Boost Your Credit to Afford Home Purchases

By Rick Tobin

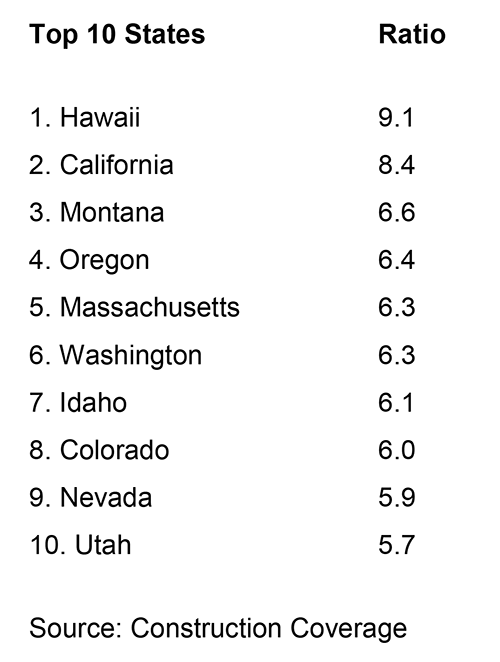

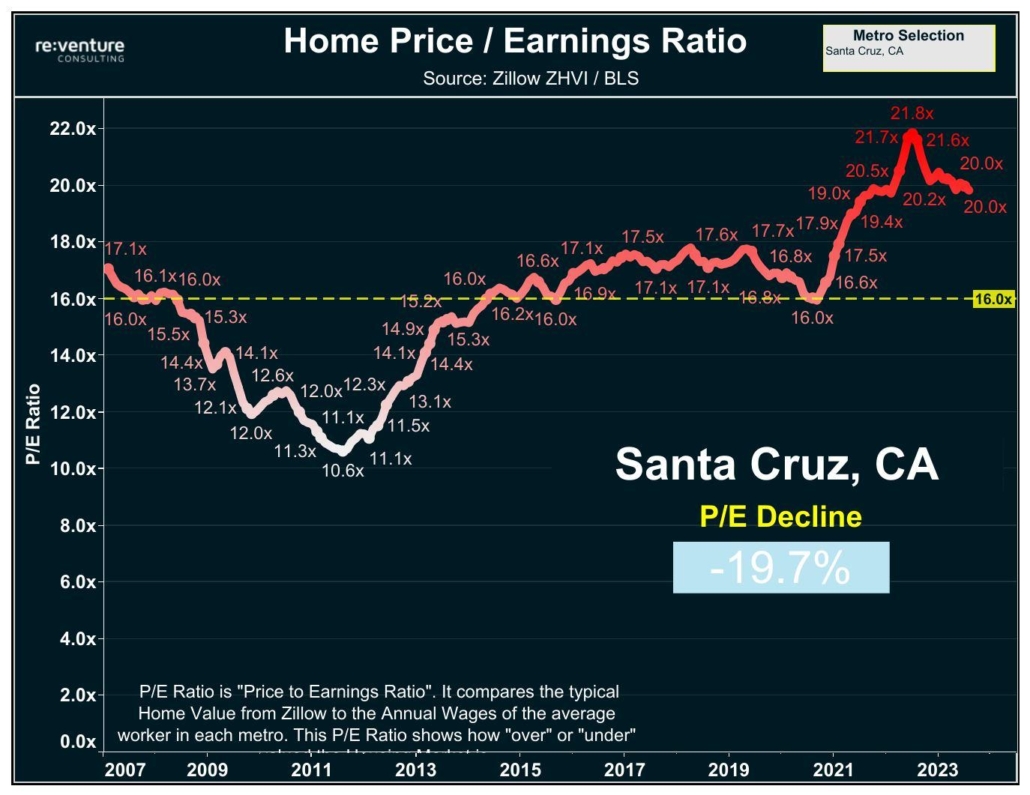

The average single-family home statewide across California reached $888,000 in October 2024, according to the California Association of Realtors, and a California condominium might cost you about $670,000.

While the unusually perfect number of $888,000 for California properties may seem a bit high for most Americans, it’s lower than the few consecutive months earlier this summer when average home prices surpassed $900,000.

