Top Ten Myths Preventing People from Investing In Real Estate

By Lloyd Segal,

President of LAC-REIA

Myth 1: No Cash

The Myth: “You need money to invest in real estate.”

The Truth: Find a good real estate deal, and the money will find you. Ask any experienced investor and they will tell you that a lack of funds is never an issue; lack of good deals is! If you can negotiate a good price on a house, you will find plenty of partners or lenders willing to put up the money.

Myth 2: No Time

The Myth: “I’ve got a job, a spouse, kids, and little spare time to invest.”

The Truth: Turn off your television and you’ll have all the time you need! People spend an average three hours per day in front of the tube. They spend even more time on weekends. Want to do something fun this Saturday? Load the kids in the mini-van and drive around looking for ugly houses. Make a game out of it giving a dollar to each of your kids that spots an ugly house. Tell them that each ugly house you buy means enough money to take them all to Disneyland.

article continues after advertisement

Myth 3: Everyone Says This Stuff Doesn’t Work

The Myth: “Those late night infomercials and reality shows don’t work”

The Truth: You can convince yourself that anything won’t work. Henry Ford once said, “Whether you think you can or think you can’t, you are always right.” If you listen to the critics, the naysayers, and other pessimists, you’ll convince yourself it doesn’t work. Most people that criticize money-making ideas need to do so for their own ego. After all, if it were true, what’s their excuse for not being successful? Make a point of not taking financial advice from anyone who makes less than you do.

Myth 4: Too Much Competition

The Myth: “There’s too many people trying to buy houses to find a deal.”

The Truth: There are more than enough deals to make everyone successful. At any given time there are hundreds of distressed properties for sale in your market for each investor looking for them. Besides, a majority of people who say they are investors are just sitting on the sidelines waiting for something to fall in their lap. Don’t be one of them – go out and make deals happen! You will be successful if you spend your time finding deals and not worrying about other people.

Myth 5: It Doesn’t Work in My Market

The Myth: “It doesn’t work in my city.”

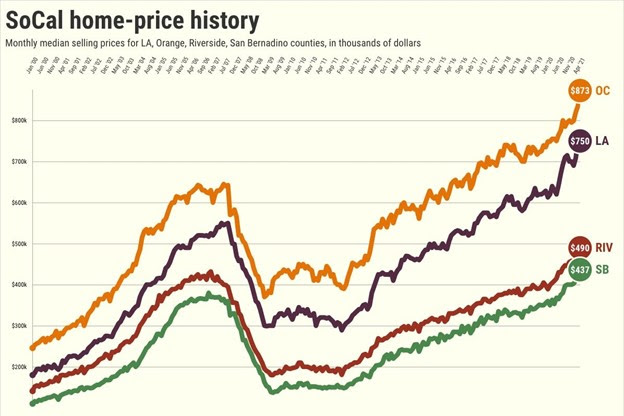

The Truth: It works in EVERY market. True, it may work differently in some markets than others, but there are investors making money in every city, every day of the week. You have to learn your market – the rents, the trends, the local customs, the lenders, the title companies, etc. Then, learn the techniques and adapt them to your market. If you are in a hot market, you can buy and sell properties faster and ride inflation. If you are in a down market, you can find lots of bargains. Regardless, in every market, there are people with financial problems that are forced to sell their homes.

Myth 6: The Recession is Coming

The Myth: “Although the market is good right now, I hear that we are heading for another recession.”

The Truth: There are always naysayers predicting market crashes. You need to ignore these pundits. Besides, there are always deals regardless which way the market is heading. If the market changes, change your strategy. For example, if the market falls, sell cheaper or with attractive terms. When Dell wants to move more computers, they drop the price. When GM wants to move cars, they offer no-interest financing. Be creative and do things that make your houses sell or rent faster. If prices are falling, buy way below market and sell just below market. If rental vacancies go up, offer free cable or WiFi. After all, when everyone else is “dooming and glooming,” it only clears out the competition.

Myth 7: Realtors Won’t Cooperate With Me

The Myth: “Real estate agents don’t cooperate with investors.”

The Truth: The right agent can be your best friend and #1 source of business. I have one agent that brought me six deals in the past year. She knows exactly what I want and only calls me when there’s a deal. You need to educate a few agents and let them know exactly what you want. Few agents have repeat customers. In contrast, you have to make them understand that you will be giving them business over and over again.

Myth 8: I Have Bad Credit

The Myth: “I need good credit to buy houses.”

The Truth: Good credit helps, but you don’t need it to make money in real estate. Lease/options, owner-financing, flipping properties, assignments, and other creative techniques will allow you to buy real estate without credit. Besides, you can always use a partner who has good credit. You can also borrow “hard money” without having good credit. In the interim, you can work on fixing your bad credit so you can use it as an asset in the future.

Myth 9: I Might Lose Money

The Myth: “Real estate is risky. I could lose everything.”

The Truth: Real estate is one of the safest investments you can make! The stock market is beyond your control. Savings, CDs, money market funds won’t earn you enough money to make it worthwhile. You have to be willing to take a calculated risk to make money. The more you educate yourself, the less risky real estate becomes. However, don’t think you need to know everything before taking action.

article continues after advertisement

Myth 10: I Don’t Know What To Do First

The Myth: “I need to learn more before I start.”

The Truth: If you’re reading this, you probably know more than enough to get started in real estate. After all, you’ll never learn everything. Knowledge is an ongoing learning process, not a result. Read books, attend seminars, and take action. Then, learn some more and take a lot more action. If you are really impatient, enlist the help of others.

Henry Ford said, “Why should I clutter my mind with general information when I have men around me who can supply any knowledge I need?” Henry Ford was a smart man because he realized that he didn’t need to know it all if he could consult with others that did. And this was before Google!

Now go out there and start submitting offers. Remember, you won’t catch any fish if you don’t put your hook in the water.

Lloyd Segal

After practicing law for over 30 years (specializing in real estate litigation), Lloyd Segal assumed the leadership of the Los Angeles County Real Estate Investors Association in 2017 from the late Phyllis Rockower. Lloyd is an author, real estate investor, mentor, public speaker, and landlord. He is the also the author of four real estate reference books, including “Stop Foreclosure in California” (Nolo Press), “Stop Foreclosure Now” (American Management Association), “Foreclosure Investing” (Regency Books), and “Flipping Houses” (Regency Books). The Los Angeles County Real Estate Investors Association is the oldest (1996) and largest investor group in California. In his role as President, Lloyd is busy expanding LAC-REIA’s events and programs for members and real estate investors. For more information, visit www.LARealEstateInvestors.com