Tips To Minimize Your Risk & Maximize Your Profits (Part 1)

Quote to live by:

“Without effort, you cannot be prosperous. Though the land be good, you cannot have an abundant crop without cultivation.” – Plato

article continues after advertisement

Real Estate As a Path To Wealth & Freedom

Forbes magazine lists the top 400 wealthiest people every September. In September 2007, 40 of the 400 people on that list made their billions specifically in real estate. Many of these people started with nothing, some immigrants even, to move up into this category. Real estate is definitely a path to be seriously considered in building your wealth. Did you know that most of those 40 billionaire real estate investors are only doing their real estate part time? And do you realize they can run their real estate investing business from anywhere in the world?

Freedom… Just the sound of that word brings a smile to my face. Real Estate investing offers you the freedom to make your own choices about how and where you spend your time along with who you spend it with. Financial and time freedom is definitely something successful real estate investors enjoy.But what about the risks you say? Of course for every “tit” there is a “tat”, for every high a low, for every good a bad. Yes, unfortunately like any entrepreneurial venture, there are risks. My husband owns a retail store and he risks every day that someone is going to trip and fall and sue him. He risks that he may not sell enough to pay his bills, etc. I think you get the point. However there are steps you can take to minimize your risks and maximize your profits.

Top 7 Tips To Minimize Your Risk & Maximize Your Profits

Rule #1 – You Do Not Need To Re-Invent “The REI Wheel”

You will need to get training and have a mentor or coach, (or maybe several), in order to succeed. Even the best athletes in the world have a coach. Why? Because a coach will keep you on track. Don’t try to do it on your own. That school of hard knocks is going to cost you way more than good training and an experienced coach. I believe this to be the first step in minimizing your risks and maximizing your profits.

Rule #2 – Do Your Due Diligence (or as I say, “Do the Due”)

Would you buy a car without checking the engine, tires, brakes, or interior? Would you marry someone without learning all you can about them and knowing their flaws and good things before you take the plunge? I hope not!! Then why do so many real estate “investors” buy a property without doing the proper due diligence before they get into a contract?Answer: Many simply lack the knowledge of what to look for in a property when considering it for investment purposes. In other words, you don’t know… what you don’t know, right? So here’s what you need to know. Before you ever buy a piece of real estate you should check it out from top to bottom so you know exactly what you are getting into. A little bit of work upfront will save you huge headaches and money down the road.

article continues after advertisement

People often ask me, “What should I look for before committing to buy a property?” There are two ways to make money in real estate. If the property is going to supply these profits for you, you would want to consider it.

- When the property brings you cash flow from monthly rents while also appreciating.

- When you make a profit re-selling the property through appreciation.

Now keep in mind, you can profit from appreciation two ways.

