How to Purchase and Manage an Investment Property in Japan

By Priti Donnelly

Real estate investments in Japan continue to attract foreign buyers from around the world for high yield, affordable prices and cash flowing rental income. But, in a foreigner-shy country that speaks mostly Japanese, conducting due diligence, negotiating and making an offer can be almost impossible. To complicate matters further, properties in the Japanese real estate market are sold within days, sometimes hours, making it more difficult to compete against local buyers. So, how then do foreign buyers successfully manage to invest in the market?

Find a Local Proxy/Agent

The first step is to find a local bilingual (Japanese-English) proxy/agent who will help you familiarize yourself with the property market. Look for someone who is available to you, communicates well and who can provide you with information in a timely fashion. Consider your proxy as an extension of yourself. Expect transparency about their services, keeping you informed at all stages of the purchase process and clearly explaining the management process. Don’t hesitate to ask for client references.

Familiarize Yourself with the Market

There is no need to travel to Japan to scout the area, unless you want to. Your experienced and trusted proxy will work with you to familiarize yourself with the market. They should have strong knowledge of locations, in particular, areas with population growth to ensure tenant demand. Ask about properties close to shopping districts, schools and hospitals where tenant demand would be higher. Another factor to consider is the age of buildings. In 1981, the building standards act changed their policies to ensure earthquake resistant construction methods. This is the turning point that some buyers look to when purchasing an apartment, although many older buildings built prior to 1981, have been retrofitted to bring them up to code. Next, you may have a certain size and features in mind – one room with a living room, kitchen and dining room, close to a train station is ideal for a student, single or elderly person. Two or more rooms could suit a family. Of course, your budget and yield are naturally of significance.

Analyze the Numbers

Once you have a good idea of the features you have in mind, your proxy will send you analyses of properties to suit your criteria and break down the numbers (price, costs, yield, etc.) For example, with the exception of Tokyo, investment properties across Japan range from $40K to $60K at 6% to 12% yield. In the center of big cities, or first tier cities such as Fukuoka and Nagoya you can expect a yield of 6% to 8%. In second tier cities such as metropolitan Sapporo, you will find properties with a yield of 9% to 10%. In the third tier are smaller townships, albeit with good profiles, 10% to 12%, all net pre-tax. With an occupancy rate of 93% to 94% in these areas, you will generate immediate income of $250 to $400 a month, on average.

