HOW TO ACHIEVE GENERATIONAL WEALTH IN REAL ESTATE

By Joe Arias

In the last two centuries, real estate was how 90% of millionaires made their fortunes. To achieve generational wealth, there is no doubt that real estate should be the main asset class to invest in. For over two centuries, and arguably longer, real estate has continued to offer unique benefits for generating generational wealth in real estate. You are asking yourself whether it’s too late for you to start the journey to achieve this goal. The answer is no! It is never too late to begin. If you plan to pass down wealth to your kids or your grandkids, then real estate is the perfect asset class for this. To best understand how to achieve generational wealth through real estate, it is equally important to know why it works.

article continues after advertisement

Appreciation

If you are unfamiliar with what appreciation is in real estate, essentially it is defined as an increase in value over time. Real estate generally increases in value over the long run. Compare what a house costs in one of the most expensive real estate markets during the 1970s compared to the value of a home now in the 2020s. In 1970, you could buy a home in San Francisco for an average price of $25,000. An average home price in San Francisco now will set you back $1,700,000. That’s right, your grandparents’ home can be worth over 7 figures. What if they pass that home down to you? That would be considered generational wealth in real estate as you are now taking ownership of a million-dollar asset. Over time, appreciation works in favor of real estate as the asset class stays ahead of inflation.

Depreciation

One of the main benefits of investing in real estate is tax benefits. Depreciation is one of them. This does not mean that your home is losing value. Simply put, depreciation describes the ability to write off some of the value of your asset every year. What this does is significantly reduce the tax burden that an owner is responsible for. Essentially, you are protecting your wealth as your net worth grows. One of the main destroyers of wealth is tax liabilities. Therefore, it is important to understand the proper legal accounting practices that help reduce your overall burdens. Another benefit of depreciation is that often, the write off exceeds the amount of cash flow you may have brought in from a rental. The amount written off oftentimes is more than the entirety of the cash flow will actually help reduce your tax obligations. Of course, you do need to speak with a CPA to get all the details and to support you when filing for taxes. Most CPAs understand how to utilize depreciation properly.

article continues after advertisement

Loan Pay Down

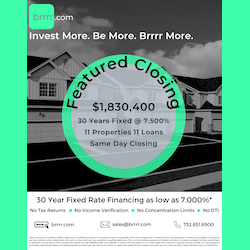

Most investors of real estate use leverage to purchase properties. This involves taking out a loan to buy real estate and using a fraction of your available cash within the deal. In some cases, there are opportunities to buy without any of your own money. For the sake of keeping the concept simple, if you are just starting in real estate, you can take out a 30-year fixed mortgage with a low-interest rate. Over time as you rent your unit and earn an income from the cash flow, a part of the rent also covers the monthly expenses including the mortgage. Your loan’s principal payment is paid down over time. Each payment adds equity to your position gradually adding to your net worth. By the end of your 30-year term, you will have a fully paid off property that you can pass on to your children.

Leverage

One important wealth generator in real estate is the ability to buy properties using leverage. If you were presented with two options which would you choose? Buy one property free and clear for $100,000 or use the $100,000 towards down payments on 5 properties with each requiring $20,000 down payments. If you opted for the second option, then you understand the power of leverage. You are essentially making your money work harder for you. Tied with loan pay down, rental cash flow, and appreciation, your investments are magnified when you leverage your cash across multiple properties instead of sticking to only one deal.

Forced Equity

When you invest in real estate, investors have the opportunity to make a significant amount of money directly from the purchase of the property. Forced equity is defined as the wealth that is created when you buy a property at a discounted price and improve the property to be valued more. For example, let’s say you bought a property for $50,000 and added $25,000 in improvements, then based on the comparable homes in the neighborhood, your property could be worth closer to $100,000. By improving the property, an investor can force the creation of equity in their deals which overall is a driver of wealth.

Passing Your Property To Your Heirs

Now that you understand all the ways to generate wealth, it is also important to understand the different ways you can pass your properties down to your heirs. There are four main ways to accomplish this. First, you can sell your home to your kids. A second approach is simply giving the property to your kids. Bequeathing your property would be a third option. Last, a deed transfer can be done.

Each of the options presented has different ramifications from a tax and legal perspective so it is best to consult with your lawyer and accountant to gain the best insight for transferring over your real estate assets.

Overall, real estate can create generational wealth in a variety of different ways. It is no coincidence that 90% of millionaires were created through real estate. Consider starting your journey towards financial freedom and generational wealth.

Joe Arias

Joe Arias and his partners have flipped hundreds of properties in the Southern California Region. He has developed cutting-edge systems to simplify and scale the entire remodel process that can easily be applied to flipping, rentals, wholesaling, and other passive income strategies. More recently, Joe founded a real estate investing education company called RealSuccess Investments, allowing him to share his tools and systems with hundreds of up-and-coming investors.

RealSuccess is focused on education on flipping, rentals, passive income, and wholesaling.

Joe is also a best-selling author. He has written 4 books: Finding your RealSuccess, First Steps to Flipping, R stands for Rentals and Retirement, and Wholesaling Real Estate.

“I came from Argentina when I was 20, I am 40 years old now. I didn’t know anyone, I am CERO generation, usually people say, I am first or second generation but I was the one that crossed the border, no language, no friends, no family, no money, nothing, nada… If I can do it, anyone can.”

From a young latino immigrant to a celebrated real estate investor, Joe is a true testament to hard work and discipline. As an investor, he has made it his mission to help others achieve financial freedom while enjoying living a life of passion, fulfillment, and empowerment.

RealSuccess Website

Personal Instagram:

https://www.instagram.com/joeariasinvestor/

Real Estate Investment- Instagram:

Instagram: https://www.instagram.com/realsuccesseducation/

Video For Finding Money from All Day Training (10 Hour Seminar)

https://vimeo.com/manage/videos/528446162

1 Hour Webinar

https://vimeo.com/manage/videos/530996751

Amazon Book#1:

Amazon Book#2

Learn live and in real-time with Realty411. Be sure to register for our next virtual and in-person events. For all the details, please visit Realty411Expo.com or our Eventbrite landing page, CLICK HERE.