The Los Angeles Real Estate Grand Expo Returns on Oct. 22nd Showcasing Top REI Educators

3rd Annual Los Angeles Real Estate Grand Expo

DATE: Saturday, October 22, 2022

TIME: 9:00 am to 6:00pm

LOCATION: Iman Cultural Center,

3376 Motor Ave,

Los Angeles CA 90034

Keynote Speaker – Rick Sharga: “What to Expect in the Post-Pandemic Real Estate Market”

FREE ADMISSION – FREE PARKING

Watch a video from the 2021 Expo:

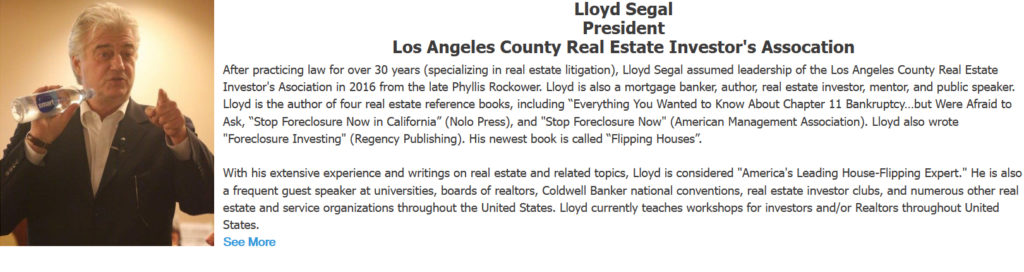

Please join us on Saturday, October 22, 2022 9:00 am to 6:00 pm, for our “Annual Los Angeles Real Estate Grand Expo.” The theme of this year’s Grand Expo will be “Investing in a Pre-Recession Market.” Our Grand Expo will be presented by the Los Angeles County Real Estate Investor’s Association, Sam’s Real Estate Club, and Realty411. An entire day celebrating real estate investing and you can be part of it. There will be twelve national guest speakers (in breakout sessions), and a Vendor Expo area (the size of a hockey rink!) with over 60 real estate related vendors. Best of all, this Grand Expo will be FREE to attend.

Our economy is sliding out of a disastrous pandemic into a recessionary market. Given the challenging real estate climate, this is no time to go in it alone. In a transitioning market like this one, you need experienced and resourceful experts who can teach you how to adapt investment strategies to current conditions. That’s why the theme of this year’s Annual Los Angeles Real Estate Grand Expo is “How to Invest in a Pre-Recession Market.”.

Our unique selection of national speakers has more than four decades of real estate experience and will be sharing their strategies and experiences on how to adapt post-pandemic. Don’t miss this exciting opportunity to rub elbows with the best and the brightest all in one location and all in one day. We look forward to seeing you there!

Don’t miss LA Grand Expo’s Exhibition Hall!

Don’t miss our special “Vendors Expo.” The Vendor Expo will be open all day (9:00 am to 6:00 pm). We will have a collection of over 60 of the finest real estate vendors in Southern California, with all of the professional services you will need to become a successful investor, including private lenders, title companies, data services, CPA, escrow companies, building suppliers, title insurance, home inspectors, business credit, tax auctions, Realtor services, hard money lenders, Airbnb, mortgage brokers, 1031 exchanges facilitators, contractors, out-of-state investment opportunities, insurance agents, credit repair consultants, staging companies, and much MUCH more!

So come early, meet and greet, and expand your “Dream Team” of real estate professionals that are eager to help you succeed. And just like the rest of the Grand Expo, the Vendors Expo will be FREE. But, please RSVP below.

TOPICS COVERED INCLUDE:

- How to fix and flip houses

- How to profit with tax deeds

- Where to invest in a shifting market

- How to invest in multi-residential apartment buildings

- How to buy foreclosures and probates

- Be the lender, not the borrower

- How to get started investing in real estate

- Do’s and don’ts when dealing with tenants

- How to renovate a house

- How to wholesale (assign) properties

- And much, much more!

Complimentary Private Consultations

As a special super-duper unique feature of this year’s Grand Expo, you can sign-up for private, one-on-one consultations with your favorite guest speakers during the Grand Expo. Registration will begin on Saturday morning, starting at promptly at 8:30 am. First come – first serve. So come early and schedule your private consultations. This is a once in a lifetime opportunity!

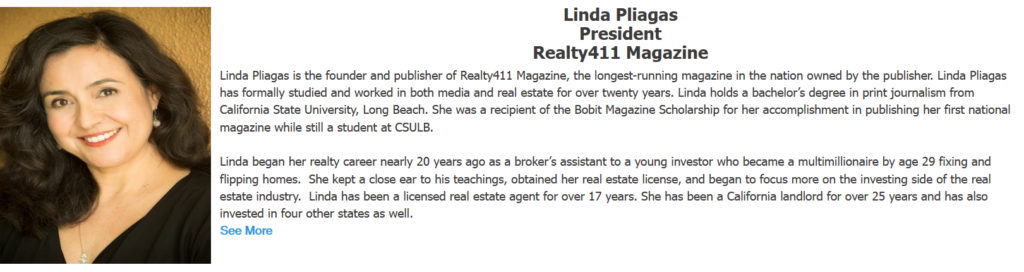

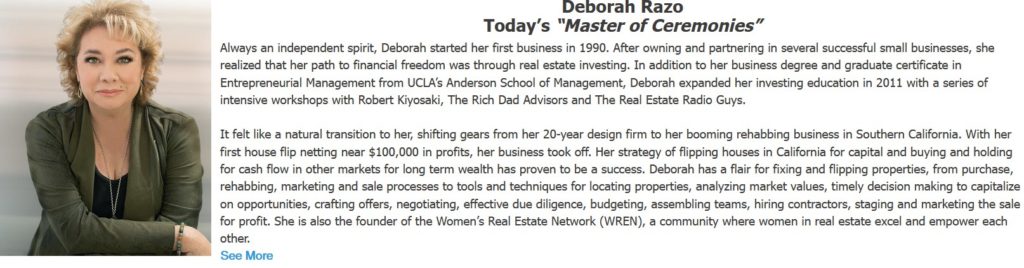

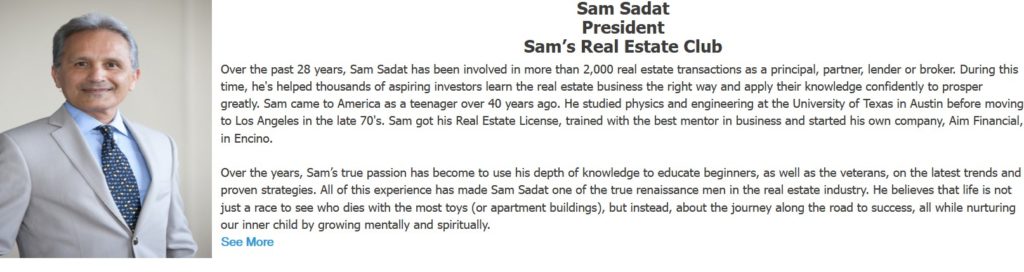

PRESENTERS (in Alphabetical Order):

If you’re like us, you hate real estate gurus who spend their time up-selling products rather than teaching. We understand they need to sell online courses and programs to cover their expenses, and we respect their knowledge. But geez, can’t they at least teach us something first before selling us?

Well, this won’t happen at our Grand Expo! We have required each speaker to sign a solemn promise that they’re going to spend at least 90% of their presentation actually teaching us real estate strategies and techniques. Only then, in the final minutes of their presentation, our speakers will explain what programs and materials they have available for those students that want to pursue that subject in more depth. A fair resolution to all involved, don’t ya think!