So Many Ways to Buy

By Bruce Kellogg

#1 – Cash Purchase

This is the simplest method: write a check, wire the funds, etc. But more needs to be known etc. a) The investor needs to calculate their percent cash return on their cash invested in order to compare with other investment opportunities in front of them. b) When buying with cash, try for a price discount. Don’t pay “retail” unless you have to. c) After buying with cash, take out a credit line on the property for security if times get tough. Credit unions are good for this. In tough times, banks often reduce or cancel credit lines, which makes banks unreliable when you need them.

#2 – Assume an Existing Loan

This involves applying to the existing lender to replace the existing borrower. You will have to qualify as a new borrower, and pay fees. In this low interest rate environment, it can be preferable to simply assume the loan. Some commercial and private loans are assumable as well as institutional loans on 1-4 residential units.

#3 – “Subject to” an Existing Loan

Unlike formally assuming an existing loan, this method involves taking title to the property without disturbing the loan, and just start paying on it. Conceptually, it is simple, but in practice it is not. Most loans nowadays are “due on sale”, so if the lender finds out the property was transferred, they can “accelerate” the loan and call it “due and payable”. They have the right to foreclose if they are not paid, or a satisfactory arrangement made.

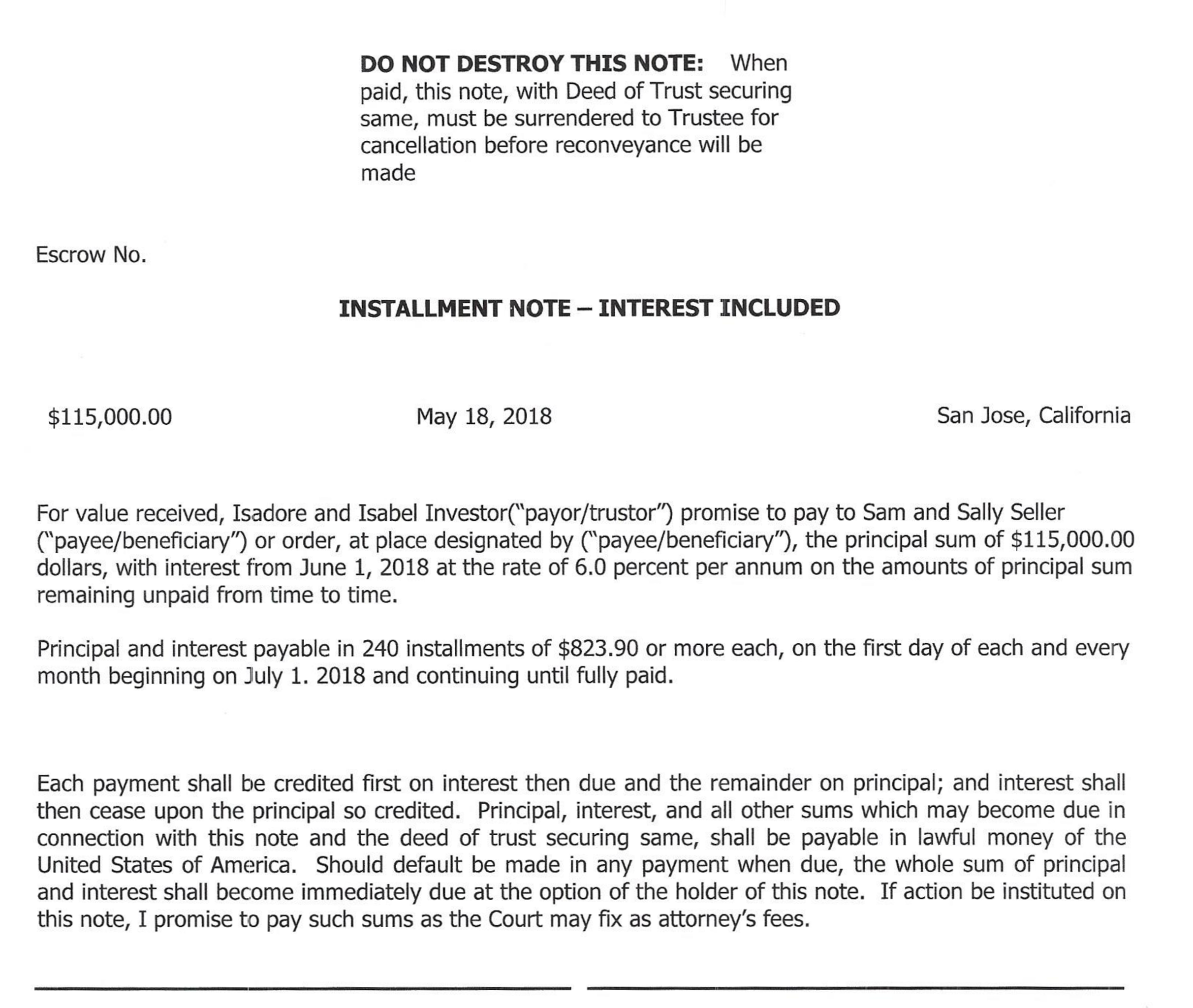

#4 – Create Financing

When a property is purchased, the numbers have to add up. If the down payment and the existing or new loans do not equal the purchase price, then financing has to be created. Often, the seller will agree to “carry back” a created loan for the buyer to complete the purchase. This “note” can be sold, often at a discount, or borrowed against by the seller, so they are not stuck with it. Or, they might like it and keep it in their pension fund, for example. The terms of the loan are whatever the parties agree, as long as the terms are legal.

#5 – Create a “Wraparound” Loan

