Women in Real Estate — Build the Lifestyle of Your Dreams with Real Estate Investing

By Laura Alamery

In 1987, at the young age of 23, I had my first glimpse of a future as a real estate investor. It all started with my love of visiting open houses, which led me to obtain my real estate license to learn the industry. At the time, I lived in Hawaii where I found inspiration from the successful women real estate agents around me. After a move to the Midwest in the early 1990s, I quickly learned that the commissions and energy around real estate weren’t as inspiring. For me, this led to the transition from real estate agent to real estate investor. Over the next few years, I launched into real estate investing while managing a young family and career. After a divorce, I realized I needed to leave my corporate job and fully dedicate myself to establishing a reliable income and building long-term wealth through real estate investment.

Along the way, I made mistakes, learned many valuable lessons and ultimately built a lasting and successful real estate investing business. Today, I use that knowledge and experience to help other women launch and grow their real estate investment businesses at Real Estate Investing Women, a resource for training, live events and networking in a community of likeminded women.

Lessons for New Real Estate Investors

Looking back at how I built my real estate investing business, I now have the wisdom to see the ways I would change my strategies to avoid mistakes and build wealth with fewer risks. One of the big lessons I like to share with new female investors is to trust your instincts. The ability to tap into our gut feelings to make decisions is a benefit that makes women a natural fit for real estate investing.Another piece of advice is to use money from your real estate investments to buy more real estate, instead of putting all your personal money into investments. The challenge is finding the money to start out. The mistake I made was purchasing too many buy and hold properties too quickly. This led to unnecessary risk and eventual burnout. I now tell new investors to start with one buy and hold property and grow slowly.However, unlike my path into real estate investing where I dabbled in fix and flip, moved on to buy and hold and then finally figured out how to work wholesale deals, I suggest new investors start with wholesale deals. Wholesale isn’t easy and requires work. Yet, wholesale real estate investing has lower risks than other investment strategies.

With wholesale investing, you learn while making money. In fact, wholesale investment is a great way to delve into the details of real estate investing without taking possession of properties. Set aside the money you make money through wholesaling to build the financial foundation of your real estate investment business.

Not only does wholesaling produce quick profits, it also establishes a portfolio that you can use to attract private money. Creative financing with private money gives more control over your real estate investing business. Private money safeguards against the volatility of the market.

With wholesale investing, you learn while making money. In fact, wholesale investment is a great way to delve into the details of real estate investing without taking possession of properties. Set aside the money you make money through wholesaling to build the financial foundation of your real estate investment business.

Not only does wholesaling produce quick profits, it also establishes a portfolio that you can use to attract private money. Creative financing with private money gives more control over your real estate investing business. Private money safeguards against the volatility of the market.

As your business grows, you then have the money, knowledge and reputation to tackle larger-scale investments with bigger risks. Ultimately, this is how you build a viable business and path to long-term wealth and the lifestyle of your dreams.

Three Keys to Success in Real Estate Investment

While real estate investment offers many different strategies and paths to wealth, the keys to success come from your determination to make it. When I finally became serious about real estate investment as my career, I was newly divorced with three small children. I gave myself six months to build a business that allowed me to walk away from my corporate job.

Looking back, the three keys to my success were focus, consistency and time management. These areas were critical to get me out of my comfort zone and take real estate investing from a hobby to a true business.

Often when I talk to women interested in real estate investing, the barrier they struggle with most is the confidence to take the first steps. Men historical dominate the real estate investing industry, which makes trusting your abilities as a female investor even more intimidating. However, with these keys to success and the support of other successful female investors you too can create a prosperous business.

Focus – A serious approach to real estate investment requires focus. This means you create actual goals for your business. For me, my goal was to quit my corporate job within six months. This meant I needed to close at least one deal per month, which required willpower fueled by my excitement and inspiration. My eyes stayed on the prize.

Consistency – You cannot build anything without consist dedication. To exceed my goal of closing one deal per month, I had to work daily toward that goal. Remember, I was a working, single mom, yet I put in time daily to find, connect and close deals. It was this consistent effort that led to achieving and surpassing my goal.

Time Management – Life is busy. This is true of almost everyone I meet. The difference in the people who grow a sustainable business that produces wealth and those that don’t is good time management. During my six-month transition, I realized that a little sacrifice could change my life. Good time management means you don’t waste your time. Instead, you find those pockets of time to dedicate to your goal. For me, this meant working on weekends and evenings until I had the money to quit my corporate job.

Often when I talk to women interested in real estate investing, the barrier they struggle with most is the confidence to take the first steps. Men historical dominate the real estate investing industry, which makes trusting your abilities as a female investor even more intimidating. However, with these keys to success and the support of other successful female investors you too can create a prosperous business.

Focus – A serious approach to real estate investment requires focus. This means you create actual goals for your business. For me, my goal was to quit my corporate job within six months. This meant I needed to close at least one deal per month, which required willpower fueled by my excitement and inspiration. My eyes stayed on the prize.

Consistency – You cannot build anything without consist dedication. To exceed my goal of closing one deal per month, I had to work daily toward that goal. Remember, I was a working, single mom, yet I put in time daily to find, connect and close deals. It was this consistent effort that led to achieving and surpassing my goal.

Time Management – Life is busy. This is true of almost everyone I meet. The difference in the people who grow a sustainable business that produces wealth and those that don’t is good time management. During my six-month transition, I realized that a little sacrifice could change my life. Good time management means you don’t waste your time. Instead, you find those pockets of time to dedicate to your goal. For me, this meant working on weekends and evenings until I had the money to quit my corporate job.

