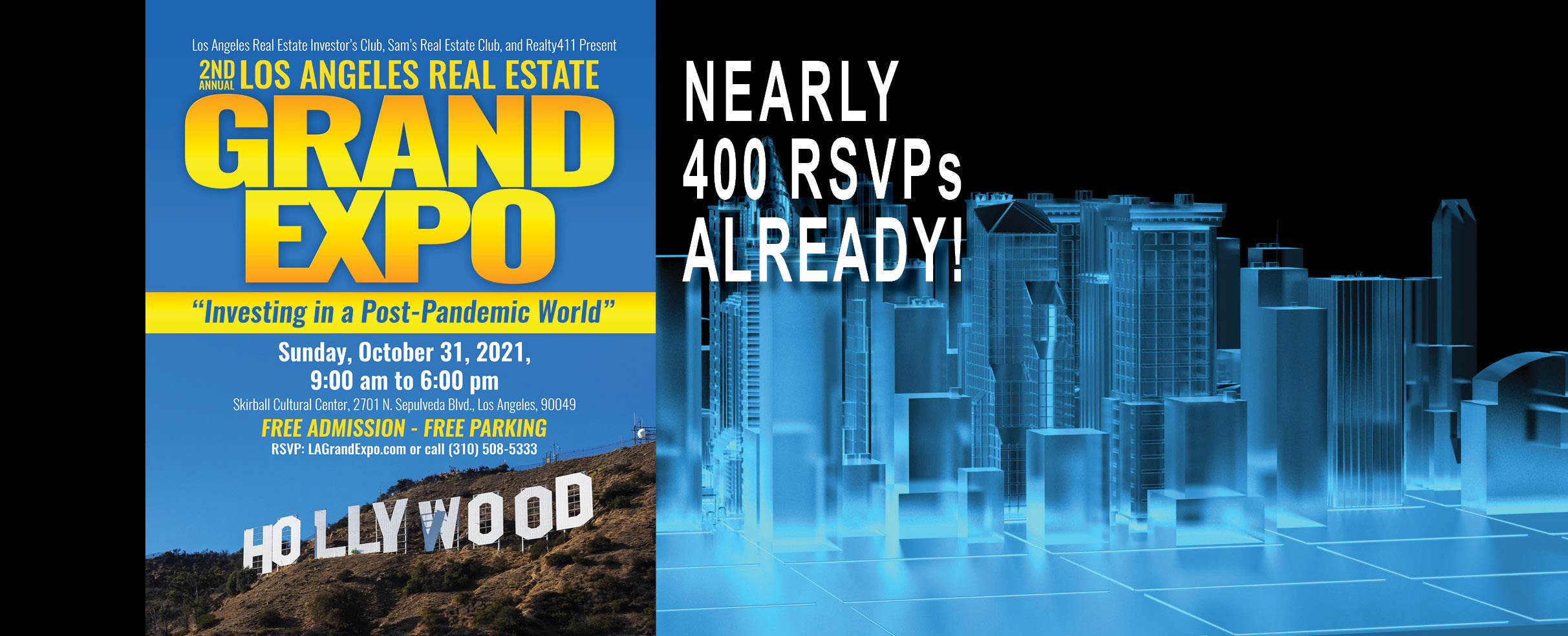

Realty411 Helps Investors take their Real Estate Portfolio to a NEW LEVEL in a Post-Pandemic World.

Realty411 is ready to help investors take their life, business and real estate portfolio to a NEW LEVEL in our post-pandemic world.