One really useful created loan is called a “Wraparound” or “All-Inclusive” loan. This is where a loan is created that “wraps” or “Includes,” the existing loan(s), which the buyer executes in favor of the seller. Usually , the “wrap” includes the part of the purchase price that is unpaid by the down payment. It’s basically the “carryback” amount due to the seller over time.

There are a couple of benefits to the “wrap”. First, it is a useful way to work with a “subject to” transaction, described above as being somewhat complicated.

Second, if the “wrap” is written at a higher interest rate than the loan(s) enclosed in it, the seller will receive excess interest above what he is paying out. Yields can be high with a “wrap” this way.

#6 – “Creative” Financing

This is where real estate gets “creative”. By legal definition, personal property is any property that is not real property. Examples of personal property are cash, corporate stock, gemstones, art, vehicles, promissory notes, and so on. How about, instead of cash, use other personal property for the down payment? A 4 carat diamond was used to purchase the Mt. Diablo Hotel in Contra Costa County. A mid – 1930’s 40 foot wooden motor boat (gorgeous woods) was used to acquire a triplex in Redwood City. How about a travel trailer for a down payment? Anything goes, sometimes!

#7 – Funds From a Whole Life Policy

In most cases, it is possible to borrow from a “Whole Life” insurance policy and use the funds to buy real estate. This can be investigated by reading the terms of the policy, and then discussing this with the company. Repayment will be required, and reasonable interest will be charged, but it’s a good source of funds.

#8 – Invest Using Your IRA

Now that interest yields have been low for so long, people are moving to invest in real estate using their Individual Retirement Account (IRA). Investments can be made in real property or personal property such as notes, coins, paintings, securities, and so on. Basically, the method is to move your IRA account to a “custodian” and have them buy, manage, and sell your properties at your direction. Custodians are plentiful on the internet, and they have literature galore. Leverage by borrowing from banks can be used to enhance the return in your IRA. Your custodian can steer you to banks that offer to do this.