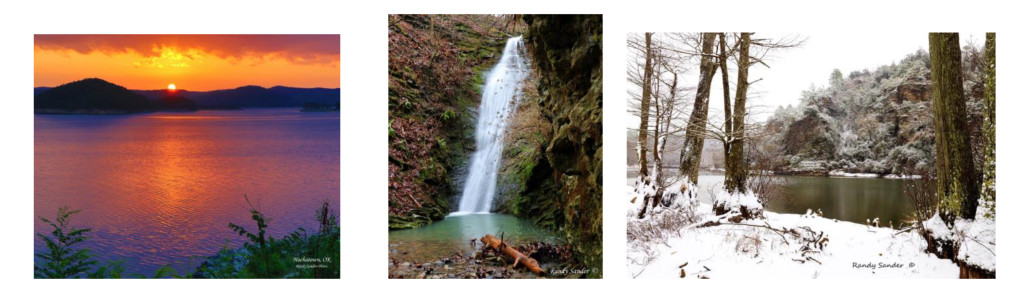

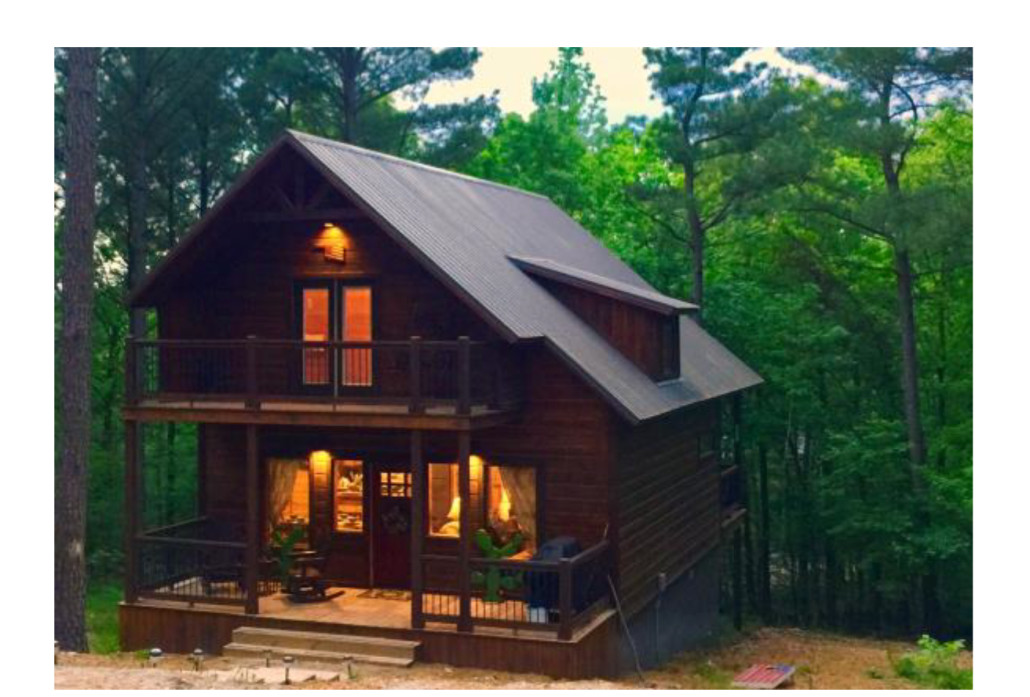

Identify Your Dreams and Go After Them

Over the course of my life, my dreams have changed. Yet, the basic dream has remained. I desired to have financial freedom and independence. I achieved that dream through focus, consistency and time management. I continue to use these tools today in my new ventures.

For me, my dreams included taking care of my family, a flexible schedule, world travel and helping others. One of my passions is helping other women identify and go after their dreams by building successful real estate investing businesses. You don’t have to let a lack of confidence stifle your dreams. Instead, tap into your natural instincts to create a path to your dreams.

Women benefit by helping other women. In real estate, I’ve never feared scarcity. There are more than enough deals for everyone. My dream now is to leave a legacy by empowering other women. My work at Real Estate Investing for Women is one way I work toward this goal. Through mentoring, community building, live events and online resources, like podcast, articles, eBooks and more, women have access to unprecedented knowledge and encouragement.

As I look back over my more than 30-year career in real estate investing, I see a story of hard work and determination. I also see the gift of my dream lifestyle that real estate investment empowered. You too can find the lifestyle of your dreams through a focused, consistent and well-managed real estate investment business.

Women benefit by helping other women. In real estate, I’ve never feared scarcity. There are more than enough deals for everyone. My dream now is to leave a legacy by empowering other women. My work at Real Estate Investing for Women is one way I work toward this goal. Through mentoring, community building, live events and online resources, like podcast, articles, eBooks and more, women have access to unprecedented knowledge and encouragement.

As I look back over my more than 30-year career in real estate investing, I see a story of hard work and determination. I also see the gift of my dream lifestyle that real estate investment empowered. You too can find the lifestyle of your dreams through a focused, consistent and well-managed real estate investment business.

To Learn More about Real Estate Investing for Women:

Laura Alamery and Liz Klingseisen are a mother and daughter team, who are real estate investors and mentors to other women. Their goal is to empower and help women, who want to learn about real estate investing through a supportive and experienced community of women investors. We offer training and live events nationwide. You can learn more at www.realestateinvestingwomen.com