one million new rentals coming to market by 2025 over and above the 1.2 million new apartment units that were built over the past three years, according to REjournals. Will this drive down rental prices even more due to excess supply?

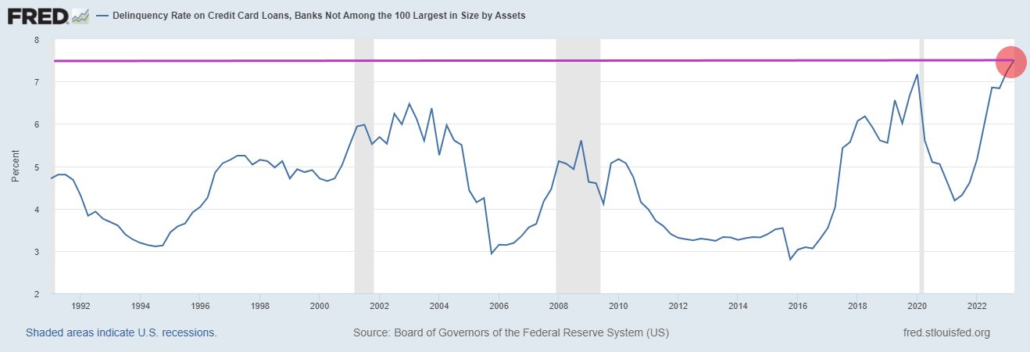

Banks

Between 2017 and 2023, more than 10,000 bank branches closed nationwide. From January 1, 2023 through October 19, 2023, banks fired 20,000 employees. Yet, an additional 42,000 bank employees were let go in the final 72 days of the year between October 20th and December 31st for a grand total of 62,000 bank layoffs in 2023. Will these numbers accelerate in 2024?

Next month on March 11th, the Federal Reserve is terminating their “safety net” for many banks that’s called the Bank Term Funding Program (BTFP). After the financial system almost collapsed last year in March 2023, it was the BTFP bailout programs that possibly prevented bank runs after many banks became technically insolvent. On March 12th, private money may become quite popular as a backup lending solution because fewer banks may be able to lend to even their most creditworthy clients.

The banking dominoes continue to fall…

The push towards the “Basel III Endgame” banking regulation, which requires banks with assets over $100 billion to set aside more capital or cash reserves while driving down their ability to lend, is almost here.

Basel is a reference to the city in Switzerland where the world’s superbank, named the Bank for International Settlements, is located. They govern all central banks worldwide, including the Federal Reserve. We may see an increasing number of bank closures and mergers this year and next, partly due to these new regulations.

article continues after advertisement

China’s Defaulting Real Estate Marketplace

Here comes the next potential Asian Contagion event and derivatives debt tsunami from Evergrande (3333.HK stock symbol – they were once China’s largest real estate developer) as I’ve been writing about for several years. Country Garden, also ranked as high as the #1 largest real estate developer in China, is having their own serious financial challenges as well. It could force many Chinese investors to sell off their US Treasury holdings, which, in turn, may drive the 10-year Treasury yield and corresponding 30-year fixed mortgage rates higher.

January 2024 was somewhat reminiscent of the Russian financial crisis (stocks, bonds, and currency implosions) that spread to Asia (aka Asian Contagion) and South America back in 1998. At the same time, the derivatives investments held by Long-Term Capital Management (LTCM) were so volatile and at risk that they ran out of money while almost taking down the world’s entire financial system at the same time.

Several large financial institutions were asked by the Federal Reserve to put upwards of $100 million each to save LTCM’s derivatives bets so that the financial system wouldn’t collapse. The only investment firms that refused to bail out LTCM in 1998 were Lehman Brothers and Bear Stearns. Ten years later in 2008, they were the first big investment firms to implode as the Credit Crisis (primarily related to a frozen global derivatives market) worsened and were not bailed out either, ironically.

Never forget that the global bond and currency markets absolutely dwarf all stock markets combined. Get your popcorn ready and keep a close eye on financial institutions in China, Russia, Germany (Deutsche Bank, especially), and here in the U.S.

