A Primer on “Creative Financing”

Image from Pixabay

By Bruce Kellogg

History

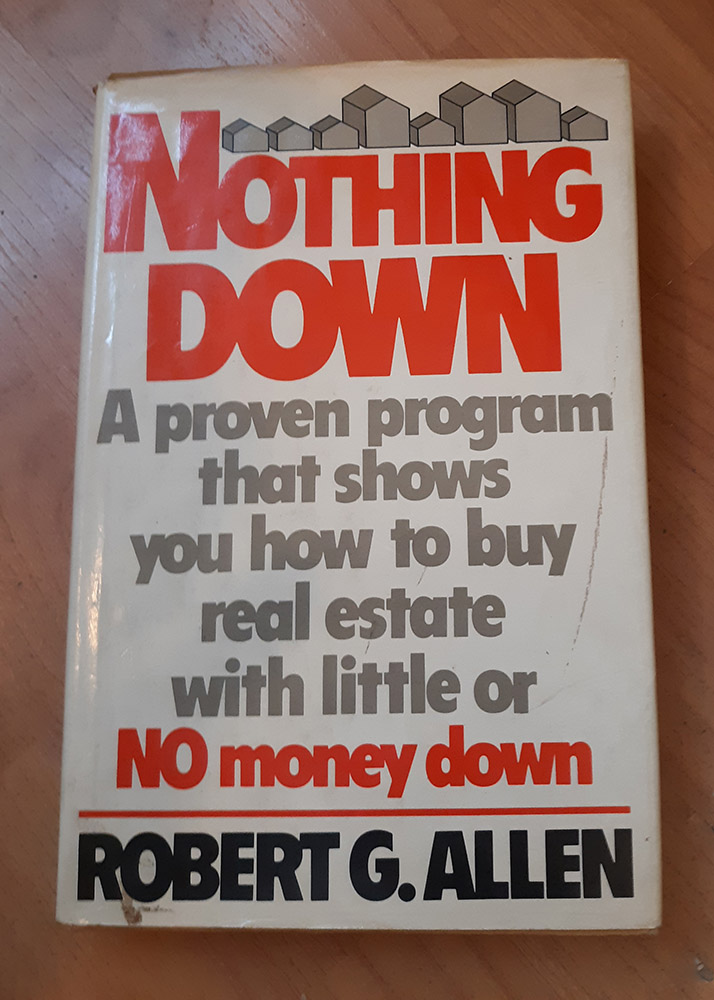

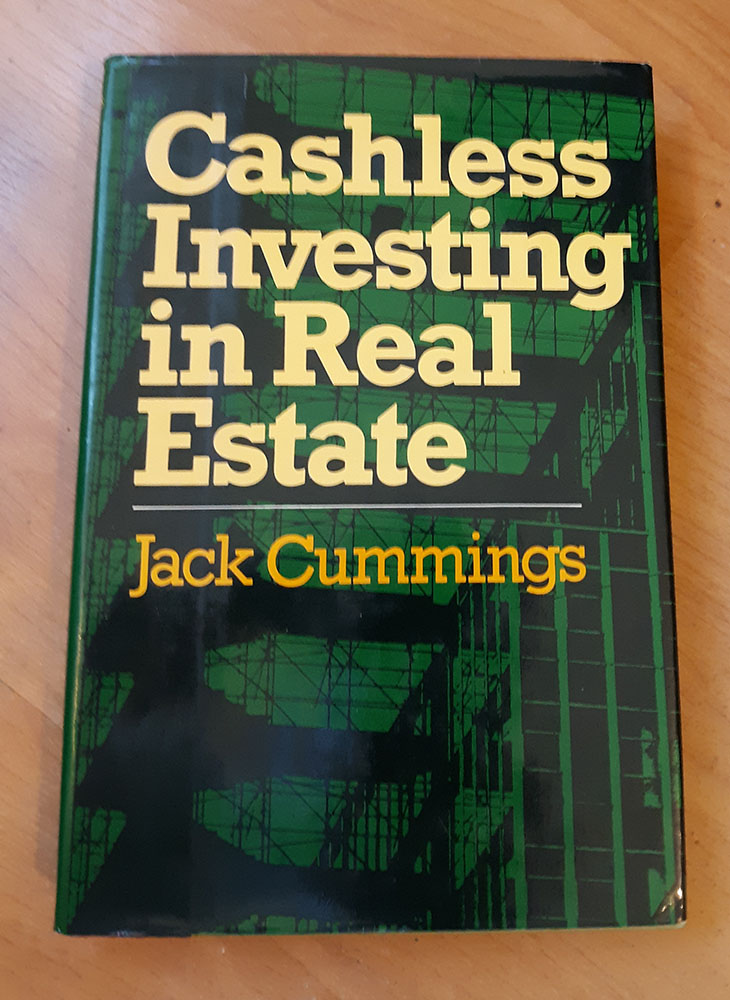

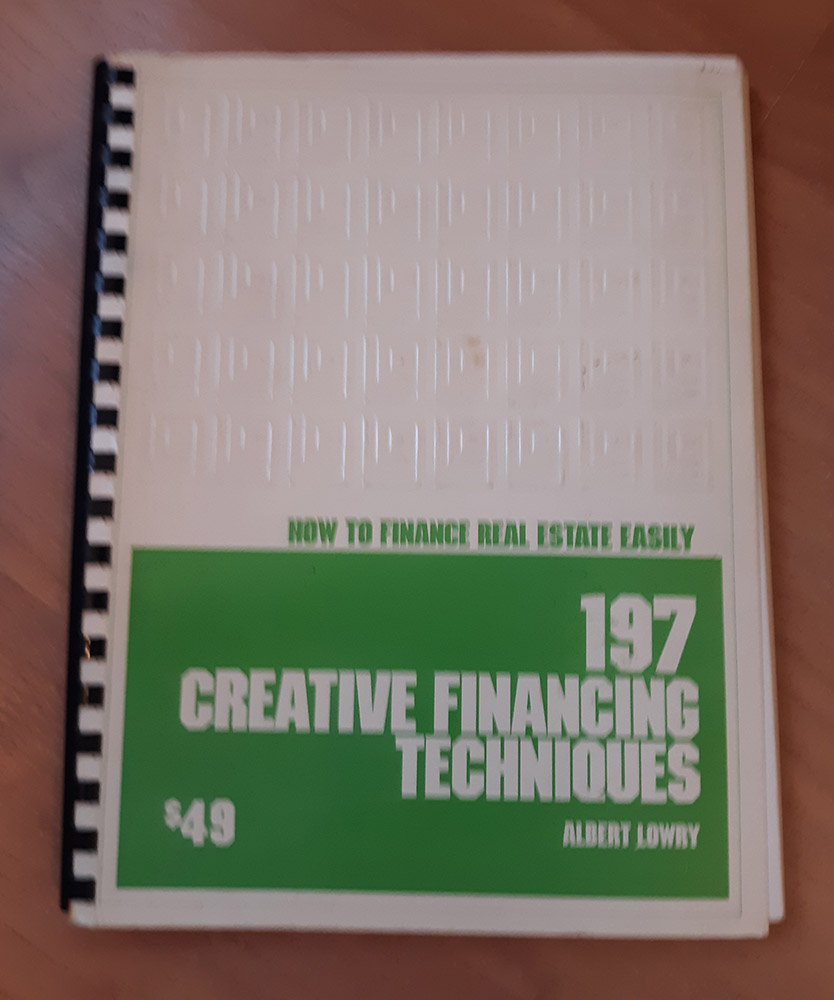

Modern awareness of “Creative Financing” began about 1980 with Robert G. Allen’s famous book, Nothing Down (Fig. 1). For the next five years or so, a flurry of books were published on related subjects (Fig. 2 and 3). I “grew up” in real estate during this period, and accumulated the library shown in Fig. 4 in addition to closing over 600 transactions using these techniques. In the process, I became known as a “leverage mechanic”. Now, I am preparing a comprehensive book titled, Leveraging Real Estate – Your Guide to Creative Financing. This article is a primer on the subject.

Fig.1

What is “Creative Financing”?

The original use of the term “Creative Financing” applied to anything that was not “CTNL”, “cash-to-new-loan”, when purchasing a property. Then it got narrowed down to financing that was “created” as part of the transaction, such as seller financing. Now, it has opened up to mean all techniques that display imagination on the part of the parties. I like this definition best!

Seller Financing

The most common form of “Creative Financing” today is still “Seller Financing”, or “Owner Carryback Financing”. The following Realty411 magazine articles thoroughly present this subject.

REI Wealth Monthly #49 “Seller Carryback Note Terms”

Real Estate Wealth Vol. 1, 2018 “Seller Financing 101”

Realty411 Vol. 6 No. 4 “Seller Finance 101”

Realty411 Vol. 7 No. 2 “Seller Carryback Note Terms”

Best of Realty411 “Seller Finance 101”

Fig.2

Managing “Creative Financing”

In the process of using “Creative Financing”, problems could arise in two areas, negative cash flow, and balloon payments. These are thoroughly covered as follows:

REI Wealth Monthly #44 “Dealing With Negative Cash Flow”

REI Wealth Monthly #50 “Dealing With Balloon Payments”

Creative Acquiring Properties

There are other applications of “Creative Financing” besides the use of notes. The following series of articles describe 24 ways, many of which are creative.

