Ask the Right Questions! To Determine the Viability of a New Loan Request

By Dan Harkey

Educator and Private Money Finance Consultant

949 533 8315 [email protected]

Visit www.danharkey.com

Introduction:

The following is an example sequence of questions that loan agents can use to obtain the information from the borrower. These are suggested. Each loan agent may set up their questioning sequence, which will vary but accomplish the same result.

Conversations with borrowers may be fluid and take the loan agent into complex life stories to obtain intended information. I often pause to let them talk because I know they are upset, not about me but their life circumstances.

Borrowers love to tell you their life’s problems while you are attempting to obtain material facts. Compassionate listening is a natural, thoughtful, learned trait that helps develop trust and lasting relationships.

article continues after advertisement

Any sales career endeavor involving products, goods, or services will have a similar best practices sequence of questioning. All salespeople should take the time to write down a sequence of questions as an effective platform for intended results. The intended outcome is to obtain the material facts, represent the customer with good intentions, explain and answer questions, determine the transaction’s viability, and close and drive the transaction forward. Or decline the transaction if it does not fit the company’s requirements.

Educating a client or customer is part of the job of any professional salesperson. The customer should come away with the idea that the salesperson honestly had their best interest in mind. A byproduct of this philosophy is a lasting relationship, spreading goodwill, and referrals.

Stage I: Questions as a best practices platform include:

• Loan amount, for what term?

• First or second lien?

• Type of property: single-family, owner- or non-owner-occupied, commercial, apartments, industrial, occupancy, or other.

• Loan purpose: This question is paramount if the loan request is single-family owner-occupied. Is the use of loan proceeds primarily for business purposes? Primarily means 51% or more of the loan proceeds. What portion will be used for consumer purposes?

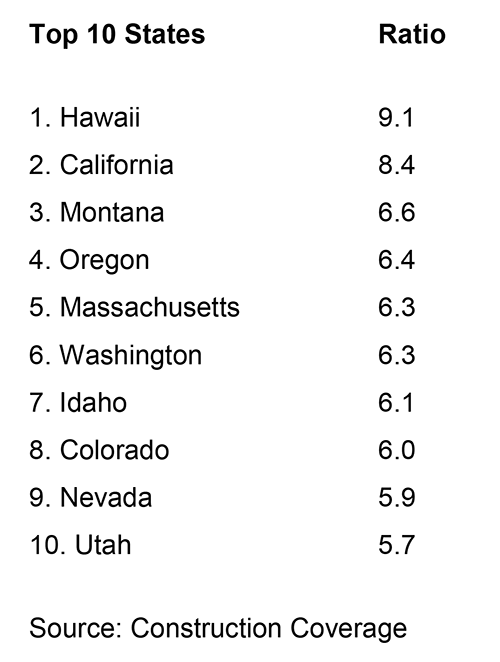

• Where is the property located?

• Property value. How did the borrowers determine the

value? A borrower’s estimate of value is often incorrect or intentionally exaggerated.

• Cash out requested?

• Current total liens

• Are the liens current? If not, how much is the arrearage and the reason? Get the complete story in writing. Completeness may make or break your transaction. Some reasons may be rational, while others are just an attempt to conceal.

• Loan-to-value: LTV ratio total loans divided by appraised property value (APV)

• Description of collateral property.

• Property address

• Exit strategy: What are the borrower’s plans to repay this loan?

• Rental income stream? What gross rents, vacancies, and expenses are required to determine net operating income, often called NOI? The NOI calculation excludes debt service. Will the NOI cover the loan payments and property expenses?

• Most recent payment statement(s)-Please obtain.

• When was the property purchased, and for how much?

• Have they made any significant improvements or upgrades? Please provide a list of upgrades and costs.

• Pictures of the outside and inside: In most cases, pictures are found online, with Zillow, Redfin, Realtor.com, and Trulia. Photos of the inside and outside are necessary if the property has undergone significant upgrades that enhance its value.

• Is the property owner/borrower a private individual(s) or an entity? If an entity, what is the purpose of the enterprise?

• If the property is newly or partially reconstructed, inside and out pictures are necessary, as well as a list of improvements, costs, and what improvements remain to be completed.

• Any exceptional circumstances? Weaknesses in the transaction include a history of late payments, significant arrearages in payments, accrued unpaid property taxes, outstanding judgments and liens, state and federal taxes due, probate sales, bad credit, open bankruptcy, pending divorce proceedings, tax liens or judgments, the property has a recorded notice of substandard condition, red tagged for code violations, successor trustee acting on behalf of a family trust, multiple borrowers, multiple cross-collateralized properties, etc.

article continues after advertisement

• Forward the prospective borrower a loan application and authorization to obtain credit. Request the most recent property loan payment statement and at least three months of bank statements. Use a commercial loan application rather than a 1003 residential form when possible.

• Ask for a handwritten purpose of the loan letter.

• Does the borrower have an online presence? If they are a company, they may have a website. If they are individuals, they may have a presence on LinkedIn. Does the borrower have a promotional summary about themselves? Add these items to the executive summary sent to the lender. Positive promotional material will add credibility to the prospective borrower.

The above information is sufficient for the loan agent to write an executive summary and email it to a prospective lender. Then, follow up with a phone call.

