Image from Pexels

By Dan Harkey

Business & Finance Consultant

cell 949-533-8315 email [email protected]

“Being and Time” written in 1927, best discussed the concept of authenticity, of being, and caring. Martin Heidegger, a German philosopher, is an excellent read. In Heidegger’s study, he referred to as “Dasein,” which means “Being-there.” One may interpret it as “being-ever-present.” Also, to be fixed, embedded, and immersed in the physical, literal, and tangible day-to-day world. Another good read about the development of Heidegger’s concept of authenticity is in the book, Eclipse of the Self by Michael E. Zimmerman.

In the late-1970s into the early-1980s, I developed a unique strategy and grew from a high school business teacher to one of the highest producing real estate agents between Newport Beach to San Clemente between 1978 and 1984, and later in the mid-2000s to produce up to $10-25 million per month in sales volume in the real property lending business. On a side note, I developed the business curriculum in the 1970’s for Saddleback School District in Orange County, CA. The classes included word processing/keyboarding, typing, business math, consumer education, economics, and accounting. This was pre-computer science days.

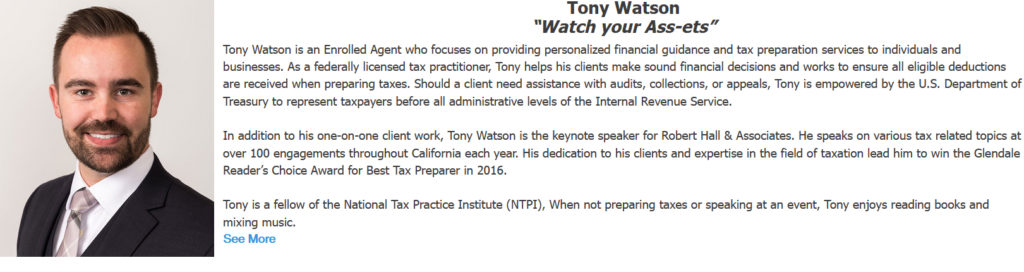

ADVERTISEMENT

Before 1980, I was an early adopter of cross-selling. I created a real estate brokerage, a public escrow company to close the sales, a mortgage company to originate residential and commercial real estate loans, and a general insurance agency to place the insurance policies on the purchased property. Additionally, the insurance agency placed investment property coverage, liability coverages, auto insurance, life & disability insurance. An adjunct company that I formed was a property management company to manage residential and commercial rental income property, including commercial leasing.

Effective salesmanship is a learned skill set but developing into an authentic and unique being is the treasure. Confucius and Dan say, find a man who enjoys his work, and you will find a person that will never work another day in his life.

If one’s objective in the sales business is to follow up with your few friends, the potential success will be minimal. An effective sales network starts with a few but grows into thousands and tens of thousands.

The 80/20 rule applies to the sales profession. 20% of the salespersons develop 80% of the sales. Conversely, 80% of the salespeople develop 20% of the sales and resulting profits. Successful salespersons are willing to do the heavy lifting and do tasks others refuse to do.

It will help if you start by defining your universe of possibilities. In other words, what is the maximum and broadest number of individuals or prospects that you may develop to sell your products, goods, or services? Is it 1 or 1000 or 10,000? Size matters! A salesperson’s understanding of this process may be limited by lack of experience, willingness to take the risk, or just plain lack of enthusiasm for engaging in a long- term systematic enterprise. A more straightforward explanation is that some people are just plain “lazy and irresponsible.”

Image from Pixabay

I have consulted with many eager salespersons. Yes, the size of one’s prospect lead base matters. But relationships matter more. The size of a prospect network may start with 10 or 20 but grow to 1000 or more. You may start with a smaller number but limit the number of lead potentials unless you sell multimillion-dollar products with a considerable profit margin. Two examples may be Caterpillar and airplanes. These items cost from mid five hundred to hundreds of millions of dollars.

You may want to formulate a strategy to communicate daily to develop new business leads that, hopefully, will become lasting friendships. Therein lies the process, how do you turn prospects into friendships. I do not want to suggest that you create superficial but develop friendships that are bonded by authentic caring and communication. Can you call a friend and have a general conversation and enjoy the time spent without the thought of getting something out of it?

Herein lies the struggle between the salesperson who will never or only marginally become successful and one that can develop into a master salesperson with life fulfillment in relationships with others.

Image from Pixabay

Yes, you locate a buyer; you do not create one. In other words, if you were taught that slick language, like handling the objections and then switching to assumptive close works, Fuller Brush Company and Encyclopedia Britannica may have a job for you. Also, using online tools like LinkedIn and Facebook may be effective or a complete waste of time. A new link with a new person is only the most minute beginning and introduction to developing a future relationship and eventual friendship.

To be effective, a salesperson needs a good customer relations software package (CRM) to manage prospects, memorialize conversations, histories, families, events, interests, backgrounds, and essential aspects of developing a friendship. The effective salesperson needs an email marketing system like Salesforce or MailChimp.

The more you understand your friends more the relationship will grow. They will look forward to talking with you, and you will have mutual interests. And, of course, you will enjoy talking and sharing things that are interesting to you.

Now comes the strategy of calling 10 to 25 prospects per day to become friends over time. What can you do for them? How can you assist them in accomplishing their goals? Continue the exercise until you develop so much business that you can hire assistants. Delegate as much of your job tasks to others, then get back on purpose.

Image from Pixabay

If you make your outbound calls and receive an answerphone, leave a message, then follow up with an email with a purpose message. “Just calling to catch up,” or “Just called to check if I can do anything for you or your clients,” Or “just called to share an interesting article or news segment that I read.”

A difficult part of any conversation is developing the habit of listening rather than doing most of the talking. No, I am not that interesting, no matter who told us we were. It is easy to talk about me when having conversations with others. We can all become amused about ourselves and our life histories. It is imperative to stop talking and start listening.

Developing authentic friendships that will choose to work with you will be a natural transition from acquaintance to business prospect to genuine friendship. The process requires you to learn about your friend’s background, family, and what is important to them, not about you. What can you do to improve their lives, help their client, or help them put bread on the table?

Find a person who develops enough friendship relationships to do business, and you will both have a whole and enriched life. The journey is never complete!

Developing your unique ability will create a positive magnet around you so that people will be drawn to you through developed friendships, social networking, enhancing your satisfaction, professional career, and the same for those who meet you.

ADVERTISEMENT

My opinions, which comes from experience:

- 20% of the people and friends in your life give you 80% of life’s satisfaction. Conversely, 20% of the negative, disrespectful, and unreliable people will result in 80% of the dissatisfaction. Tolerating people with negative attitudes, belligerent, rude, condescending, game playing, or jealousy does not fit into a satisfying life journey. Included in this group are superficial, sycophantic, and parasitic friendships. Eliminate all these people from your life, pronto?

- Develop a management infrastructure and support system around you. These may be employees or independent contractors. Only with a whole support staff and operational techniques and strategies can you develop into high sales volumes and consistently deliver a quality outcome. If you allow weak staff members or weak systems, this will drag you down and make you marginally effective.

Thank you for taking the time to read this article.

Dan Harkey

Dan Harkey is a contributing author to Weekly Real Estate News and is a Business & Financial Consultant. He can be contacted at 949-533-8315 or [email protected].

Learn live and in real-time with Realty411. Be sure to

register for our next virtual and in-person events. For all the details,

please visit Realty411Expo.com or our Eventbrite landing page, CLICK HERE.