Image by Alexander Stein from Pixabay

By Rusty Tweed

Using Cap Rates to Make Informed Real Estate Investing Decisions

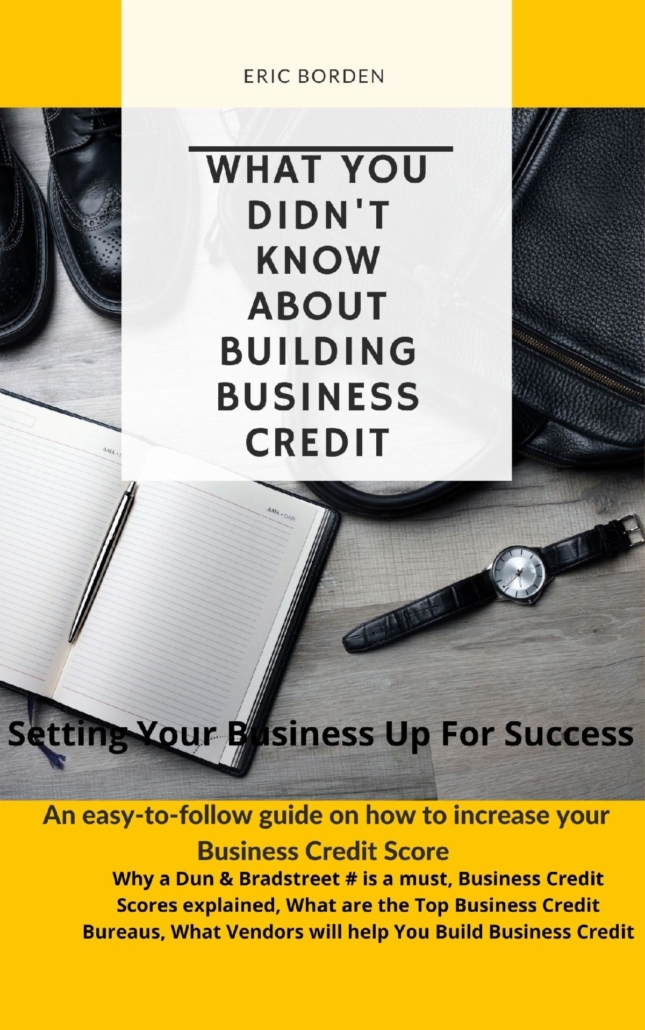

Don’t be fooled by the simplicity of the cap rate, or capitalization rate — this simple calculation can reveal a trove of insight on potential real estate acquisitions. Some have even argued that this number is the single most important metric for any budding real estate investor to understand.

Our guide makes it easy to wrap your head around cap rates and use them to your advantage. So, without further ado, let’s jump in and learn.

Image by Gerd Altmann from Pixabay

Image by Gerd Altmann from Pixabay

What Can a Cap Rate Tell Me?

In a nutshell cap rates provide a quick and simple way to help get a feel for a property’s overall investment potential and a balance with the property’s levels of risk and return on investment. To better understand how to achieve this, we’ll look at a few examples.

Cap Rate Formula: How to Calculate Cap Rate

The cap rate formula is simple: Divide net operating income (NOI) by the property value (or the purchase price).

Cap Rate = Property’s Net Operating Income/Property Value (or Purchase Price)

We can find net operating income by subtracting the property’s annual expenses from its annual gross revenue. Expenses will include things like operating expenses, management, taxes, and anything else you must pay to keep the property running.

Image by Michal Jarmoluk from Pixabay

Image by Michal Jarmoluk from Pixabay

Careful though — debt payments, capital expenditures, and depreciation deductions are NOT included in the calculation. This is because we are trying to get a sense of the property’s performance irrespective of any mortgage arrangements, improvements we might make or depreciation schedule that may be selected.

For revenue or cash-flow, you’ll simply plug in what tenants currently pay in rent (total rental income), as well as any other sources of income (Ex: a laundromat or a parking garage).

Should I Use Market Value or Purchase Price as my Denominator?

For the bottom of our capitalization rate fraction, market value is generally preferred. A purchase price can be used if the property has sold recently, but using a purchase price from ten years ago won’t result in a meaningful cap rate. If we are considering purchasing the property, it would be very useful to plug in various possible purchase prices to see what rate we’ll achieve. This can be a helpful guide when determining an acceptable offering price.