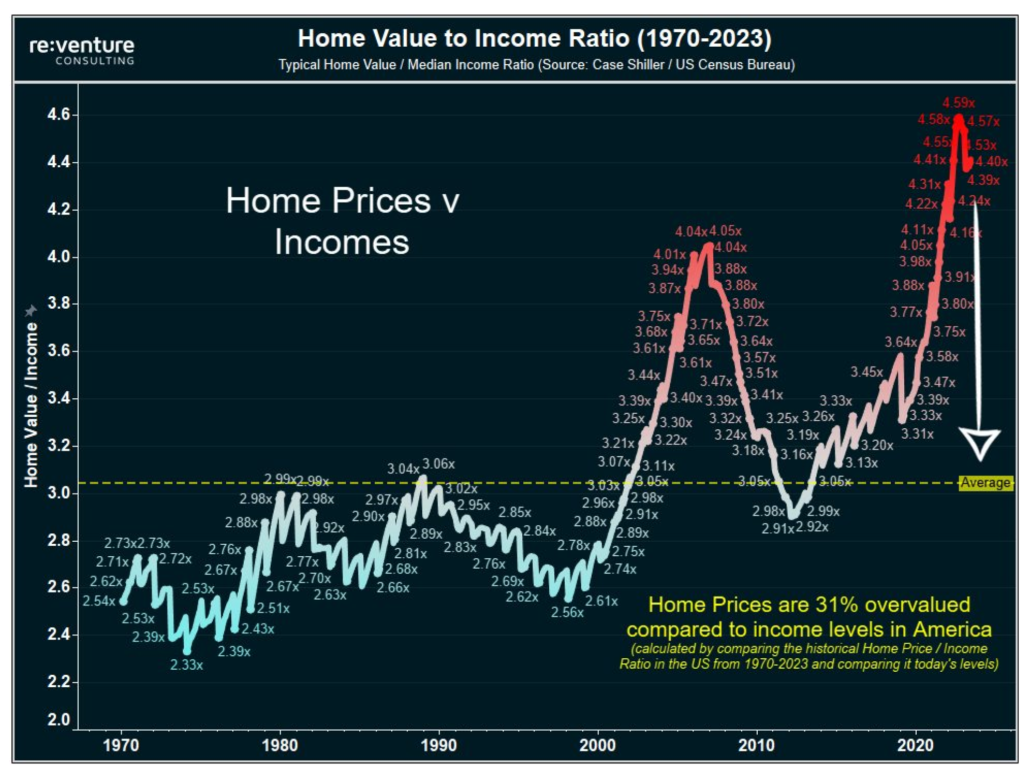

- Market appreciation – the economy is causing properties to increase in value.

- Forced appreciation – when you either buy property cheaper than what you can resell it for or you can do some improvements to increase the value more than what you spend.

Here are Three Most Important Questions I ask myself before I consider a property for investing?

- Would we buy it for ourselves?

- Would we want to tell our friends and family?

- Is this a good deal for other real estate investors?

The most important outcome to consider is if the answer to this question is yes, “Will my money put into this property make me more money?”I call what I do real estate “investing”, not real estate “divesting”. You will always want to do the same. How do you know if it is going to make money? You do your due diligence before you commit to buy any property. Of course, as you know, there are never any guarantees in life.

However, if you have certain criteria every property needs to meet in order to profit and how to evaluate a property for those qualities, the likelihood that you will succeed are much greater. It’s very easy to get caught up in wanting to help people if they need to sell their house. Or you may just personally think a property is good looking. But those are not the only reasons you would want to buy. To avoid getting emotionally involved in a property purchase, I have created a due diligence checklist. I have provided a tool that has saved many people from both passing on deals they should take as well as taking deals they should pass.

I took from my own trials and errors & created a checklist – The Real Estate Investing “Before You Commit” Due Diligence Checklist. Keep in mind every one of mine or your personal due diligence items on that “checklist” do not need to be followed on every deal you consider. However, it’s a great list to follow and assure you have remembered to consider all that can affect the outcome of your purchase. Your due diligence makes all the difference on whether your purchase of property brings you a profit or a loss.

Rule #3 – Invest Using the Strategies that Make Sense and the Location That Makes Sense for the Current Market Conditions

I always say invest where it makes sense and dollars. You don’t need to invest in your home town, because you live there…nor do you need to go all over the country investing everywhere else. Do your homework and invest in locations that align with the real estate investing niche you chose using the strategy that is a fit.

For example, three years ago I was investing nationally in pre-construction in most strong appreciating markets. That strategy made sense at the time. It would not make sense in a depreciating market.

Today I live in a town that has been on the top 5 most foreclosures list for over 2 years. Why would I need to invest nationally when there are more than enough leads right in my own backyard? Where to invest varies depending on the location of the investment as well as market timing.

My investment choices change as often as the market does. Being sensitive and aware of changing market trends is helpful to know where to invest and the most profitable strategy to follow. The last four rules of the “Top 7 Tips To Minimize Your Risk & Maximize Your Profits” will be concluded in Part 2.

Tamera Aragon

Tamera Aragon is a professional online entrepreneur and has bought and sold over 300 properties, establishing her as an expert in the real estate investing field. Since 2003, she has purchased over 10 million dollars in real estate and currently holds properties all over the world. Tamera’s focus is on the booming Foreclosure market, buying Pre-foreclosures, REOs and Short Sales. Tamera who is a noted Author, Success Trainer, Speaker & Coach, shows her passion for helping others with the 17 websites she has created and several specialized products to support fellow investors throughout the world. When Tamara is not busy running her website, she is very involved with her Fiji joint ventures and investments. Tamera Aragon is one of the few trainers and coaches who is really “doing it” successfully in today’s market. Tamera’s experience has earned her a solid reputation in the industry as well as the respect and friendship of many of the top national real estate investment and internet marketing experts. Tamera Aragon believes her success has garnered her the financial freedom to fully enjoy her marriage and spend quality time with her children.

Learn live and in real-time with Realty411. Be sure to register for our next virtual and in-person events. For all the details, please visit Realty411Expo.com or our Eventbrite landing page, CLICK HERE.