#9 – Cash to New Loan

The most common method of purchasing real estate involves the buyer putting up a cash down payment, then qualifying for a new, long-term “purchase money” loan from a bank, credit union, or mortgage broker. Sometimes, the seller will make (i.e., “carry back”) the loan. Usually an institution will fund the loan and either keep it in their portfolio, or, more often, they will bundle it with others and sell it as a security on Wall Street. This replenishes their lendable funds.

Down payments vary. Commercial loans are usually 20 – 40% down, depending upon the lender’s guidelines and risk assessment. Owner-occupied, residential loans can be as low as 0 – 3.5% with mortgage insurance usually required. 1 – 4 unit investment properties typically require 20 – 25% cash down, but no mortgage insurance. Lenders’ programs vary widely, including rates and fees, so comparison shopping is recommended.

#10 – Gifting

Purchasing as described in #9, above, many times offers the opportunity for the borrower(s) to receive a gift of money toward some, or all, of the required down payment. Acceptable donors include “a relative”, defined as a spouse, child, or other dependent, or any other individual who is related to the borrower by blood, marriage, adoption, or legal guardianship. A fiancé, fiancée, or domestic partner can also donate.

Lenders will want a “gift letter” signed by the donor stating that repayment of the gifts is not required. Many lenders will require proof of the funds being transferred, so it is important to learn the lender’s requirements prior to transferring funds around.

#11 – Buy Defaulting Note, Then Foreclose

This method involves buying notes or mortgages that are in default at a substantial discount, then foreclosing to acquire the property. Notes can be purchased through advertising on Craigslist, newspaper ads, direct mail to purchased lists, or websites dealing with note transactions. Searching on the internet will provide organizations with courses on notes. This method can be highly profitable, but is quite sophisticated. Additionally, foreclosing on a note usually does not afford the opportunity to conduct inspections, and a title search is essential. Some states provide a “right of redemption” for the foreclosed borrower to recover ownership, adding further complexity and risk.

#12 – Tax Liens and Tax Deeds

In order to stay solvent, when owners fail to pay property taxes, countries will issue tax liens or tax certificates which are sold to investors at a certain yield. Depending upon the state, yields run from 6% to 36%, with 8 -18% being most common. Under some circumstances, investors can foreclose and obtain ownership of the property. Searching the internet under “tax liens” will produce teachings and organizations offering to help investors get involved. Be advised, however, that this axquisition method is also sophisticated and has the same warnings as #11, above.

#13 – “Trade” or 1031 Exchange

A “trade” of real estate involves swapping one property for another. An example would be if the owner of a vacant lot traded it with the owner of a mountain cabin, probably with some cash changing hands to even out the values. One party might obtain financing, or one trader might carry back some “owner financing”. Noteworthy here is that the trade is not a tax-deferred exchange, but just a swap. These transactions are advertised on real estate and barter websites from time to time, saying “For Sale or Trade”, or similar.

A tax-deferred exchange is a transaction governed by Section 1031 of the Internal Revenue Code and is designed to defer long-term capital gains taxes for the “exchangor”, the one moving up in property. The properties have to be “like kind”, such as real estate for real estate. They do not have to be identical types of real estate. For example, an airport hangar could be exchanged for a duplex. However, they do both have to be either an investment property, or a property “used in a trade or business”. So, a plumber who is retiring could exchange his shop building into a fourplex for retirement income. However, an investment property CANNOT be exchanged into a property that is promptly turned into a residence after the close. Capital gains taxes will be due. The Internal Revenue Service (IRS) has issued “safe harbor” guidelines for a successful exchange, so real estate, accounting, and possibly legal experts need to be used.