Examples

Suppose you’re an investor considering buying Property A. The property is valued at $1,000,000 and generates an NOI of $50,000 annually. Plugging this into our equation we get:

Cap Rate = $50,000/$1,000,000 = 5%

Suppose you compare Property A to a similar property that is valued at $1,000,000 and has an NOI of $60,000. This gives us a Cap Rate of 6%. If all else between Properties A and B is equal, the higher cap property is the better buy.

Investors can also think of cap rate as a measure of their rate of return on their investment. For example, with the 5% rate, an investor earns 5% of their purchase price annually and will recoup the purchase price in the 20 years.

What Does a High Cap Rate Mean? What About a Low Cap Rate?

Image by Arek Socha from Pixabay

Image by Arek Socha from Pixabay

There’s a lot more to cap rates than “higher cap = better investment.” No two properties are created equal, and in practice, properties with a very high cap rate often turn out to be higher risk as well.

Let’s think about our capitalization rate equation again, and what factors might contribute to driving it higher. We’ll look at Property A again, which had an NOI of $50,000, a property value of $1,000,000, and a 5% cap rate.

If we want to raise our rate by changing NOI, then NOI will have to increase. This could be accomplished by increasing revenue, or lowering expenses. In either case, increased NOI is typically a good thing.

Now, let’s say we want to raise our cap rate by modifying property value. In this case, property value will have to decrease. A decrease in property value could be driven by several things, including the worsening reputation of a location or the revelation of some costly deferred maintenance.

To summarize: high cap rates are great, but they can also point towards factors that increase the risk of an investment. A property with an 18% cap rate might need work, and might not be in a highly desirable area. Ask yourself, “Is this amazingly high cap rate stemming from high NOI, or low property value?”

What Drives Cap Rate Lower?

Let’s consider what factors might contribute to driving a cap rate lower. If NOI decreases, our cap rate will decrease as well. We also see lower cap rates in the case of property appreciation — and appreciation is a very good thing.

If a property appreciates significantly, but revenue trails this appreciation, the property’s cap rate will go down. Lower cap rates can indicate high-value properties, suitable for investors seeking lower risk. Generally, better neighborhoods trade at lower cap rates.

High vs Low Capitalization Rates

Image by Arek Socha from Pixabay

Image by Arek Socha from Pixabay

High cap rates are driven by two things — higher NOI, and lower property value. If a building needs renovation, this could result in a lower property value and, therefore, a high cap rate. With large amounts of maintenance needed to bring a building up to date, that high cap rate might mislead the investor and leave him with far more work and expense than he bargained for. But, if an investor is interested in updating a property, these high cap properties can potentially provide large rewards.

These property types are best left to investors who have experience, or who have a trusted guide that can help them find the right properties that balance their investment goals with their risk tolerance.

Figure Out What You Need to Know

If you know any two of the three variables of the capitalization rate formula, you can figure out the whichever variable you’re missing. This can be useful in a range of situations. For example, suppose you are trying to determine what you should offer on a property. If you know the property’s NOI and have a cap rate goal you want to target, then you can calculate what purchase price will give you the result you’re looking for.

For example, suppose your target is 8%, and you’re looking at a property that generates $100,000 in NOI:

8% = $100,000/Purchase Price

Purchase Price = $100,000/.08

Purchase Price = $1,250,000

Or, if you have $500,000 to spend on an investment property, and are targeting a 7% cap rate, you can figure out what level of NOI is required for you to meet your goals:

7% = NOI/$500,000

NOI = 7% * $500,000

NOI = $35,000

Re-Cap

There’s no set range for which are “good cap rates” — they’re most useful as a comparative tool between a few potential purchase opportunities that are similar in terms of location and kind.

High cap rate properties can be lucrative, but also come with an increased level of risk. If you’re new to high-cap real estate investing, it’s best to partner with someone who has the experience and know-how to get a deal done right. At TFS Properties, we specialize in pairing investors with properties that match their investment profile and risk comfort-level while guiding them through the journey of building a secure investment portfolio.