By Karen A. Walker

For Los Angeles Police Department (LAPD) Officer and master real estate investment teacher and trainer Alton Jones and his wife, Rocio, it’s all about relationships, helping others succeed and being your best self. Every day. Every minute.

But while Jones has helped people succeed in real estate investing beyond their wildest imagination, he doesn’t promise, and never himself expected, overnight success. His experience as a police officer prepared him for that.

He knows first-hand that success takes learning, listening, focus, persistence, a good sense of humor, a healthy dose of humility (did I mention persistence?!) and, most importantly, taking action.

That last step—action—can be the most difficult, but simply doing the right things and repeating until it become second nature marks the difference between success and none.

“It’s one thing to talk about it,” says Jones, “but a totally other thing to actually DO it!”

Did you say police officer?

Jones has been an LAPD policeman for more than 34 years. For the first 16 of those years, he served as a full-time, active duty officer. After that—to this day—he serves as reserve officer.

In the last 10 years, Officer Jones has been honored as a Reserve Officer of the Year. Twice!

“Officer of the Year is a big deal,” explains Jones. “A few officers are selected each year and honored for exceptional service during the year. About 600 people attend the honoree dinner, and it’s really a big deal, with any funds raised going to help the families of fallen officers or others in our police family who need it.”

At his more recent honoree event, the main cast and the creator of the TV series THE ROOKIE attended, which made it extra fun.

People skills

Just as in police work, real estate investing involves good training and good people skills. Relationships matter.

Knowing how to talk with a myriad of different types of people can mean the difference between life and death in police work.

“As an officer, especially on patrol, you have to talk with so many different kinds of people—victims, drug dealers, the mentally unstable, drug users on a high, the traumatized, witnesses, violent or less violent criminals,” says Jones. “Good officer safety skills are critical. You also have to be able to get accurate, useful information from witnesses. Those statements have to be able to hold up in court or identify a perpetrator, so you have to know how to ask a question and which information to pursue.

“In addition, sometimes you have just seconds to assess a situation or persons involved. Knowing how to quickly assess and talk with different people can determine if you come home that day.”

In real estate investing, regardless whether you are fixing and flipping houses, negotiating fair win-win deals, managing contractors, or teaching others your proven system for success, it’s critical to develop good people skills and to build strong relationships.

And to build any kind of relationship, you have to be a person of integrity in words and actions.

Knowledge alone isn’t enough

“It’s one thing to talk about it, but it’s a totally other thing to actually DO it!!” says Jones, who gets his students quickly to action.

Again, the comparison to police work is clear.

In the training process you learn how to talk to different people, what you need to ask and what to do in different situations, what information you need, and so forth. But learning it in a classroom doesn’t make you successful.

It’s a different story when you get out on the streets and you’re talking with real people, or in the chaos of an incident and trying to sort it out.

Same for the investor.

Practice (i.e. taking action) sharpens people skills until the right thing to do in negotiating an opportunity or managing contractors becomes second nature.

Never stop learning: Mentors matter

Alton always says, “It’s OK to copycat, as long as you copy the right cat.”

Jones got into the rehab, fix and flip business in 2009. But he didn’t do it alone. He chose his mentors well. He invested in himself and in his success, and he hasn’t stopped to this day.

Even with the success he and his wife have achieved and continue to achieve… even with his rapid rise to being asked and encouraged by his mentors to become a teacher for others, beginning in 2013… even with his popular books and with the success he and his wife continue to nurture and grow in themselves and others… even with all that, Jones continues to listen and learn from others.

Two of his stand-out mentors are Ron LeGrand and Dan Kennedy.

From his mentors, Jones learned early on that to be successful you must be purposeful in all you do. You must run your business as a business, not as a hobby.

He learned what to do and how to do it.

He also learned to expect uphill battles and set-backs, even after you’ve achieved remarkable success.

It is what it is.

Be prepared. Go forward. Keep your eyes on the prize, on doing the right thing, and on serving others.

Knowledge alone isn’t enough

“The majority of people will tell you ‘no,’” says Jones. “So what? You have to rise above. There’s EGO, but you gotta drop the “e” and just GO!

“In the police department you have to have the will to live. You learn and you have to face the reality every day that there are people who want you dead, but you have to — you MUST — have the will to LIVE. That keeps you doing the right things, following the good skills and training you received.

“In developing a real estate business, you have to have the will to WIN. That keeps you focused on the end goal. It keeps you going forward.”

Good mentors tell you the truth. They also practice what they preach.

The best mentors don’t just deliver knowledge. They don’t teach swimming lessons while standing on the edge of the pool. No. The best mentors lead by example. They get in the pool with you and show you how it’s done. They insist you get into the water and learn how to swim for yourself. And they’ll be with you every step of the way, IF you allow it.

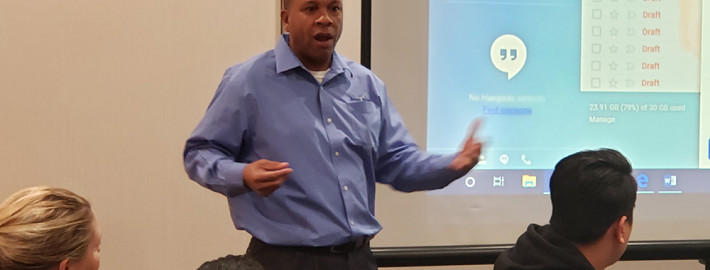

When Jones holds training sessions and boot camps, he tells it like it is. With a smile, he calls himself a minister of truth. He doesn’t deliver what attendees might want to hear. He delivers the reality, the truth.