#14 – Syndication

When investors get together to buy a property, it is commonly called a “group investment”, which is legally termed a “syndication”. This is usually done to allow the purchase of a larger property and provide “passive” ownership benefits for the investors. The common types of syndications are: 1) Limited Partnership 2) Limited-Liability Corporation (LLC), and 3) Tenancy-in-Common (TIC). Each one has an organizer who usually becomes the manager of the project. An “offering circular” is prepared describing the project, including financial projections, organizations, management, and risks. Investors sign a “subscription agreement” and contribute their “share” of the project. Syndicatiions are a “security” under federal and state laws, so there are regulations to be followed concerning marketing, disclosure, handling of investor funds, management, and reporting. Larger projects typically require the investors to be “accredited”, which necessitates a substantial income and net worth. Syndications are easy investments, but investigation of the project and the organizer is essential due to the potential for the promoter to take advantage of the investors through slick marketing. Additionally, if the organizer is honest yet inexperienced, the project could fail. Don’t be afraid, but be careful with syndications.

#15 – Equity-Sharing

Another method of investing with lots of potential is “Equity-Sharing”. This is when an investor and a potential homeowner buy a single-family residence together, and the aspiring homeowner occupies it. They are called the “resident co-owner” (RCO), and the investor is called the “investor co-owner” (ICO). Percentage shares are negotiable with the RCO paying the property taxes, insurance, loan payment, and routine repairs, while the ICO puts up the down payment. There is a “Shared Equity Agreement” or “Joint Ownership Agreement”, which sets the term, allocates the income-tax benefits, and specifies how the arrangement is to be wound-up. One party could buy out the other, or the property could be sold and the net proceeds divided.

Equity-Sharing works well between relatives. One Lockheed engineer has seven of these going to help his children, nieces, and nephews become homeowners. College housing is another application where the son or daughter owns part of the house with the parents then rents bedrooms to other students.

#16 – Joint Venture

A “joint venture” is where two parties undertake a project together, such as a “fix and flip” of a property. One party usually supplies the funds, while the other supplies the expertise and management. This is often called a “rich man, poor man partnership” and is a great way to get started. A “Joint-Venture Agreement” describes the arrangement. These can be found on the internet.

#17 – Contract-of-Sale

The “Contract-of-Sale”, also called “Contract for Deed”, “Land Sales Contract”, or “Land Contract” is a method of acquisition that defers the buyer’s receipt of the deed (fee ownership) until all of the contract’s terms have been fulfilled. Meantime, the purchaserhas what is known as an “equitable interest”, an interest under the contract. It is a security device for the seller who is financing the transaction. It’s a good method for selling to a buyer with a low down payment or weak credit that can be improved over time. Since it is a contract, foreclosure requires an action in court. Additionally, most states have a “right of redemption” where the foreclosed party has a certain period of time to pay the arrearage plus costs and recover the property. For a purchaser, it is an easy way to begin ownership of a property. A good practice is to obtain a quitclaim deed and record it if the contract in not fulfilled. This cleans up the title.

#18 – Shared-Appreciation Mortgage

When the market is appreciating rapidly it is sometimes difficult to convince a seller to sell on reasonable terms, or to carry back owner-financing. One approach to this is to create a “Shared-Appreciation Mortgage” which the seller carries back. Usually, it involves a low interest rate, but then gives the seller a percentage of the profit at the end of the loan term. This approach also works well in a high interest rate environment because it helps the buyer achieve a reasonable cash flow to sustain the property. A “standard form” for this type loan is not normally available, so it’s best to have an attorney draw one up, or customize an existing one.

#19 – Option to Purchase

An option confers the right, but not the obligation, to do something. Real estate examples include the option to purchase, option to lease, option to renew, option to extend, and so on. Usually, a prospective buyer negotiates an option to purchase when they want the property, but sometime later. They give the owner some agreed “option consideration” for the right to purchase the property on mutually-agreed terms on or before a specified future date. Option consideration is frequently cash, but it could be personal property, like a used tractor, or even “personal service” where the future buyer fixes up the property before buying it. If the option is not exercised, the owner is entitled to keep the consideration. A good practice is to obtain a quitclaim deed and record it if the option expires without being exercised. This clean up the title.

