Stop Overpaying on Your Taxes and Get Absolute Asset Protection

|

Getting your Trinity Audio player ready...

|

Were you aware that Real Estate Investors can save 78% – 90% or more on their annual taxes? And, now you can too! RSVP to our webinar today.

Date and time

Saturday, January 20 · 5 – 6pm PST

Location

Online

About this event

1 hour

Mobile eTicket

Were you aware that Real Estate Investors save 78% – 90% or more on their annual taxes? And, now you can too! Did I get your attention yet?

We have a solution that completely solves that giant tax problem for ALL Real Estate Investors.

In today’s real estate market, the only constant is volatile change…Your business is in a constant state of flux. Yet, there is one thing that’s not changing…

Uncle Sam is still demanding his tax payments on your rental income and capital gains from your REI business, including Flippers who get classified as Real Estate Dealers. Using our Trust, you cannot be classified as a Real Estate Dealer.

Real Estate Dealers are taxed at ordinary income rates, plus self-employment @ 15.3%, Medicare Surtax & AMT. That could easily be over 50% of your profits. OUCH!!

There is a new explosion of lawsuits because of the economy and people are getting desperate!

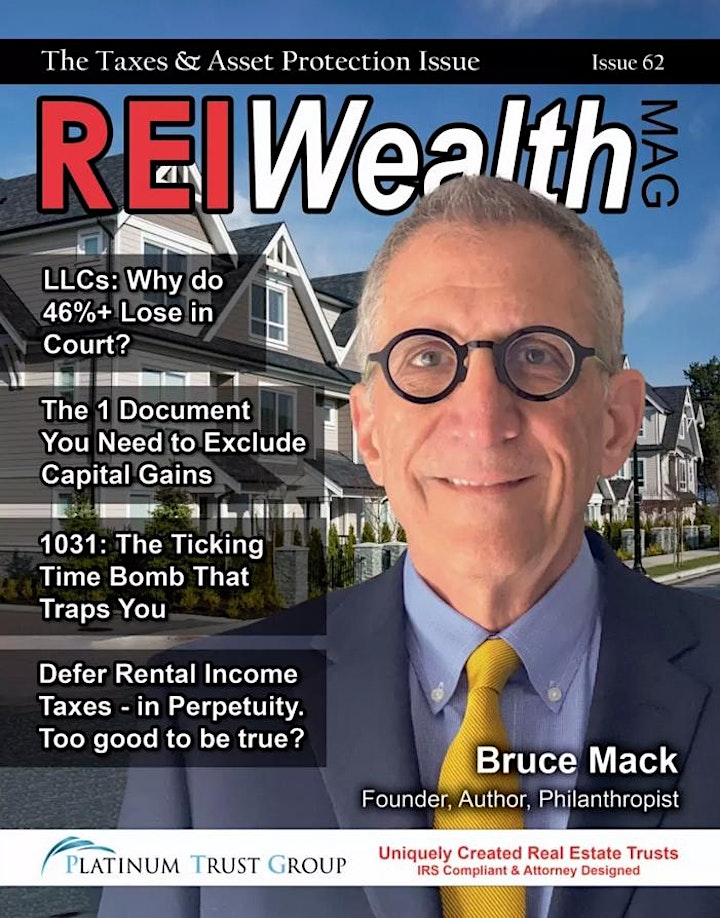

LLCs don’t protect you (in fact over 46% of the time when litigated, the corporate veil is pierced). My special guest and nationally known speaker, author and real estate investor, Bruce Mack, is going to show you a superior solution to keep your lien, levy and judgment proof.

On this upcoming, MUST attend, LIVE webinar for your REI BUSINESS SURVIVAL, you’re going to get the solutions to both problems. You will be amazed at how simple the solution is!

Join us and our friend, Licensed Financial Advisor, Bruce Mack, for this LIVE Webinar.

Reserve Your Seat here now!

January 20, 2024

5pm PST / 6pm MST / 7pm CST / 8pm EST

Reserve your space today and the event Zoom link will be sent to guests for this amazing webinar that could potentially save you money.

Make sure you stay until the end of the webinar! Bruce will tell you how you can get a complimentary one-on-one consultation ($250 value) just for attending the webinar.

See you on the upcoming MUST attend LIVE webinar!

PS: Join us for this LIVE webinar and learn if you qualify to defer 78% to 90% or more of your tax burden in perpetuity … LEGALLY, and without having to move to another country to do so.