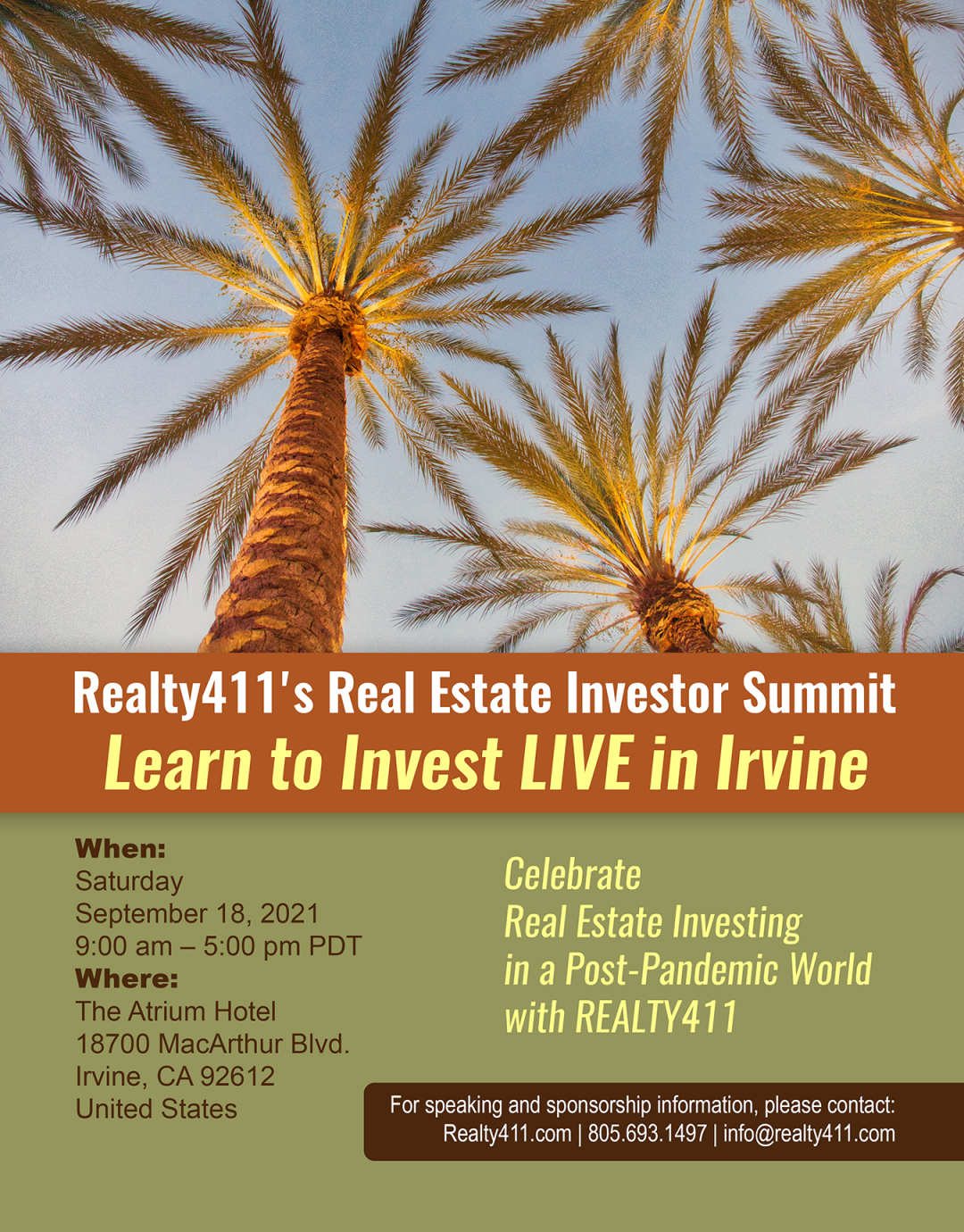

Celebrate real estate investing in a post-pandemic world with Realty411. This is your chance to learn the latest niches in real estate investing, plus connect directly with influential investors and sophisticated educators from across the nation right here in Irvine, California.

Join Realty411 and network live and in person. This is our first live event in California — Join us to network directly with amazing wealth builders who are bullish on real estate.Get Ready to Grow Your Real Estate Business, Portfolio, Knowledge and Personal Investor Network.

