By Michael Mikhail

Have you ever thought about becoming a mortgage loan officer and working for one of the Nation’s Leading Private Money and NON-QM Mortgage lenders?

Well, guess who’s hiring? That’s right! Stratton Equities.

As the leading Private Money and NON-QM Mortgage Lender in the United States, Stratton Equities is looking to grow its licensed loan officer team.

2022 was a time of growth and expansion for the company. To support the abundance and high demand of direct inbound organic lead applications in the new year, they have decided to add a new roster of licensed loan officers to their sales team.

Have you been looking for a career as a mortgage loan officer?

Stratton Equities is passionate about creating a system of success for our winning sales team. We guarantee direct organic daily leads, niche loan products with competitive pricing, advanced mortgage technology, and hands-on training with management and support when working with our company.

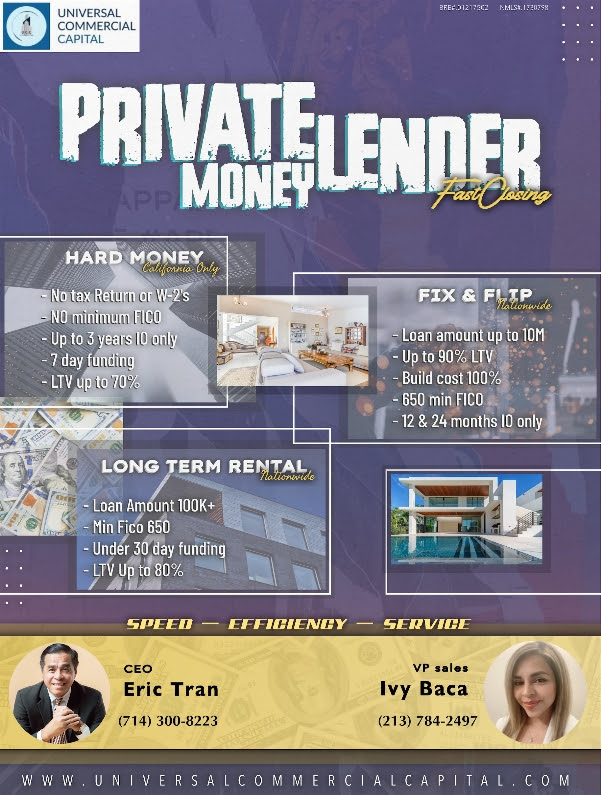

ADVERTISEMENT

When you’re a loan officer, everywhere else, you are hunting your own business, spending money on travel, promotion, and marketing expenses that cost thousands of dollars in hopes of leads or deals. We have solved this problem by providing our loan officers with a stable location and opportunities for pure profit. For example, a Stratton Equities loan officer will structure and price out 15-20 mortgage loan scenarios a day from our direct organic daily leads.

With a significant influx of clientele, we need all hands on deck to get borrowers the best mortgage program to fit their unique loan scenarios.

If you are a licensed Mortgage Loan Originator that is new to the industry and is having difficulty finding business, we have the solution.

Stratton Equities provides our loan officers with inbound organic daily leads from people who call or apply directly to our offices inquiring about a mortgage. Not the other way around.

We have a time-tested training model that includes a proprietary system for lead generation, an open-door policy with management, and one of the industry’s most comprehensive range of mortgage loan programs under one roof.

In addition, we have innovative loan products specializing in different mortgage loan programs such as Hard Money, No-Doc Loans, NON-QM Loans, DSCR Loans, Soft Money Loan Programs, Bridge Loans, Conventional Loans, Fix & Flip Loans, Commercial Loans and more.

Why should you become a Loan Officer with Stratton Equities?

Let’s first start with some motivation and intrigue. Why might someone be interested in becoming a loan officer? Well, as a loan officer, you will be able to work with numerous borrowers and real estate investors all across the United States and help make their investment dreams become a reality.

