The Unaffordable Housing Crisis

By Rick Tobin

Can it be true that finding homes to live in using creative seller-financed transactions may soon become easier and more affordable than qualifying to lease or purchase a home with traditional financing options?

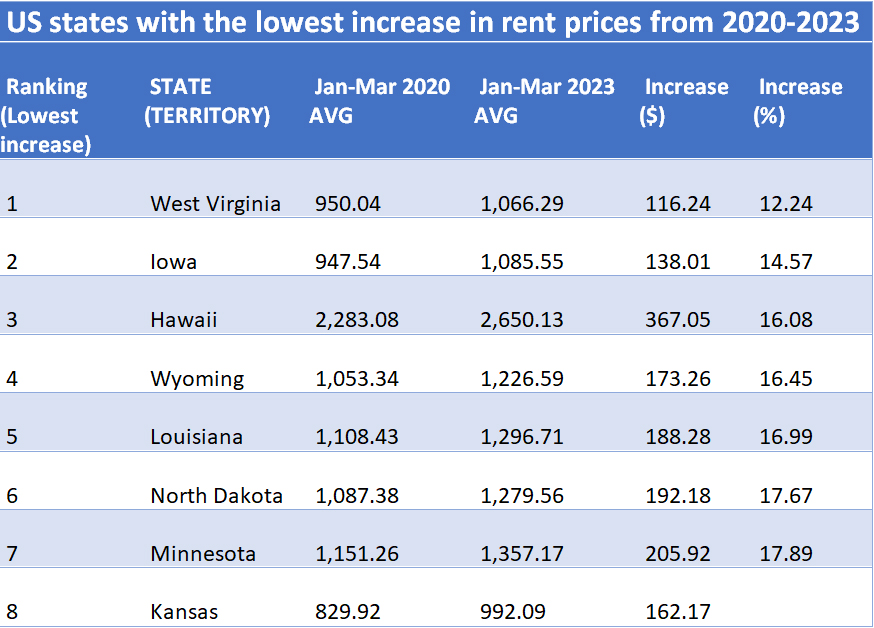

The typical home today is about $80,000 higher than it was just two years ago. The average monthly rent payment today is more than $1,000 higher than it was in 2020. Middle-income first-time buyers are unable to afford 70% of homes.

To qualify as a tenant, many landlords require that the tenant applicant’s income be three times the proposed monthly rent. In California where some average rents are $3,000 to $5,000 per month, the qualifying household income would need to be somewhere between $9,000 and $15,000 per month. Additionally, a significant deposit and the paying of at least one month’s rent upfront can be challenging for many tenant applicants.

Most Expensive Home Regions

San Diego is ranked as the #1 most expensive housing market in the nation, as per this U.S. News report. In more recent times in late 2022 and early 2023, San Diego’s home price-to-household income ratio almost reached an average of 15x (15 times), which is three times higher than the national average of 4x or 5x.

“In April 2023, the median listing home price in San Diego, CA was $999K, trending up 6.3% year-over-year. The median listing home price per square foot was $698. The median home sold price was $877K.” – Realtor.com

The main criteria for this Top 10 ranking of the most expensive cities in the nation included the median home price and average salary. In spite of using 2021 household price data, this analysis was recently published in May 2023 and is used as a forecast for the 2023 to 2024 years.

1. San Diego, CA

Average median home price 2021: $889,225

Average salary: $67,200

2. Los Angeles, CA

Average median home price 2021: $807,498

Average salary: $63,056

3. Honolulu, HI

Average median home price 2021: $581,658

Average salary: $61,860

4. Miami, FL

Average median home price 2021: $490,162

Average salary: $54,790

5. Santa Barbara, CA

Average median home price 2021: $464,954

Average salary: $62,020

6. San Francisco, CA

Average median home price 2021: $1,082,875

Average salary: $86,590

7. Salinas, CA

Average median home price 2021: $986,702

Average salary: $56,350

8. Santa Rosa, CA

Average median home price 2021: $828,156

Average salary: $64,080

9. San Juan, Puerto Rico

Average median home price 2021: Not Available (N/A)

Average salary: $31,650

10. Vallejo & Fairfield, CA

Average median home price 2021: $562,567

Average salary: $64,270

The ranking of Santa Barbara, California as #5 is a bit confusing because of the incredibly low median home price that is listed for this region. This data count estimate must take into consideration inland properties that are very far away from the ocean. Homes near the beach in this beautiful region are closer to $2 to $20 million.

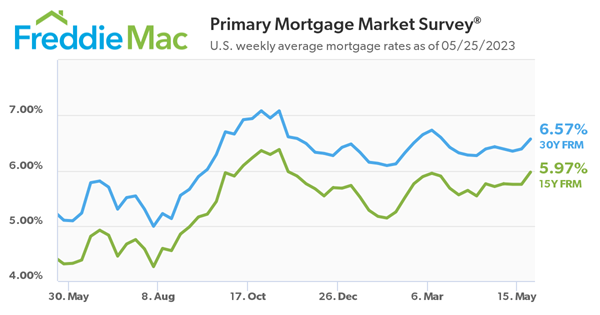

Rising Household Income Requirements

Data provided by the California Association of Realtors (20% down payment and 30% front-end DTI or debt-to-income ratio estimates) for the following Southern California counties shows us how ridiculously high the household income requirements now are to purchase a median (or middle) price home based upon the rising mortgage rate trends:

Ventura County: A$205,200 household income is required to purchase an $828,750 home.

Los Angeles County: A $185,200 household income is needed for a $746,750 home.

Orange County: A $296,400 household income is required for a $1.2 million dollar home.

Riverside County: A $148,000 household income is needed for a $597,000 median home price.