>>> Learn more about Realty411 at: http://realty411.com or http://realty411guide.com or http://realty411expo.com

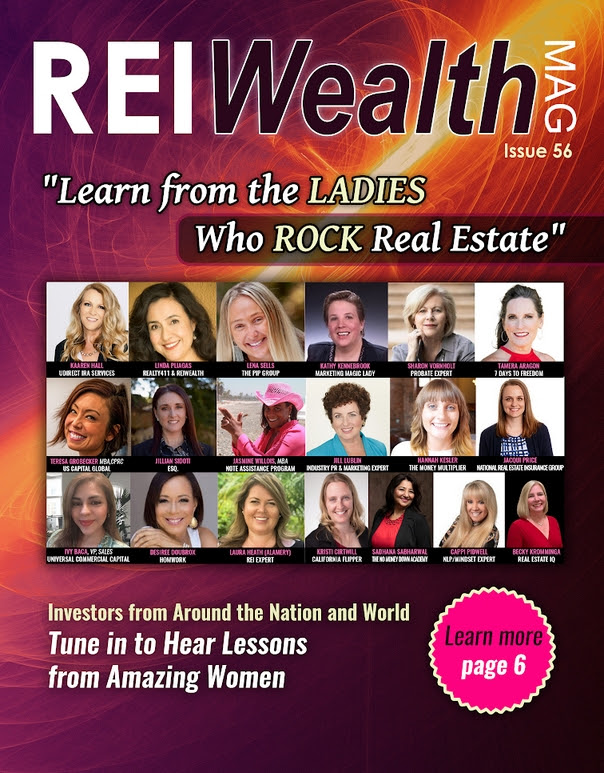

Realty411 also produces REI Wealth magazine, which is the longest-running magazine for investors specifically developed for online readership. Our digital, interactive issue is designed to be read and viewed online. We now also print copies of this fabulous publication as well. Learn more about this publication at: http://REIwealthmag.comInvest Your Time Here for One Special Day of Networking and Motivation — Take Your Real Estate Skills to a Whole New Level.

Don’t miss our first complimentary live, in-person real estate investor summit in Southern California. What can attendees expect at this one-day event in Orange County, California?

- Learn with PROVEN Leaders in the Industry

- Receive the latest REI knowledge from active investors

- We feature the latest technology to expand your income

- Meet other investors with common goals and mindsets

- Develop relationships with leaders in the industry

- Share your opportunities with potential clients

- Learn how to save money with our Realty411VIP.com members’ network.

