Converting Home Equity to Cash

By Rick Tobin

The average American homeowner has the bulk of the household’s net worth tied up in the equity in their primary home where they reside. As noted in my past Equity Rich, Cash Poor article, the average US homeowner at retirement age has 83% of their overall net worth tied up in home equity (or the difference between current market value and any mortgage debt if not free and clear with no liens). As a result, the typical homeowner only has about 17% of their overall net worth available for monthly expenses.

Real estate isn’t as liquid, or the ability to quickly convert to cash, as a checking account. We can’t just go to our local grocery store and ask the cashier to deduct the full grocery cart from our debit account tied to our home’s promissory note or deed of trust. Yet, we all have to eat, so what are some ways to gain more access to cash that originate from the equity in our primary home or investment properties?

ADVERTISEMENT

Let’s take a closer look at ways to convert equity in real estate into spendable cash:

● Sell your primary home or rental properties: If so, where will you live? Are rents nearby lower or higher than your current mortgage payments if you need to move? Are there any potential unforeseen tax consequences or benefits? Will you miss the monthly rental income from your investment properties?

● Sale-and-leaseback: You find an investor willing to purchase your primary home while allowing you to stay there for months or years as a tenant.

● Cash-out 1st mortgage: Pay off some or all forms of consumer debt (credit cards, auto loans, school loans, business loans, tax liens, etc.) with a larger mortgage while possibly lowering your overall monthly expenses significantly with or without any verified income.

● Reverse mortgage: A combination of a mortgage and life insurance hybrid contract that gets you cash out as a lump sum and/or with monthly income payments to you while not requiring you to make any monthly mortgage payments. Lower FICO scores are usually allowed and minimal sourced monthly income like from Social Security may be sufficient to qualify.

● Business-purpose loan as a 1st or 2nd: A type of loan that may be tied to an owner-occupied or non-owner-occupied property for so long as the funds are used for business or investment purposes such as assisting your self-employed business or buying more rental properties. These types of loans have much less paperwork and disclosure requirements and can be funded within a few weeks with or without income or asset verification.

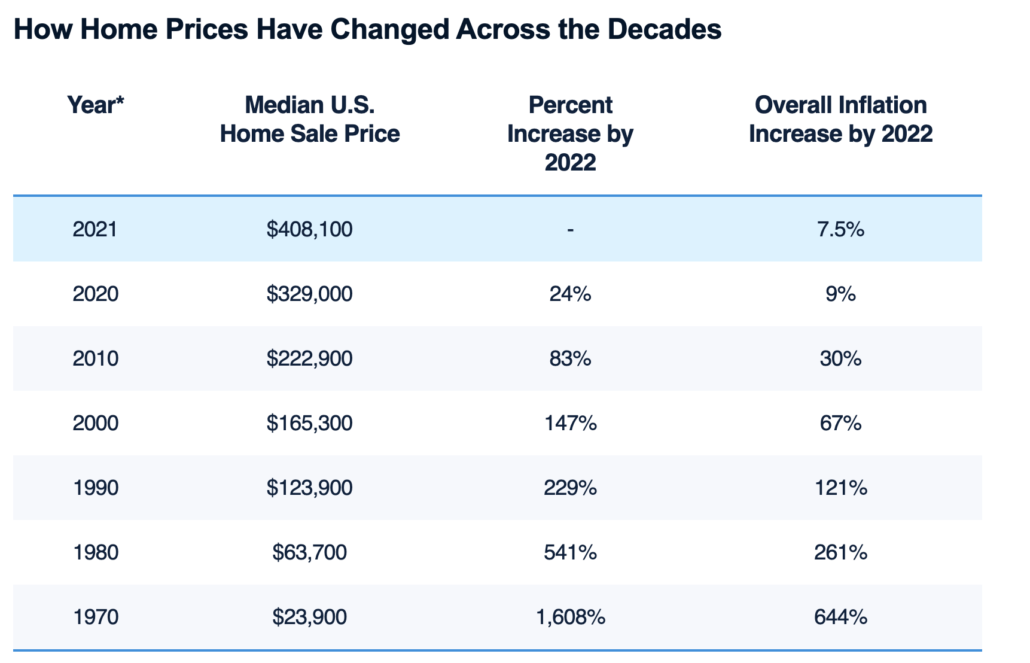

Declining Dollars and Rising Expenses

Although U.S. wage earnings rose 5.1% nationwide between the 2nd quarter of 2021 and 2022, the published Consumer Price Index (CPI) inflation rate reached 9.1% in June 2022 which was the highest inflation rate pace in over 40 years. As a result, the purchasing power of our dollars continues to decline while consumer goods and service prices rise too quickly.