By comparison, the median home listing price in October for the entire nation reached $424,950, as per Realtor.com. Both the number of homes listed for sale and home prices are higher than one year prior.

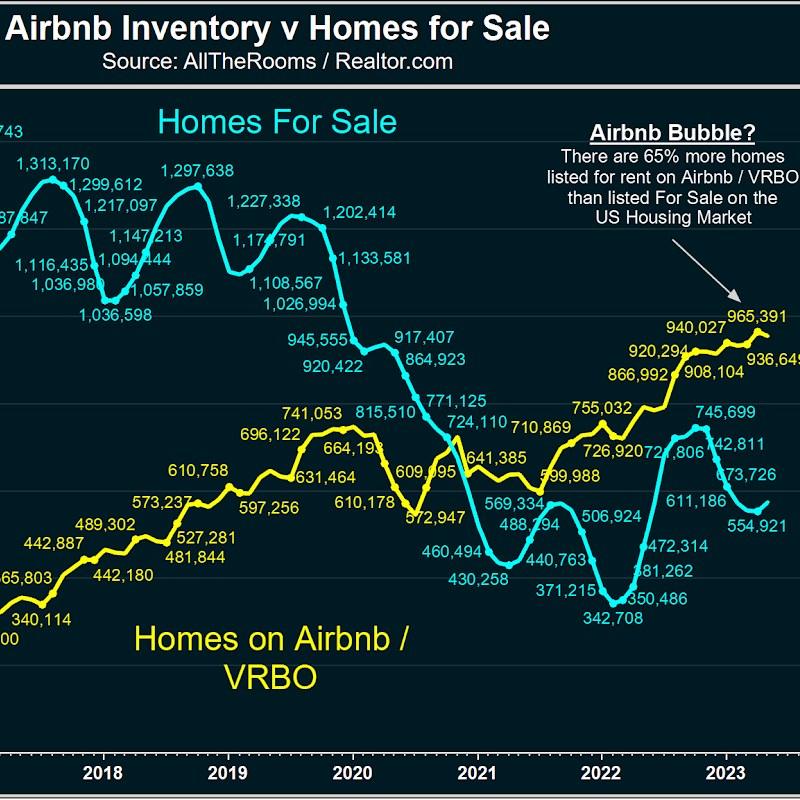

For example, the total number of home listings rose +22.5% between October 2024 and October 2023 while home prices still increased in most U.S. home regions. This is quite an unusual combination of rising inventory and prices that are usually inverse to one another like a seesaw.

Generally, home prices either remain the same or start to fall as home listing inventory rises. However, our total national home listing supply is still well below historical averages and we’ve haven’t seen significant home price drops yet.

Unaffordable Home Prices and Payments

Nationwide, the typical monthly mortgage payment hit $2,175 in November 2024, which was quite a jump of +6.9% from one month prior when the October payment was $2,034, as per Reef Insights.

The good news about mortgage payments in the 4th quarter of 2024 is that they are -10.7% lower than last year’s record high of $2,435. This is primarily due to the fact that long-term 30-year fixed mortgage rates have fallen quite a bit over the past year.