Submit an Offer

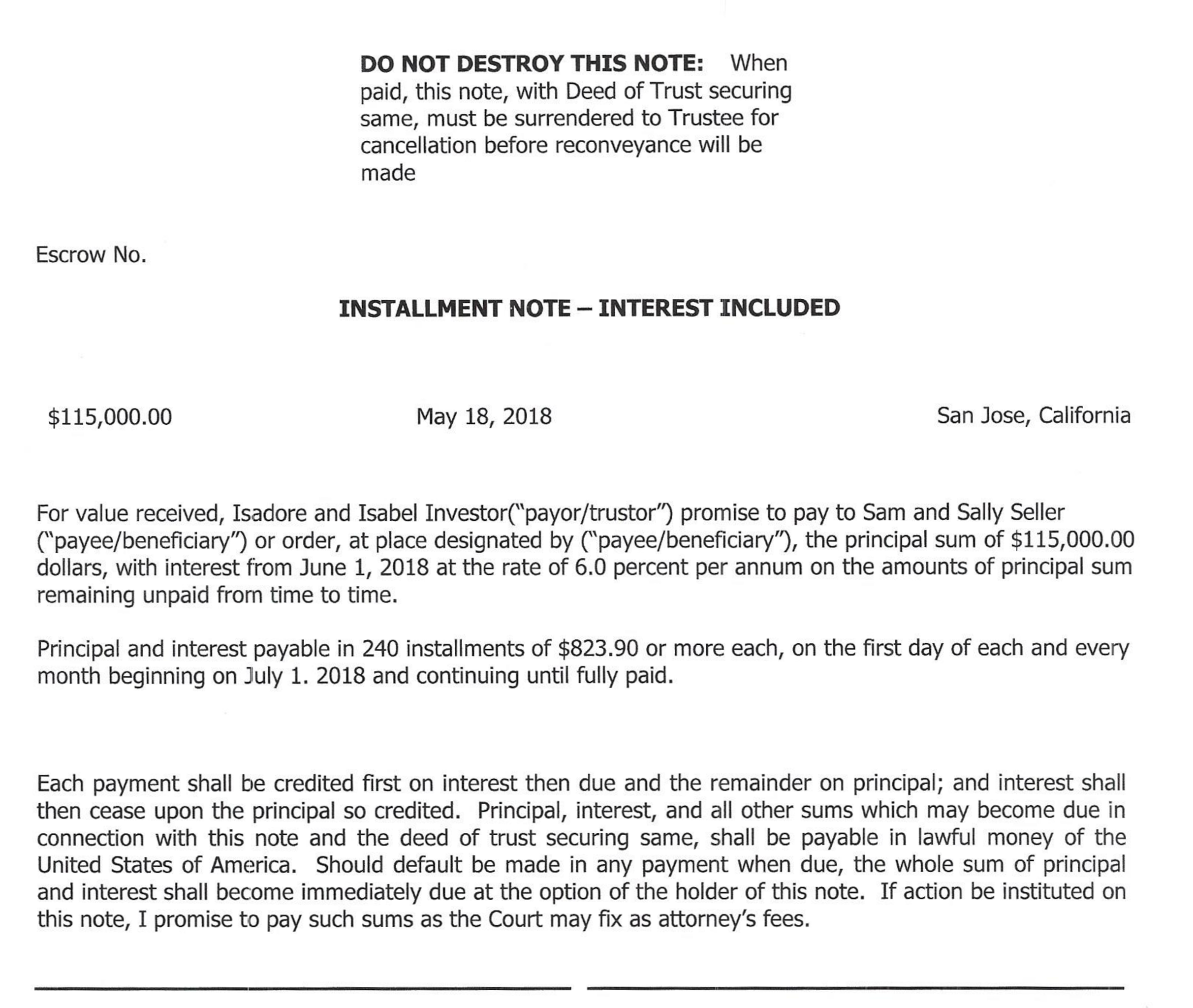

It’s easy to see why properties are sold within hours or days at the most in this market. As soon as you see something you like, notify your proxy to submit an offer on your behalf. It’s a good idea to have your agreements with your proxy signed in advance to save valuable time. Because properties are sold so quickly, you won’t likely have time to perform thorough due diligence on any particular deal before submitting your offer, but you should have enough information on your deal analysis to determine whether or not you want to submit your offer.

Conduct Due Diligence

If your offer is accepted, you will receive due diligence information from the real estate agent. One of the key items to look for is the accumulated fund, also known in some countries as a sinking fund. This fund goes toward a renovation/repair pool. Due diligence should be able to determine if the size of the funds pool is sufficient for building repairs. If lacking in funds, then the building report should show substantial renovations to the building to justify the shortage. If not, an experienced proxy will advise you to forego this deal. If you do submit an offer and then discover that you are not satisfied with the due diligence including tenancy history, building renovations or accumulated funds, you should be able to pull back your offer.

Seal the Deal

Once you are satisfied with the due diligence, your proxy is there to help you with the contract and deposit, required documents, deposit and settlement. On the day of settlement, your proxy will pay the rest of the funds on your behalf and the scrivener will perform the ownership transfer from the seller to your name. Within a month you will receive the equivalent of a Title Deed. Congratulations! You just purchased property in Japan from around the globe.

Manage Your Property

You have successfully invested in Japanese property. Now it needs to be managed. Most foreigners do not have a local bank account, physical address or local phone number and therefore, the two challenges are communication and banking. Do not worry. On your behalf, your experienced proxy communicates with the property/rent manager, building management company, tax authorities, and insurance company. The right proxy can also act as your bank account to pay the bills, receive rental income, and provide you with a monthly balance sheet and remittance/acceptance of any funds from overseas.

Finally, what you may not know is that unlike many other countries, there are currently no laws or regulations in Japan prohibiting the purchase of real estate by foreigners. This allows 100% ownership of deeded, freehold property, registered to a foreign address. Currently Japan is the second largest real estate investment market in the world, only behind the U.S.

Priti Donnelly, Sales and Marketing Manager, Nippon Tradings International

Priti Donnelly – Manager, Sales and Marketing

Nippon Tradings International (NTI)