Wondering What to do NOW In Real Estate? (Part 1)

By Jimmy V. Reed

So what do you do when the market is flooded with so much

Competition? How do you really get Wealthy in Real Estate? Getting fed up!?? How about Real Wealth Deals???

It seems everyone has started buying any and everything in real estate and the worst part is everybody is in real estate and everyone in real estate is claiming to be some kind of Expert! There is so much overload on what you should do and how you should to do it. It can certainly drive a person crazy just starting out in the business. Well it can also drive a 30 plus year Seasoned investor crazy too!

So, what happened? Well Social Media and the Internet has given everyone access to everyone and everything real estate. To top it off you can get a lot of new wanna be investors mixed in with those who are really serious and interested in investing, that in return creates so much run around that it sometimes all seems like a big waste of time. All these Experts are saying you need to be on Facebook, Craigs List, every Internet site there is. Market everywhere & to everyone, and yet I think when you send an email these days everyone just gets use to hitting the delete button from all the overload of emails, they no longer even really read them.

So, what happened? Well Social Media and the Internet has given everyone access to everyone and everything real estate. To top it off you can get a lot of new wanna be investors mixed in with those who are really serious and interested in investing, that in return creates so much run around that it sometimes all seems like a big waste of time. All these Experts are saying you need to be on Facebook, Craigs List, every Internet site there is. Market everywhere & to everyone, and yet I think when you send an email these days everyone just gets use to hitting the delete button from all the overload of emails, they no longer even really read them.

Now let’s step back to the days of old, by the way everyone out there will also tell you old stuff wont work. But give me a minute and I can explain, “yes it can”! See there is a higher level of investing from what I call Real Networking. You see most investors today go to all these free Networking events, well because there free! Broke people tend to be the majority at most of these Networking events. Go back in time yet even still today and you find that the Wealthy still Network like they always have. They’re at their Monday Golf games, or their every Tuesday lunch meeting with the 2 to 4 people that they have done business with over the years.

You see the Wealthy hang out with other wealthy people. They want the people around them to be smarter & wealthier than themselves. And no matter what the investment or the technique they use to get it done there are some basic principles that never change. So, let’s talk about some of the most important.

You see the Wealthy hang out with other wealthy people. They want the people around them to be smarter & wealthier than themselves. And no matter what the investment or the technique they use to get it done there are some basic principles that never change. So, let’s talk about some of the most important.

First most people may start out just like I did, broke! So, they go straight for the greatest technique Wholesale! But now days it’s changed a lot. If you are in a market where prices are soaring and everyone and their mother is your competition, then it’s going to be tough! You also must look at where you are looking for your potential deals? Is it on Social Media? MLS? Keep in mind now days everyone likes to market that they have an “OFF Market Deal” as they scream that out over the Internet to the whole world. So, what do you do?

Well first let’s list other ways to make Money vs get Wealthy. Second thought lets just go for Wealthy! However, before I do let me help a little with Wholesale. How about Wholesaling Notes. You may have less competition. Or look at Probate but not a list! Check out other articles or our website about these and other ways to find deals with less competition at www.JimmyReed.net.

Now Wealth, real Wealth is really just this simple, whether you like it or not. “You Buy & Sell to create Cash! And You Buy & Hold to Become Wealthy!” If you just keep buying and selling you will always be working a job. Regardless if you are Wholesaling or Flipping Rehabs, it’s just work, a JOB!

Holding Houses or any real estate that pays you Monthly is the first step to becoming Wealthy. By the way holding houses verses holding notes both are great, but the notes do eventually come to an end. Holding assets that produce income in the right Markets will always keep you in the Cash Flow regardless if you work or not.

Holding Houses or any real estate that pays you Monthly is the first step to becoming Wealthy. By the way holding houses verses holding notes both are great, but the notes do eventually come to an end. Holding assets that produce income in the right Markets will always keep you in the Cash Flow regardless if you work or not.

I’m sure you’re asking yourself well how are you going to do that with no money, well you’re not, but someone may be able to help you. That is exactly how I got started back in the late 80’s. I found a partner with money to put down to get a house we could buy, fix and sell. However about 6 months in it became a buy & hold asset instead. I won’t go into all the details but basically it became one of my first rentals.

Now I know many will say I don’t want a rental, or I don’t want to manage property, or even the most popular “tenants will just tear it up”. Well I can agree with you on all of that. However, after 30 plus years of investing this one strategy of Buy & Hold has truly been how we have made the most money over time. We have had every issue you can think of from damages to drug raids even fires, you name it and it has happened to us.