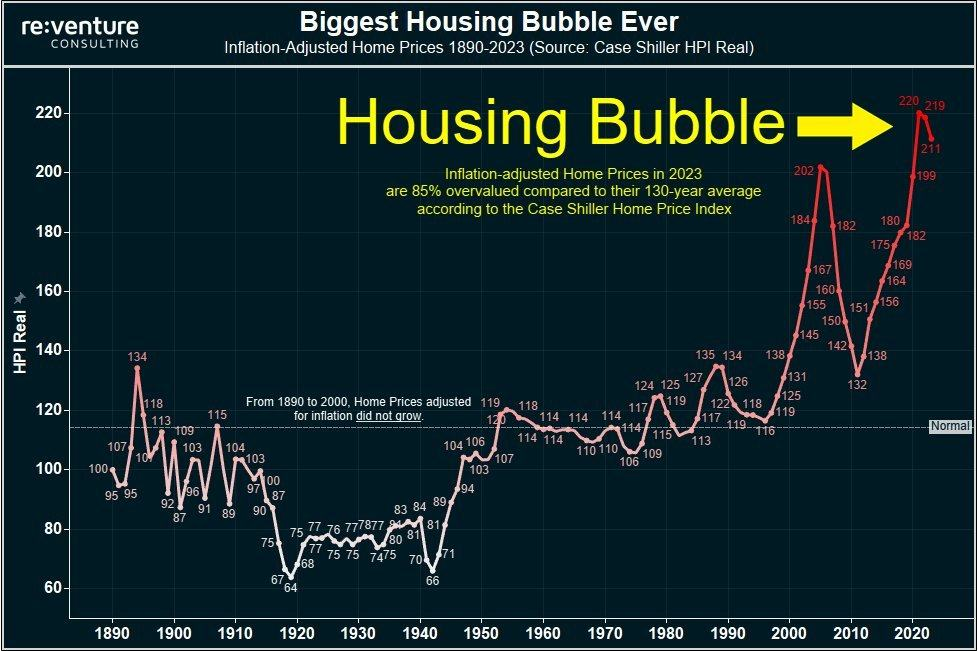

In spite of the more recent national mortgage payment averages being -10.7% lower than last year, today’s monthly payment for the U.S. is a whopping +78.7% higher than back in January 2020. The combination of record low mortgage rates and record high home prices in many regions between 2020 and 2024 were key reasons why home payments and home prices changed in recent years.

Today, a homebuyer needs to budget or set aside another $1,000 per month ($12,000/yr.) to purchase the same house compared to just four years ago. How many Americans today are earning $12,000 more per year today to help cover these costs? It’s probably not that large of a number for home buyer prospects who are earning much more money today than back in 2020.

article continues after advertisement

The Importance of Boosting FICO scores

As shared before in my article entitled The Interconnected California & Global Real Estate Markets, it’s never been more important to figure out ways to increase your FICO credit scores so that your qualifying mortgage rates are as low as possible and your qualifying loan-to-value (LTV) options are as high as possible, especially if you have minimal cash reserves for real estate purchases.

Understanding Credit: FICO scores range from 300 to 850. The higher the score, the better the credit grade.

The three main credit bureaus or credit reporting agencies (CRAs) include Experian, TransUnion, and Equifax. The credit scores are derived from the following factors:

● Payment history—35%

● Amount owed—30%

● Length of credit history—15%

● New credit—10%

● Types of credit used—10%

Newer Credit Score Models: The average American has a FICO credit score near 690 to 700, according to various reports. In October 2022, the Federal Housing Finance Agency (FHFA) announced the approval of a new credit score rating system named FICO 10T and VantageScore 4.0 for use by Fannie Mae and Freddie Mac. FICO 10T and VantageScore 4.0 will consider payment histories from rent, utilities, and telecommunication bills. Yet, a rental payment history can be very bad for tenants on Covid moratoriums with years of no payments.

I’ve written real estate courses in most states for the two largest real estate publishers as well as for the oldest and best-known real estate school in California. Many of the courses that I create include details about how to build, rebuild, or boost overall credit scores.

Oftentimes, I am helping my clients increase their FICO scores during our mortgage pre-approval process. If and when successful with boosting my clients’ credit scores by 20 to 200+ FICO points within a relatively short period of time, the client may then qualify for a much lower rate while saving tens of thousands of dollars’ worth of interest payments on their mortgage.

California’s Rising Rents

The median rent for all property types.in California reached $2,800 in October 2024, as per Zillow. California rents were $795 higher than the national median. The more encouraging news for California renters is that rents only increased by $5 per month as compared to back in December 2023.

Top 10 Most Expensive Rental Markets in California

For those people who are struggling making rent payments here in California and elsewhere, it’s quite understandable why as we review the Top 10 priciest average rental regions below:

1. San Diego: $3,175/mo.

2. San Francisco: $3,168/mo.

3. Los Angeles: $2,893/mo.

4. San Jose: $2,570/mo.

5. Santa Monica: $2,500/mo.

6. Oakland: $2,450/mo.

7. Irvine: $2,400/mo.

8. Santa Ana: $2,370/mo.

9. Berkeley: $2,350/mo.

10. Fremont: $2,300/mo.

article continues after advertisement

Top 10 Most Affordable Rental Markets in California

Conversely, let’s take a look at the 10 most affordable rental markets in California as per Zillow:

1. Redding: $1,142/mo.

2. Turlock: $1,351/mo.

3. Lodi: $1,358/mo.

4. Bakersfield: $1,367/mo.

5. Yuba City: $1,375/mo.

6. Merced: $1,481/mo.

7. Modesto: $1,546/mo.

8. Fresno: $1,430/mo.

9. Clovis: $1,627

10. Citrus Heights: $1,755/mo.

Boost Your Credit, Boost Your Quality of Life

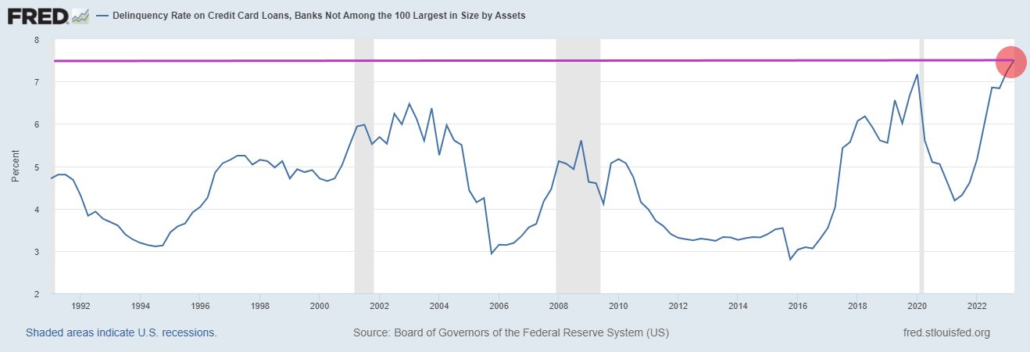

Please focus on increasing your FICO credit scores whether or not you currently own real estate or dream to one day buy your first home. With average credit card APRs (Annual Percentage Rates – includes rates and annual fees) hovering in the 35% to 45% APR ranges today for many consumers, it can be very challenging to pay off this unpaid and compounding consumer debt as well as to set aside enough cash reserves for a down payment and closing costs for home purchases.

Earlier this year, the average store merchant credit card rates were closer to 28.93% before the Federal Reserve cut short-term interest rates by 0.75%. In spite of the 0.75% rate cuts by the Fed, several big box retailer merchant card rates rose by 7% to today’s 35.99% rate average in recent months, according to USA Today.

In normal economic times, credit cards rates would’ve fallen after the Fed cut short-term interest rates. However, many of these same merchant credit card rates rose by almost 7%. This may be completely unprecedented as I can’t think of any other time in U.S. history when credit card rates rose so quickly and at such a large 7% rate increase following two Federal Reserve rate cuts for short-term rates that usually lowers credit card rates.

These rates don’t include annual fees, so the true APRs (Annual Percentage Rate) are probably closer to 40% to 45%+ as most credit card issuers don’t have to follow usury laws.

Usury: the illegal action or practice of lending money at unreasonably high rates of interest. (Source: Dictionary.com)

Credit card default rates are reaching all-time record highs for some credit card issuers. As a result, they are seemingly punishing the credit card customers who are still making their payments on time to cover these credit card issuer losses with higher rates and fees for both the good and bad paying customers.

If possible, please pay off any double-digit debt as fast as possible. Then, focus on boosting your credit scores. Once achieved or if you need some free credit repair advice from me and a new mortgage, please contact me for more details. I’m easiest to reach via email at [email protected].

Rick Tobin

Rick Tobin has worked in the real estate, financial, investment, and writing fields for the past 30+ years. He’s held eight (8) different real estate, securities, and mortgage brokerage licenses to date and is a graduate of the University of Southern California. He provides creative residential and commercial mortgage solutions for clients across the nation. He’s also written college textbooks and real estate licensing courses in most states for the two largest real estate publishers in the nation; the oldest real estate school in California; and the first online real estate school in California. Please visit his website at Realloans.com for financing options and his new investment group at So-Cal Real Estate Investors for more details.

Learn live and in real-time with Realty411. Be sure to register for our next virtual and in-person events. For all the details, please visit Realty411.com or our Eventbrite landing page, CLICK HERE.