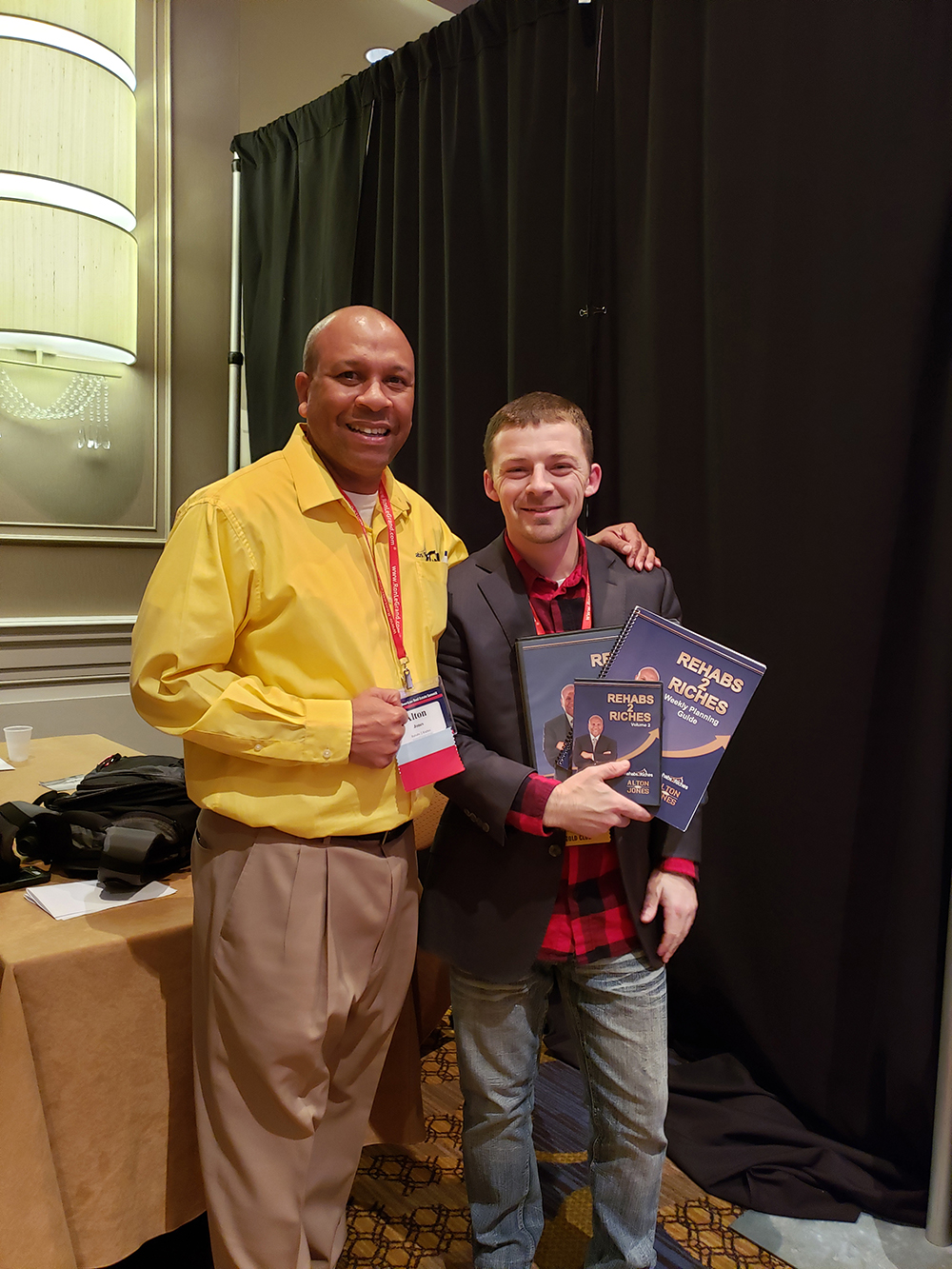

Rehab 2 Riches

It was an unexpected honor when Ron LeGrand, in 2016, not only praised the system for success Alton and his wife had developed, but when he also strongly encouraged Jones to launch his own training courses on that very system.

Alton’s Rehab 2 Riches courses, bootcamps and more soon followed, to popular acclaim by attendees.

“I believe what we do changes lives,” says Jones. “People who come to one of our events, they’ll make a life-changing decision at that event. Those relationships made at our events can take you from $0 to self-sufficient.”

Jones smiles when he talks in his bootcamps about the importance of building a Million Dollar Rolodex of exceptional resources for your business. “These days there are a lot of people who don’t know what a rolodex is,” he says. But it hasn’t held any of his students back. They still understand the point.

Jones practices in three markets—southern California, Dallas and Memphis. Of all these, however, his preference is his beloved southern California.

For more information, go to Rehab2Riches.com.

Alton Jones says that in this business there are five things you have to do to succeed:

1. Locate prospects

2. Pre-screen prospects

3. Construct and present offers

4. Follow-up

5. Close quickly

Books by Alton Jones include:

• Ask Me How I Know? Four biggest house-flipping mistakes that made me millions, by Alton Jones

————————

Karen Walker is the founder and executive producer of The Mentors Radio Show (TheMentorsRadio.com)