San Bernardino County: A $115,200 household income would be needed to purchase a $464,500 home.

Please note that these “median” home prices are right in the middle of the county home averages. For properties close to the Pacific Ocean, the home prices may be 2, 3, 5, 10, 15, or 20+ times higher.

The average owner-occupant in recent years has used just 6% as a down payment instead of the 20% down payment number used for this California Association of Realtors (CAR) estimate. As a result, it’s more likely that the average loan amount for each borrower would be higher and also require mortgage insurance for loans above 80% loan-to-value (LTV). If so, the qualifying household income would probably be much higher than what’s listed on this county forecast estimate provided.

Disappearing Homeowners Insurance

In California, both State Farm and Allstate announced that they will no longer offer new homeowners insurance policies. In recent times, Geico closed down all of their California offices and Progressive stopped advertising in the state. The California FAIR Plan with limited coverage and higher costs than other plans, which is considered the last resort option for homeowners who can’t seem to qualify for other insurance plans, just announced another nearly 50% hike for their annual premiums.

Florida (#1 most expensive homeowners insurance state), Louisiana, Texas, and many other states are tightening up their insurance policy requirements as well or pulling out of these states, so it’s not just happening here in California. Some homeowners insurance policies in Florida are three or four times higher than the national average near $1,800 due to the extreme flood and weather risks there.

Right now, many insurance companies are focused more on not writing new homeowners insurance policies. What happens when some of them later change these restrictions to not allow the renewal ofactive policies?

More than 70% of all homes in California have a mortgage (lenders require active insurance in place to protect their interests also), which is higher than the national average. With fewer insurance plan options available, an increasing number of homeowners will be inspired to sell here in California, Florida, and elsewhere while pushing the listing inventory supply higher.

ADVERTISEMENT

Declining Purchasing Power for the Dollar

It’s not Americans “spending too much” that’s causing record inflation. Rather, it’s the combination of the record printing of dollars and the skyrocketing government debt spending that’s crushing the purchasing power of our dollar while making housing increasingly unaffordable to lease or purchase.

Generally, the loosening or tightening of the money supply is the root cause of periods of extreme inflation or deflation. For example, the M1 (cash, checking, etc.) money supply went from $4 trillion in January 2020 to $20 trillion in October 2021 in just 22 months. As the supply of new money reached the economy, the purchasing power of the dollar rapidly declined and fewer goods, services, and assets could be purchased with the same dollars as I’ve shared before.

Paying Loans Back

At some point, debts have to be paid back if the borrower doesn’t plan on filing for bankruptcy. This is true whether it’s an individual or a billion-dollar corporation with two billion in massive debt.

After more than three years of deferred student loan payments due to the pandemic declaration, millions of consumers will be faced with the reinstatement of monthly payment obligations for student loans starting in late August 2023.

Unpaid student loan debt reached more than $1.75 trillion and automobile loans surpassed $1.55 trillion by April 2023. It’s a $393 per month average payment for student loans. There’s another $1 trillion for all unpaid credit card debt at a 24% rate average.

Consumer spending usually represents about 70% of the US GDP (Gross Domestic Product). Student loans equal 7% of GDP. Approximately 64% of the $1.7 trillion in student loan debt has been in forbearance for the past three years, which equates to $1.1 trillion.

Millions of other homeowners haven’t made a monthly mortgage payment as well as far back as 2020. At some point in the future, mortgage lenders or loan service companies will also require the collection of monthly payments with or without a forbearance or loan modification plan in place.

ADVERTISEMENT

New FHA Bailout Loan Proposal

It appears that FHA is proposing a 0% interest 2nd loan bailout for the millions of their distressed mortgage borrowers who may be months or years behind in their payments. It’s called the Payment Supplement Partial Claim.

The previously proposed FHA bailout solution offered was a loan modification option which would have doubled or tripled the homeowner’s current rate while not dropping their payments at all. Again, there are millions of distressed FHA loans nationwide that are months or years behind.

Preparing for New Opportunities

As I shared in my previous article entitled A 33-to-1 Vacant & Distressed Home-to-Listed Home Ratio, there are potentially upwards of 18 to 20 million vacant (abandoned, 2nd, and rental homes) or distressed homes in the nation. If just a relatively small percentage of these homes are listed for sale or go into foreclosure, it may more than double or triple the national home listing supply while driving home prices downward.

If and when mortgage rates and other forms of consumer debt rates continue to rise right alongside the national home listing supply, an increasing number of sellers will welcome the creative seller-financed transactions that I share with my So-Cal Real Estate Investors Club members and with my real estate course students across the nation.

For example, how would you like to purchase a home with a minimal down payment, no formal loan qualification, and take over a 2.75% fixed mortgage rate payment that’s lower than a nearby rental?

Now is the best time to learn about creative real estate investment strategies that very few people truly understand well before the housing market begins to change direction yet again. Denial is no longer an option. If you’re the first person to go in a different direction than your competition, you’re more likely to be the first person to succeed due to your preparation.

Rick Tobin

Rick Tobin has worked in the real estate, financial, investment, and writing fields for the past 30+ years. He’s held eight (8) different real estate, securities, and mortgage brokerage licenses to date and is a graduate of the University of Southern California. He provides creative residential and commercial mortgage solutions for clients across the nation. He’s also written college textbooks and real estate licensing courses in most states for the two largest real estate publishers in the nation; the oldest real estate school in California; and the first online real estate school in California. Please visit his website at Realloans.com for financing options and his new investment group at So-Cal Real Estate Investors for more details.

Learn live and in real-time with Realty411. Be sure to register for our next virtual and in-person events. For all the details, please visit Realty411.com or our Eventbrite landing page, CLICK HERE.