So, get over it! Here is what you need to focus on, one you have tax benefits, two you have Monthly income, and third you can refi the property several times over the years you hold title on it. Lastly you can even use that refi money to purchase more rentals. Start to build your portfolio and start creating a line of credit with the equity. So much more I can tell you, but I want to get to the bigger picture here.

So, get over it! Here is what you need to focus on, one you have tax benefits, two you have Monthly income, and third you can refi the property several times over the years you hold title on it. Lastly you can even use that refi money to purchase more rentals. Start to build your portfolio and start creating a line of credit with the equity. So much more I can tell you, but I want to get to the bigger picture here.

After having rentals for many years including apartment buildings, duplexes etc… I decided to kick up my Wholesale machine the last couple of years, and low and behold I can’t seem to find any REAL Wholesale Deals! All those new people have driven the market up and created so much competition its just not as easy to get great deals as it use to be. However, via our Network and searching in the areas that have less competition we do find some great deals. But again, prices are nuts and the rehab has gone up all because our Market is HOT!

So now to what this whole article is really about, and that is going to Markets just outside the major Markets. See I live in what we call here in North Texas as the DFW Market. Over the last several years we went from some 5 plus million people to over 7 million plus. Outside buyers from higher priced markets such as California, New York, etc… have driven up our prices with all the demand. So, everyone has jumped into the real estate game.

So, as you have probably figured out, I like to be in my own little arena where no one else is playing or at lest very few. I aim for the strategy most investors are not, and buying rentals is one of those. Especially if that rental is NEW Construction. Yes, we are starting to do something a lot of Texans in the past just would not do, and that is travel outside our markets like the Californian Investor has done for years.

So, as you have probably figured out, I like to be in my own little arena where no one else is playing or at lest very few. I aim for the strategy most investors are not, and buying rentals is one of those. Especially if that rental is NEW Construction. Yes, we are starting to do something a lot of Texans in the past just would not do, and that is travel outside our markets like the Californian Investor has done for years.

Only thing is we don’t have to travel that far. You see we have found some really hot markets anywhere from a 30-minute drive up to a round 3 hours outside the booming DFW Market. Best of all I’m now buying New Construction houses with all the higher end fixtures, flooring, even all brick construction. Best of all they cost less than that 1960 or 1970 home I buy in my backyard that still needs $30 to 50k in rehab on top of the purchase price. Even after those houses are rehabbed, they still are older houses.

So, let me tell you this article will be a two-part piece. This first part we will look at some of these new construction properties in these out of the Metroplex market. Yes, they still have a high demand and do cash flow as rentals. In the next issue (Part 2) we will talk about these properties and how to take the standard rental and have the option to turn it into a VRBO, for in many cases you will triple the Cash Flow!

So lets begin with the market where I am buying New Construction for rental only just less than an hour to hour and half outside the DFW Market. By the way we even have a great Property Manager we work with from our real estate club who can manage them.

What I’m purchasing are properties that are typically 2-1 or 2-2 brick houses with all the high-end fixtures and flooring and even include the stainless steel or black appliances. These properties are smaller but there is a demand for the price point as a rental and even as a resale later.