Stage II: Driving the loan process forward:

• Private money vs. institutional lenders have different borrower requirements, requiring tax returns, recent pay stubs, w-2s, and 1099s.

• Profit, loss, and financial statements are necessary if the borrower is an operating entity. Two data sets, one for personal and one for business, may be required separately.

• In addition to a borrower’s signed letter of interest, loan application, and credit authorization, the agent will need other data, such as a property owner family trust document, an operating statement for a limited liability company (LLC), insurance broker contact information, and association management company contact information.

• If the loan request is for a junior loan, information about the senior loans will be required. Documents for review may include a copy of the promissory note, loan agreements, and a recent payment statement from the senior lien holder or loan servicer. Reviewing the recorded documents related to the senior lien associated with the deed of trust is prudent.

• Does the first lien have a written provision in the deed of trust referred to as an “alienation clause” or a “due on further encumbrance clause” that would require the lender to obtain written approval to place a junior lien on the property? If the loan agent is working on a second lien loan, they should review the deed of trust and the loan agreement to see if there is a prohibition of placing a junior lien without obtaining the first lien lender’s approval.

This fact is important because, in many cases, the original borrower may have been parents, possible deceased members, siblings, co-trustees of a family trust, ex-spouses, or other miscellaneous parties. Some earlier property purchases were taken “subject to” a lien that prior owners obtained in the past. Completing a property sale “subject to” means that the purchaser/borrower purposefully failed to notify the first lien holder of the transfer. Was the sale transfer kept a secret, deliberately to get a lower interest rate? Therefore, the loan documents still show the obligor as the prior owner on the note and deed of trust.

• Does the person requesting the loan have the sole authority to borrow and encumber the property with a new lien? Are there other parties of interest who may object to recording a lien on the property? An estranged ex-husband, ex-wife, business partner, or trust beneficiary would be an example.

• Are there multiple borrower parties that a lender must include in the application, processing, underwriting, and closing process? A lender’s frustration will occur when the discovery that the borrower has intentionally excluded an undisclosed hostile party. I assure you that an unknown borrower party will not fool a good loan processor or the title company. When the title insurer underwrites their coverage, they will ensure that the correct parties have signed the documents. Verifying the proper parties is part of their insurance underwriter and approval process.

• Additional documentation may be required to drive the process forward as a loan processor sets up their file. The loan agent should maintain a respectful and enthusiastic relationship with the processor.

Sifting through the maze of questions and answers to develop a well-written executive summary to send to the lender

Loan agents ask prospective borrowers questions to determine the transaction’s viability. They are responsible for obtaining specific information from the borrower or the borrower’s agent.

Some agents are responsible for asking appropriate questions but then calling a lender with fragmented and incomplete information to discuss the potential loan transaction. The lender will respond that they need more information. The agent will answer, “What do you need?”

There are dozens of questions that may be asked at the front end, but getting to the basics of whether the potential loan transaction is viable is the beginning. Sifting through the maze of complexities includes:

- Property types, income generating, and occupancies,

- Agent’s competency, property ownership variables,

- Borrower creditworthiness,

- Borrower’s propensity to withhold material facts,

- Some borrowers will withhold information, unaware they will get caught while processing the loan. A critical thinking questioning sequence will avoid most of this.

The material facts of the transaction should be summarized and submitted to a lender via email as an organized written executive summary, followed by a phone call discussion. Usually, a request for more information is anticipated. Emphasize the positives first and the negatives later. However, do not bury the negatives so the lender discovers them later.

Lenders have long memories about who is professional and honest, supply only fragmented data, and summarily leave out adverse material facts. After a couple of repeated offenses, the assumption will be that the loan agent withheld the negatives intentionally. Reputations, both negative and positive, accrue quickly. Experience, understanding, and the propensity to fully disclose and protect the lender’s interest will ensure lasting relationships.

After reviewing the material facts, the lender may express an interest or decline the proposed transaction. Or the lender may ask for more information. If you receive a positive response, that is great, and if you receive a rejection, it is a rejection of your request, not a rejection of you. Move on to the next lender. Lenders have different risk assessment standards and pricing structures. For example, some lenders require an independent third-party appraisal, and some do not. Some lenders care about FICO scores, and some do not. Some lenders need assurances about the ability to pay, while others are less concerned. Some lenders should be more skilled in processing and underwriting and, therefore, take riskier deals unknowingly.

The loan agent looks forward to a term sheet or a letter of interest. The written term sheet will state the lender’s terms and conditions to make the loan subject to an appraisal and underwriting of the material facts submitted by the borrower.

The above is helpful as a platform for questioning borrowers for adequate information to submit to a prospective lender to obtain an expression of interest, a terms sheet, or a letter of interest.

I sincerely hope that you find value in this article. If so, please forward it to your associates. Please refer your friends and associates to me at [email protected].

Thank you,

Dan Harkey

Dan Harkey

Dan Harkey is a contributing author to Weekly Real Estate News and is a Business & Financial Consultant. He can be contacted at 949-533-8315 or [email protected].

Learn live and in real-time with Realty411. Be sure to register for our next virtual and in-person events. For all the details, please visit Realty411Expo.com or our Eventbrite landing page, CLICK HERE.