Jobs Layoffs and Declining Cash Reserves

Job layoffs accelerated +136% in just one month between January 2024 and December 2023. Cash reserves held at banks are near all-time record lows right now. A recent survey found that 60% of the U.S. population has $500 or less in their checking accounts. Just 12% of the U.S. population has $2,001 dollars or more in their checking accounts, as per GoBankingRates.

Ballooning Corporate Debt

The U.S. corporate loan maturity amounts that ballooned or will be ballooning or coming all due and payable by the following year-end dates:

- December 2023: $230 billion

- December 2024: $790 billion

- December 2025: $1.070 trillion

- December 2026: $1.105 trillion

- December 2027: $1.055 trillion

- December 2028: $1.240 trillion

- December 2029: $802 billion

Many corporations will be forced to refinance their debt at much higher rates while increasing their costs and decreasing their profits. As a result, more corporations will likely look to reduce their monthly costs, which may include increased job layoffs, sadly.

Between October 2019 and April 2023, there were more jobs created for foreign-born workers than for native American workers, as per ZeroHedge. My guess is that the foreign worker percentages have increased at an even faster pace between May 2023 and January 2024. In 2023, there were more illegal immigrant crossings in the USA each month than the total number of monthly births for US residents.

Government and Consumer Debt

According to Michael Snyder’s article entitled The United States Has The Biggest Government In The History Of The World By A Very Wide Margin, let’s take a look at some of these published numbers:

- Upwards of 3 million people work for the federal government.

- The federal government spent 6.13 trillion dollars in 2023. This figure is larger than the GDP of every nation on the planet except for the U.S. and China.

- More than 70 million Americans are on Social Security.

- More than 65 million Americans are on Medicare.

- More than 81 million Americans are on Medicaid.

- More than 41 million Americans are on food stamps.

Consumer and government spending trends: US households racked up $17.29 trillion in record debt last year (mortgages, credit cards, auto loans, student loans, etc.). The federal US debt crossed another milestone recently, surpassing $34 trillion. By comparison in 2009, US debt was only $10.6 trillion. Between 1980 and 1990, the total overall federal debt only increased by $2 trillion.

We’ve borrowed:

* $1 trillion over the last 3 months

* $2 trillion over the last 6 months

* $11 trillion over the last 4 years

In the previous housing crash here in California (2007 to 2012), average home prices fell to a still all-time state record amount of -41.7% from peak to trough.

- Nearly 30% of Americans are behind on one or more debt payments.

- 56 million Americans had unpaid credit card balances for more than a year.

- 40% of student loan borrowers have still not made a payment even after the recent October 1, 2023 student loan payment restart date after three years of C-19 forbearance.

- Just one late payment can drop a FICO credit score between 80 and 180 points.

Out of Chaos Comes Opportunity

Inflation is likely to remain elevated here in 2024. Historically, the ownership of real estate has proven to be an exceptional hedge against inflation while rising at a similar pace or higher each year.

With consumer debts at all-time record highs and credit card APR rates hovering between 28% and 30%+ and early paycheck loans reaching as high as 330% to 400% APR rates, it’s very important to limit your spending, set aside as much cash as possible if this may be an option for you, and keep your eyes focused on potential real estate bargains in your region.

During volatile economic time periods like seen back during the Great Depression (1929 – 1939), the Savings and Loan Crisis (‘80s and ‘90s), and the Credit Crisis or Great Financial Recession (2007 to 2012), there were incredible buying opportunities for discounted real estate. Please stay focused on your goals and targets rather than on the temporary obstacles.

Rick Tobin

Rick Tobin has worked in the real estate, financial, investment, and writing fields for the past 30+ years. He’s held eight (8) different real estate, securities, and mortgage brokerage licenses to date and is a graduate of the University of Southern California. He provides creative residential and commercial mortgage solutions for clients across the nation. He’s also written college textbooks and real estate licensing courses in most states for the two largest real estate publishers in the nation; the oldest real estate school in California; and the first online real estate school in California. Please visit his website at Realloans.com for financing options and his new investment group at So-Cal Real Estate Investors for more details.

Learn live and in real-time with Realty411. Be sure to register for our next virtual and in-person events. For all the details, please visit Realty411.com or our Eventbrite landing page, CLICK HERE.