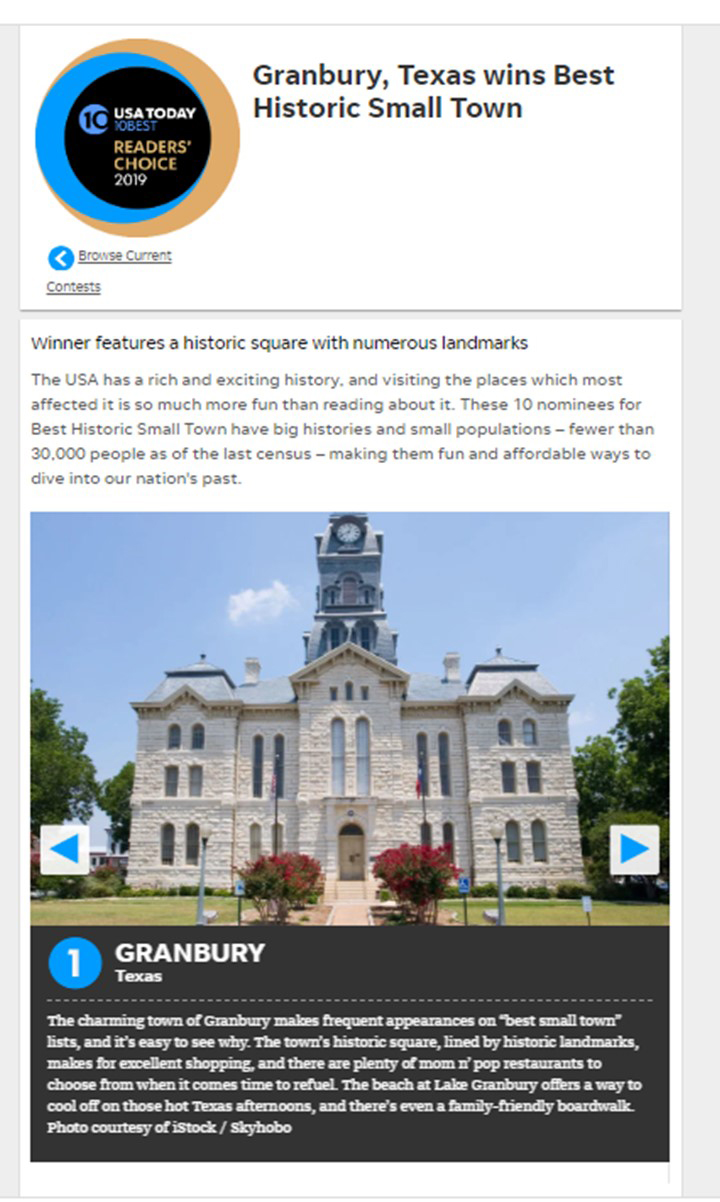

The little town they are in was voted as the number 1 Historic Downtown in the USA. And let me tell you the Market is rocking with just a few Investors. Many DFW Investors don’t even know about how Hot the Market is here. Here is a little glimpse of it.

The little town they are in was voted as the number 1 Historic Downtown in the USA. And let me tell you the Market is rocking with just a few Investors. Many DFW Investors don’t even know about how Hot the Market is here. Here is a little glimpse of it.

Yes, this little town is booming with growth and not enough properties for the growth. More importantly hardly any affordable rentals in the area. And when you find something for rent that is close to being affordable its most likely a mobile home.

So, opportunity has arrived! We can get these homes anywhere from around $158 -$165k and they can rent from $1,300 to $1,400 a Month. Keep in mind you have a new product, so repairs are very minimal. Then, because of the lake access and the properties being less than a few miles from the Square they could also be used as VRBO and Airbnb. We will talk more about that in next Month’s article.

Imagine having brand new construction houses in the hottest little Market in the US just South of the DFW Area which is rated 4th largest Metropolitan area in the US. Just 30-minute drive from Fort Worth and another 45 – 75 minutes from Arlington, and Dallas.

At the time I’m writing this Linda the owner of Realty 411 & REI Wealth has asked us to help out at her October 2020 Texas Expo. Last year we did a bus tour for rehabbing properties. This year if all goes to plan, we will be doing it again, but this time the Bus training is going to Granbury for New Construction Investing!

At the time I’m writing this Linda the owner of Realty 411 & REI Wealth has asked us to help out at her October 2020 Texas Expo. Last year we did a bus tour for rehabbing properties. This year if all goes to plan, we will be doing it again, but this time the Bus training is going to Granbury for New Construction Investing!

Make sure to keep an eye out in the magazine and Realty 411 Marketing emails so you can make it to Texas for the Lone Star Expo! Also don’t forget next Months magazine with part 2 of this article.

So, in closing for this first article was to help get you out of the box of doing what everyone else does. When we travel the country speaking at clubs and Expos, we always talk about how to Wholesale in today’s market and also how to look in areas most do not such as Probate. Sometimes we will even do a 1- or 2-Day Training in the area to teach on these subjects and more. This year part of our full day events we will include these new construction opportunities along with using them as VRBO and Airbnb as another avenue for increased cash flow.

We also cover how to make more money tax free with these investments using a Roth IRA. So, you may also want to consider opening an IRA to hold these Buy & Hold investments. Yes, you may not have much money in them when you start. But you can open one and then start to wholesale properties, or even wholesale notes so you can start to get some cash built up. Then you are also building your wealth for the future. Typically, with an IRA you are building that wealth tax free. So, using a Roth does have some real advantages.

The main thing is position yourself so you can maneuver positively so no matter where the market turns. If you keep your eyes on the market and not so much on the quick buck, you can become very successful even Wealthy at this real estate game!

Be Blessed with Success!

Jimmy Reed

Jimmy V. Reed

Jimmy V. Reed of Fort Worth, Texas has been investing in real estate since 1987. In 1991, he started conducting full-day training sessions on Wholesaling. He then began teaching and mentoring others throughout the country. He is currently the founder of the Fort Worth Real Estate Club www.1REclub.com and has his own real estate training company that includes Wholesale, Probate, Mentoring & a Biblically based Debt Free training course and more!

More info available at www.JimmyReed.net