Here are some of the benefits of joining the Stratton Equities’ Loan Officer Team:

– Direct Organic Daily Inbound Leads

– Hands-on Training & Management Support

– Largest library of niche loan products – say “YES!” more!

-Cutting-edge industry technology

Yearly Earing Potential: $129,086.00 – $189,677.00 per year

Benefits: 401(k), Dental insurance, Health insurance, Vision insurance

As a part of our private lending loan officer team, you can work directly with prospective real estate investors, entrepreneurs, and borrowers on their real estate endeavors.

Stratton Equities has the most extensive library of mortgage loan programs under one roof and can offer borrowers an array of loan strategies. In addition, we work with real estate investors advising them on what mortgage program they should opt for, all while operating under a solid private lender umbrella.

ADVERTISEMENT

We offer the most effective loan options for borrowers and direct access to new, organic leads for all our loan officers. As a result, our interest rates are some of the lowest in private money, starting at 6.99%, and we can pre-approve a loan in 24-48 hours. In addition, our new loan officers are supported to achieve the goal of closing their first loan within 4-6 weeks after training is completed.

Additionally, you will be a part of a massive operation in which you will help structure and maneuver hundreds of thousands to millions of dollars simultaneously with each client. The job will be demanding at times, but those with the patience and integrity to deal with problems as they arise will be rewarded with the satisfaction of pulling off an impressive feat for the financial glory of their clients and themselves.

How to apply to become a mortgage loan officer at Stratton Equities:

At Stratton Equities, we are looking for the following requirement for our new loan officer hires:

– NMLS License (Nationwide Multistate Licensing System)

– Have a minimum of 0-5 years of experience

– Ready to work/relocate to our New Jersey Headquarters Office

– Be a motivated individual and a team player

To be successful as a mortgage loan officer, you should be fully prepared and well-versed in our mortgage loan options. At Stratton Equities, we educate our loan officers through our extensive training program that prepares our team to reasonably help clients as they apply to secure mortgage financing.

Hands-on learning is the best way to become a master of your craft, and that is why we emphasize a direct approach with onboarding, as we want our new loan officers to be fully prepared for the career path and not stumble over minor details.

A license might be the proper prerequisite to knowing how a loan officer works, but finding out the nuances on-the-job will be the ultimate test.

Stratton Equities has openings in its next training cycle in February 2023. They will choose the following candidates for their new loan officer team during the training process.

In the office, training lasts one week, with ongoing management support and education.

Loan officer trainees are trained and supported to close loans on average between 4-6 weeks after the completion of training.

Are you interested in becoming a loan officer with Stratton Equities? APPLY NOW at www.loanofficerscareers.com or email at [email protected]

Michael Mikhail, CEO Stratton Equities

Michael Mikhail is the Founder and CEO of Stratton Equities, the nation’s leading hard money-lender to national real estate investors, with the largest variety of mortgage loans and programs nationwide.

Having launched Stratton Equities in early 2017, Michael has always been an entrepreneur and innovator in the real estate market, purchasing his first home at 19.

A serial entrepreneur with a foresight for business opportunities, Michael had a slew of small businesses prior to launching Stratton Equities. One of his most prolific ventures was a car wash connected to a gym he was affiliated with in Florida during 2001-2002 while attending college.

It wasn’t until he graduated from Florida State University with a degree in Business, that he officially joined the mortgage industry in 2003 and decided to travel to explore his options globally.

After travelling to 19 countries in 5 years, Michael knew two things; he wanted to start his own business and launch it in the United States. He knew that moving back to the states was the best place he could start something small and grow it into something infinite.

In 2017, Michael noticed how the mortgage industry had transformed after the regulations presented from 2008-2012, and knew it was time to set out something on his own, thus creating Stratton Equities.

Under Michael’s leadership, Stratton Equities has grown into one of the biggest leaders in the Mortgage and Real Estate industry across genres and platforms.

Learn live and in real-time with Realty411. Be sure to register for our next virtual and in-person events. For all the details, please visit Realty411Expo.com or our Eventbrite landing page, CLICK HERE.