REI Wealth Monthly, issues 34, 35, and 37. “24 Ways to Buy”

Additionally, there are creative ways of partnering described in

Realty411 Vol. 9 No. 2 “Partnering For Profits”

Finally, there are the subjects of Options and Lease-Options which are outside the scope of this article. There is plenty on the internet.

Fig.3

Accessing the Articles

Realty411 does not have magazine back issues nor copies of past articles available. So, to provide readers a meaningful learning experience, readers can order email copies from the author as follows.

“Seller Financing 101” and “Seller Carryback Note Terms” $12.00

“Dealing With Negative Cash Flow” and “Dealing With Balloon Payments” $12.00

“24 Ways to Buy” (3 articles) $12.00

“Partnering for Profits” $8.00

Checks should be mailed to:

Bruce Kellogg

430 N. Second St. #A

San Jose, CA 95112

Additional Resources

Fig.4

For readers who are interested in learning more about “Creative Financing” techniques, some Resources (books) are included as an attachment. A internet search will be necessary because they will need to be purchased used if they are available. Of course, current books on the subject should be searched, as well. Anyone who applies themself should be able to become well-versed in “Creative Financing.”

Bruce Kellogg

Bruce Kellogg has been a Realtor® and investor for 40 years. He has transacted about 800 properties in 12 California counties. These include 1-4 units, 5+ apartments, offices, mixed-use buildings, land, lots, mobile homes, cabins, and churches.

Mr. Kellogg is a contributor and copy editor for two national real estate wealth-building magazines: Realty411, and REI Wealth Magazine. He is a recipient of an Albert Nelson Marquis Lifetime Achievement Award, listed in Who’s Who in America– 2019.

He is available for consulting with syndication, turnkey, joint-venture, and other property purchasers and note investors nationally, and other consulting assignments. Reach him at [email protected], or (408) 489-0131.

Learn live and in real-time with Realty411. Be sure to register for our next virtual and in-person events. For all the details, please visit Realty411.com or our Eventbrite landing page, CLICK HERE.