Realty411’s Real Estate Investor Summit – Learn to Invest LIVE in Irvine

Image from Pixabay

When:

September 18, 2021

@ 9:00 am – 5:00 pm

Where:

The Atrium Hotel

18700 MacArthur Blvd.

Irvine, California

92612

Cost:

Free

Contact:

Realty411.com

805.693.1497

Email

Event website

Celebrate Real Estate Investing in a Post-Pandemic World with REALTY411

Learn the Latest Niches in Real Estate + Connect with Influential Investors from across the nation right here in Irvine, California!

Join us and network LIVE AND IN-PERSON. This is our FIRST live event in California — Network with amazing leaders.

Are you ready to Grow Your Real Estate Business, Portfolio and Network?

We want this VIP EXPO TO EXPAND YOUR MIND and help you succeed.

Since 2007 Realty411 Has Been the Leader in REI Resources for Investors around the Nation, as Well as Our Readers Internationally.

OUR COMPLIMENTARY CONFERENCE IS THE #1 SOURCE FOR REI 411 – RSVP NOW!

This is Your Chance to meet TOP Leaders in REI, Local & National Experts

- Learn from Leaders & Industry Pros

- Meet Local PLUS Out-of-Area Investors

- NON-Stop Tips for Real Estate Success

- Bring Lots of Business Cards

This event is produced and hosted by Realty411.com. Our company is based in Central California. Since 2007, we have dedicated our time, resources and energy to help expand real estate investing knowledge and education by producing complimentary magazines, virtual conferences, webinars, podcasts, and live events.

Learn more about Realty411.com, visit our numerous websites:

https://realty411.com or http://realty411guide.com or http://realty411expo.com

We also produce REI Wealth magazine, which is the longest-running magazine for investors specifically developed for online readership. Our digital, interactive issue is designed to be read and viewed online. We now also print copies of this fabulous publication as well. Learn more about this publication at: http://REIwealthmag.com

INVEST YOUR TIME HERE FOR ONE SPECIAL DAY OF NETWORKING & MOTIVATION – TAKE YOUR REAL ESTATE KNOWLEDGE TO A WHOLE NEW LEVEL, CLICK HERE!

Don’t miss our complimentary real estate investor summit. What can you expect?

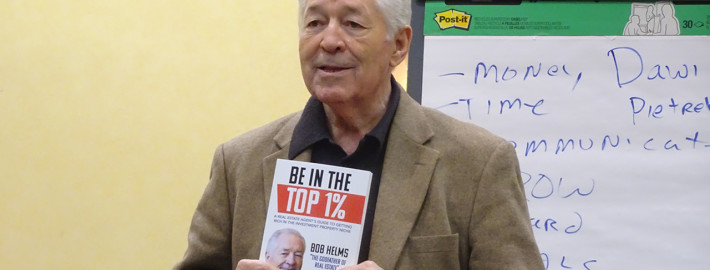

Learn with PROVEN Leaders in the Industry:

- Receive the latest REI knowledge from active investors

- We feature the latest technology to expand your income

- Meet other investors with common goals and mindsets

- Develop relationships with leaders in the industry

- Share your opportunities with potential clients

- Learn how to save money with our Realty411VIP.com members’ network.

- Realty411’s publisher has owned national rentals for many decades

- We will share life-changing information unavailable anywhere else

- We host complimentary events to meet our readers and to spread knowledge

Other events charge hundreds of dollars, but this day is PRICELESS. Be sure to RSVP Now!

Realty411’s founder has both media and real estate experience having graduated from California State University, Long Beach with a degree in journalism. Plus, her background includes 16 years as a licensed California real estate sales agent.

Our mission is simple: To provide knowledge and resources so that as many people as possible can learn about real estate investing.

This special event is a great investment of your time. We know your time is extremely valuable. In fact, time is the most valuable asset we have. We can always make more money; however, we cannot add more time to our life! With this in mind, we urge your to invest quality time in growing your business, connections, resources, knowledge and sphere of influence by attending this event. Discover why thousands of investors around the nation have attended our complimentary events.

OTHER SPECIAL BONUS PERKS INCLUDE:

- Early-Bird Guests Receive Our Investment Magazines

- Meet Local Leaders & Industry Giants – From Coast to Coast

- Influential Real Estate People & Business Owners Are Attending

- Learn How to Leverage and Meet Private Capital Lenders

- Find Potential Partners, New Friends, Build Your Circle of Influence

- Your Net Worth = Your Network — Don’t miss this event

- Mingle with Leaders & Industry Professionals Here

Please bring LOTS OF BUSINESS CARDS, it’s time to Network. Be sure to register EARLY for this event as tickets are limited.