In July 2022, credit card rates and overall consumer debt balances across the nation reached all-time record highs. This was partly due to more Americans relying upon their credit cards to cover basic living expenses to offset inflated prices.

Simultaneously, the Federal Reserve increased short-term rates a few times so far this year while making consumer debt balances more expensive. At the June and July meetings for the Federal Reserve, they increased short-term rates 0.75% at each meeting. This was the largest back-to-back or consecutive rate hike for the Federal Reserve in their entire history.

To bridge the gap between expenses and income, total credit card debt balances surpassed $890 billion in the second quarter of 2022. The increase in overall credit card debt rose 13% in the second quarter of 2022, which was the largest year-over-year increase in more than 20 years. Near the start of 2022, the average American had close to $6,200 in unpaid credit card balances as per the Federal Reserve and Bankrate.

An additional 233 million new credit cards were opened in the second quarter. This was the largest new credit card account increase in one quarter since 2008 (or near the start of the Credit Crisis). A consumer who pays just the minimum balance for a credit card with a few thousand dollar balance may need more than 30 years to pay off the entire debt partly due to the horrific annual rates and fees that are generally much higher than 30-year mortgage rates.

ADVERTISEMENT

Short-Term Cash Supplies

It would take 64.4 days for a Californian to run out of cash if they had average American savings amounts of $9,647 based upon a recent study from ConsumerAffairs.

Here’s the top 10 most expensive regions in the nation and the estimated time that it would take to run out of cash:

Hawaii (62.5)

California (64.4)

Washington, D.C. (72.1 days)

Massachusetts (73.6 days)

New Jersey (74.8 days)

Connecticut (76.3 days)

Maryland (77.9 days)

Washington (79 days)

New York (79.9 days)

Colorado (80.8 days)

Living Wages, Debt, and Wealth Creation

Another survey conducted by GOBankingRates that was published in July 2022 found that the median annual living wage, which is defined as the minimum income amount needed to cover expenses while saving for retirement, is $61,617 per U.S. household. However, the Top 14 most expensive states required much higher annual household income or living wages as listed below:

1. Hawaii: $132,912

2. New York: $101,995

3. California: $94,778

4. Massachusetts: $86,480

5. Alaska: $85,083

6. Oregon: $82,926

7. Maryland: $82,475

8. Vermont: $78,561

9. Connecticut: $76,014

10. Washington: $73,465

11. Maine: $73,200

12. New Jersey: $72,773

13. New Hampshire: $72,235

14. Rhode Island: $71,334

Nationally, the lowest required living wage income for households was $51,754 in Mississippi.

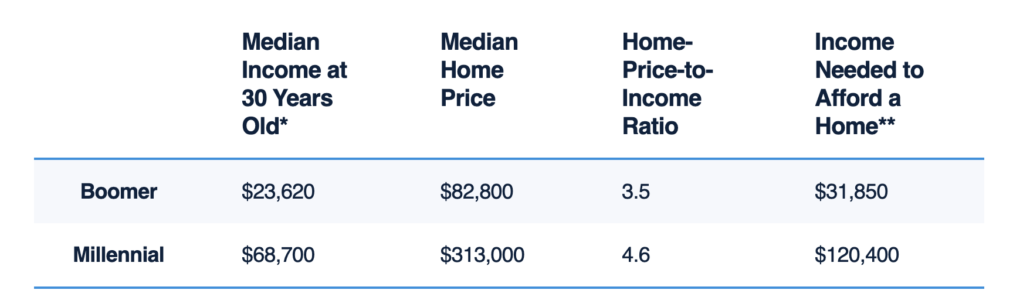

These Top 14 expensive living wage regions also share something in common in that they have some of the highest median-price home values in the nation, especially Hawaii, New York, and California. While the monthly living wages may be highest in these regions, the net worths for homeowners is probably much higher due to so many properties valued well over $1 million dollars.

Ideally, we should all focus on keeping our monthly expenses as low as possible while investing in prime real estate to boost our overall net worth. If so, you’re more likely to retire sooner rather than later while your money works hard for you (or rapidly increasing annual home value equity gains) instead of you working too hard for your money.

Rick Tobin

Rick Tobin has a diversified background in both the real estate and securities fields for the past 30+ years. He has held seven (7) different real estate and securities brokerage licenses to date, and is a graduate of the University of Southern California. Rick has an extensive background in the financing of residential and commercial properties around the U.S with debt, equity, and mezzanine money. His funding sources have included banks, life insurance companies, REITs (Real Estate Investment Trusts), equity funds, and foreign money sources. You can visit Rick Tobin at RealLoans.com for more details.

Learn live and in real-time with Realty411. Be sure to register for our next virtual and in-person events. For all the details, please visit Realty411.com or our Eventbrite landing page, CLICK HERE.