Options are particularly useful for reserving properties without appearing on the public record until the options are exercised. Developers do this to accumulate parcels without “tipping off” other players in the market that they are buying. An individual can negotiate an option in an appreciating market and exercise the option later without the costs of ownership in the meantime. It’s an excellent way to speculate, and fortunes have been made this way.

#20 – Lease-Option

A lease-option involves leasing and taking possession of the property being optioned. Prior to exercising the option, the property can be occupied as a residence, or leased to a subtenant. This is a way to “tie up” a property to take advantage of an appreciating market.

Another possibility is to enter into a contract-of-sale with an owner, then lease-option the property to a tenant. If/when the tenant exercises the option, pay off the contract-of-sale, and realize a profit. Option consideration from the tenant can be used for the down payment on the contract-of-sale, resulting in a (nearly) cashless transaction. This can be done repeatedly as a business model.

Two cautionary remarks: 1) ALWAYS make sure the option and lease agreements are separate documents so a judge cannot order the refund of the option consideration to the tenant by characterizing it as a rental deposit. 2) Obtain a quitclaim deed any time an option is not exercised in order to maintain a clean title.

#21 – Master Lease-Option

This method applies primarily to commercial rehabilitation projects. The idea is to find a building that has “gotten away from” its owner and become run-down with vacancies that are not being filled. A “Master Lease” is negotiated with the owner to take over rehabbing and re-tenanting the building, along with an option to purchase the building before an agreed future date when financing the purchase is more likely to succeed. Since the present owner is obviously short of funds, the purchaser will have to fund the project and receive a lower price or credit toward the purchase, or both. It is best to have a real estate attorney draw up these agreements.

#22 – Adverse Possession

An interesting way to acquire a property is through what is called, legally, “Adverse Possession”. It involves taking possession of a property and continuously possessing it for a number of years specified by state law. The years vary by state from six to thirty, with California being just seven. Possession has to be “open”, which means coming and going at will. It has to be “notorious”, which means it can be readily observed. It has to be continuous, so a break disrupts the timeline. It also has to be “hostile to the interests of the owner”, which means overstaying an invitation by the owner does not qualify. California also requires the possessor to pay the property taxes, as well. If all conditions are met, the possessor will sue the owner in a “quiet title action” to obtain title in their name. This situation occurs more with rural property, and is not common, but is fun to think about! See wikipedia to learn more.

#23 – Involuntary Methods

The other acquisition methods in this series are all voluntary, except two, which are involuntary. These are: a) Inheriting a property and, b) receiving a property as a gift. These are mentioned for completeness, but are too simple to warrant discussion.

#24 – “Leftovers”

There are three additional ways to acquire real estate which are more like techniques that can require no cash down payment. Here they are:

“P-Note” iivolves giving the seller an unsecured promissory note for the down payment. This works best if the parties know and trust each-other. But it’s a viable approach.

“Sweat Equity” involves the purchaser convincing the seller to allow them to fix up the property in lieu of a down payment while the seller carries back the financing. Doing the repairs prepares the property to obtain a new loan and, at the same time, it secures the seller’s loan more as the repairs are accomplished.

“Personal Service Contract” Involves a purchaser providing some service to the seller in lieu of a cash down payment. Examples include a plumber re-piping the seller’s residence, or a dentist providing dental implants to the seller.

These three techniques should probably be used with the help of a real estate attorney.

Conclusion

In many parts of the country, markets are tightening, and inventory is dropping. Investors are finding it harder to make a deal. While the 24 acquisition techniques presented here cannot increase the supply of properties, they can open up alternative ways to capture more properties that are available.

Bruce Kellogg

Bruce Kellogg has been a Realtor® and investor for 36 years. He has transacted about 500 properties for clients, and about 300 properties for himself in 12 California counties. These include 1-4 units, 5+ apartments, offices, mixed-use buildings, land, lots, mobile homes, cabins, and churches. He is available for listing, selling, consulting, mentoring, and partnering. Reach him at [email protected], or (408) 489-0131.