Boost Your Real Estate Game This Holiday Season with the Power of 4Qs

By Hugh Zaretsky

As the holiday season approaches, many real estate investors start slowing down, enjoying time with family, and reflecting on the year that’s passed. But if you’re the kind of investor who’s always on the hunt for growth, scaling and new opportunities, you know that the holidays are a golden time to get ahead. The festive season brings unique opportunities for connection, reflection, and yes, even deal-making. But how do you balance holiday cheer with serious business growth?

The secret weapon is the 4Qs! Let’s leverage four types of intelligence that go beyond traditional skills to help you stand out in a crowded market. We will discuss in detail three of the Qs in this article. Just follow the steps below to get access to the 4th Q. These four “quotients” are not just abstract concepts; they’re tools you can leverage to grow and scale your business during this holiday season.

Let’s dive into a fun framework that will give you an edge:

1. IQ – Intelligence Quotient: Thinking Smarter, Not Harder

Your IQ is your traditional intelligence quotient, and while it’s sometimes seen as “just book smarts,” but it’s much more. In real estate having a high IQ helps with analyzing market trends, understanding complex legal jargon, strategic thinking, and making sound investment decisions.

Holiday Application:

- Analyze the Year’s Data: Take some quiet time to review your performance data. Look at which investments worked and which didn’t. Dive into market reports to identify emerging trends for the new year.

- Financial Savvy: Tax strategies, end-of-year financials, and planning for next year’s cash flow are essential. Being financially literate allows you to make smart moves that might not be possible in the heat of peak season. Look into investment accounts, deductions, or year-end deals on properties.

- Plan with Precision: Use the downtime to map out next year’s strategy. Set clear, data-backed goals. For example, if you see multifamily properties trending in your area, consider allocating resources to pursue those investments in the new year.

Pro Tip: Invest in tech tools to automate data collection and analysis. You don’t need to crunch every number yourself, but leveraging the right tools can make you appear like a real estate wizard.

2. EQ (Emotional Quotient): Building Relationships That Last

High EQ, or emotional intelligence, is a superpower in real estate. It’s the ability to read people and their emotions, the ability for you to manage and control your emotions, communicate effectively, and build strong relationships. These are all critical skills when negotiating deals or working with clients. Deals are made between people, and the holiday season is the perfect time to leverage your EQ to strengthen relationships.

Holiday Application:

- Connect Authentically: Send personalized holiday greetings or small gifts to your network. A little note that genuinely acknowledges your appreciation for their business, partnership or mentorship goes a long way.

- Emotional Check-In: High EQ also means knowing when to take a break. Make sure you’re not running on empty by prioritizing a bit of holiday rest and relaxation. When you’re recharged, you’re better at connecting and negotiating.

- Listen to Learn: Many people reflect on their goals and challenges during the holidays. Reach out to potential partners or clients and take time to listen. Let them share their aspirations and challenges for the upcoming year—it will give you invaluable insights into how you can serve them better in the future.

Pro Tip: Host a low-key holiday mixer or virtual coffee meet-up with local investors, partners, or even tenants. Use this as an opportunity to listen, share stories and build goodwill.

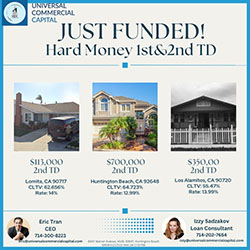

article continues after advertisement

3. AQ (Adversity Quotient): Resilience in the Face of Challenges

In real estate, things rarely go exactly as planned. Deals fall through, markets fluctuate, and unexpected expenses arise.AQ is all about your ability to handle adversity, bounce back from setbacks, and keep moving forward. A high AQ means staying resilient when deals fall through, financing doesn’t pan out, or markets take unexpected turns.

Holiday Application:

- Embrace the Market Shift: If the holiday season is traditionally slow for your market, don’t be discouraged. Use this time to refine your strategies, reassess risk, and prepare for the next active season. This is also a great time to find motivated sellers who might be looking to close a deal before year-end.

- Reflect and Reframe: Look back on the year and identify where you faced challenges. What worked? What didn’t? Use these experiences as lessons. Embrace the challenges as learning opportunities and look for ways to build resilience in your business model for the coming year.

Pro Tip: Surround yourself with a “framily” (friends who are like family) of like-minded investors who encourage you to stay resilient. Accountability groups or mastermind sessions can help you keep a high AQ even during the holiday lull. Do You Want to Join our Framily? www.eframily.com

4Q – Free bonus by following Hugh on any social media platform – Send him a DM from social media with the words “I want the bonus 4th Q”.

Making the Holidays Your Growth Season

The holidays might be quieter, but that doesn’t mean you should hit pause. Instead, use this season to plan, connect, and build resilience for the year ahead. By honing your intelligence, nurturing your relationships, building resilience and expanding your network, you can make the most of the holiday season and set yourself up for a prosperous new year. Take this opportunity to sharpen your Qs, and you’ll find yourself starting the new year with momentum, new connections, and a solid strategy.

So, grab some eggnog, deck the halls, and get ready to turn these holiday vibes into your next big investment wave.

Cheers to a successful holiday season and an even more profitable new year!

article continues after advertisement

Hugh Zaretsky

Real Estate Investor and Agent, Author, and International Speaker – www.HughZaretsky.com

Join Hugh’s framily at www.eframily.com

Follow “The Launch Button Podcast” on Spotify, Apple Music, your favorite Podcast App, or on YouTube at https://www.youtube.com/@TheLaunchButton

IG -@hughzwealth/

FB https://www.facebook.com/HughZWealth

TikTok – @hughzwealth

X – @hughzaretsky

LinkedIn – https://www.linkedin.com/in/hughzaretsky/

Youtube: https://www.youtube.com/@HughZWealth

“The Launch Button Book” is an Amazon best seller helping people find their passion or take their business to the next level. Purchase directly on Amazon.

—

Hugh Zaretsky

IG – @hughzwealth

FB – @hughzWealth – My personal page is full so use this link

www.thelaunchbutton.net or buy direct on Amazon. – My book “The Launch Button” is an amazon best seller helping people find their passion or take their business to the next level.

www.eframily.com – Want to work, train or get coached by Hugh?

www.hughzaretsky.com – To learn more