- Realty411’s publisher has owned national rentals for many decades

- We will share life-changing information unavailable anywhere else

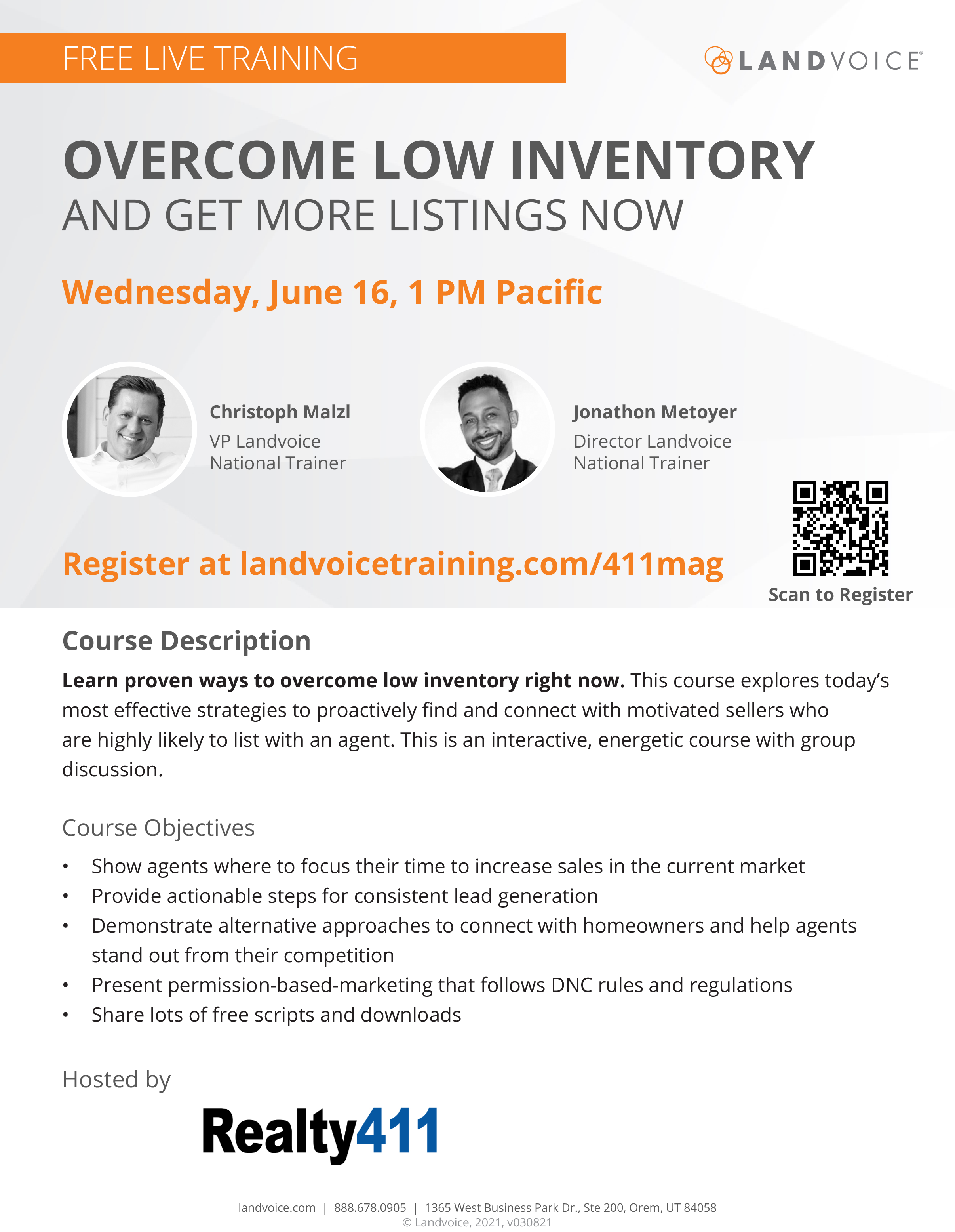

- We host complimentary events to meet our readers and to spread knowledge

Other events charge hundreds of dollars, but this day is priceless. Realty411’s founder/publisher has decades of experience in both media and real estate. Linda Pliagas graduated locally from California State University, Long Beach, with a degree in journalism. Plus, her background includes 17 years as a licensed California real estate sales agent. She has referred millions in rental real estate transactions to brokers throughout the country and has been a housing provider for over 20 years.

Our mission is simple: To share realty knowledge and resources so that average Americans can learn about the benefits of real estate investing. We know your time is valuable. In fact, time is the most valuable asset we have. We can always make more money; however, we cannot add more time to our life! With this in mind, we urge your to invest quality time in growing your business, connections, resources, knowledge and sphere of influence by attending this event. OTHER SPECIAL BONUS PERKS INCLUDE:- Early-Bird Guests Receive Our Investment Magazines

- Meet Local Leaders & Industry Giants – From Coast to Coast

- Influential Real Estate People & Business Owners Are Attending

- Learn How to Leverage and Meet Private Capital Lenders

- Find Potential Partners, New Friends, Build Your Circle of Influence

NOT IN CALIFORNIA? Don’t worry, register and we will send you a virtual pass for this event. OUR VIRTUAL EVENT IS AVAILABLE ONLY FOR OUT-OF-STATE GUESTS.

>>> Learn more about Realty411 at: http://realty411.com or http://realty411guide.com or http://realty411expo.com

COVID-19 Safety Guidelines: The safety of our readers is vital, therefore, as a precaution our onsite Realty411 staff is vaccinated. Social distancing guidelines will be followed; sanitation stations will be available. For questions or concerns, please contact us directly: 805.693.1497.