by Lori Peebles | Oct. 23, 2017 | 10 am PST

Los Angeles, California – Realty411, the nation’s only real estate investing magazine based in California and freely distributed online and on newsstands, grocery stores, libraries, and coffee shops, will finish 2017 reaching a new record of hosting educational events in eight states.

This year marked Realty411‘s 10-year anniversary. The company began with an $800 investment in the fall of 2007 in Los Angeles. It secured advertisers immediately, the first backers made up from the publisher’s large sphere of influence as a national investor and referring investor agent.

Most of Realty411’s initial advertisers are still engaged in the publisher’s life to date and also celebrated the success of the company, which began as a vehicle to disseminate knowledge and to motivate average Americans to grow their wealth with real estate.

To ensure a phenomenal and ground-breaking year in terms of activity and reaching a large number of investors around the nation, Realty411 contracted four HGTV celebrity educators to appear at their events in Texas and New York, where fans were able to get up-close and personal with their favorite stars from the hit shows Good Bones and Listed Sisters.

An aggressive national media campaign was also planned in the beginning of the year and executed monthly, with massive large scale media buys in top publications around the nation, reaching millions of consumers and business owners. Realty411 also secured numerous editorials and press coverage throughout the year in numerous languages.

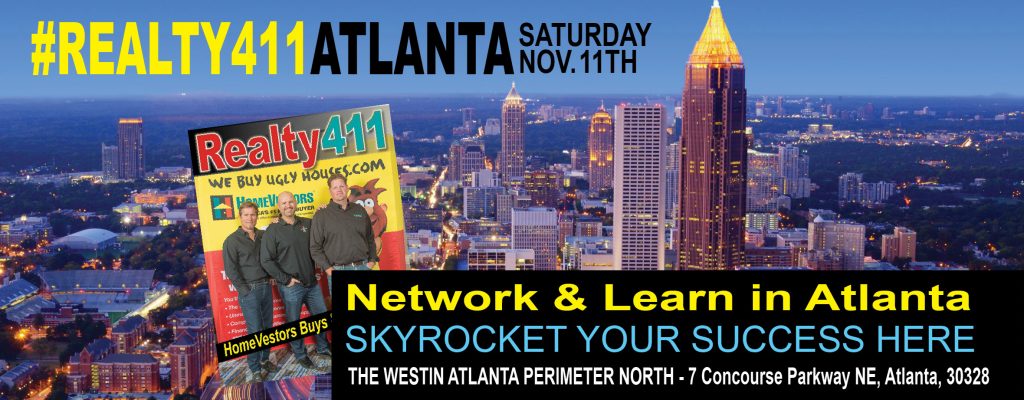

Additionally, a large number of live events were planned: 27 in total number for 2017, reaching people in eight states. The complimentary expos give guests the opportunity to learn about some of the most important companies in the real estate investing space in the areas of finance, turn-key providers, IRA companies, property managers, tech and software applications, plus more.

Attendees also acquire strategies and market updates from some of the most sophisticated thought leaders and legendary REI educators, some with up to 40 years experience in the industry.

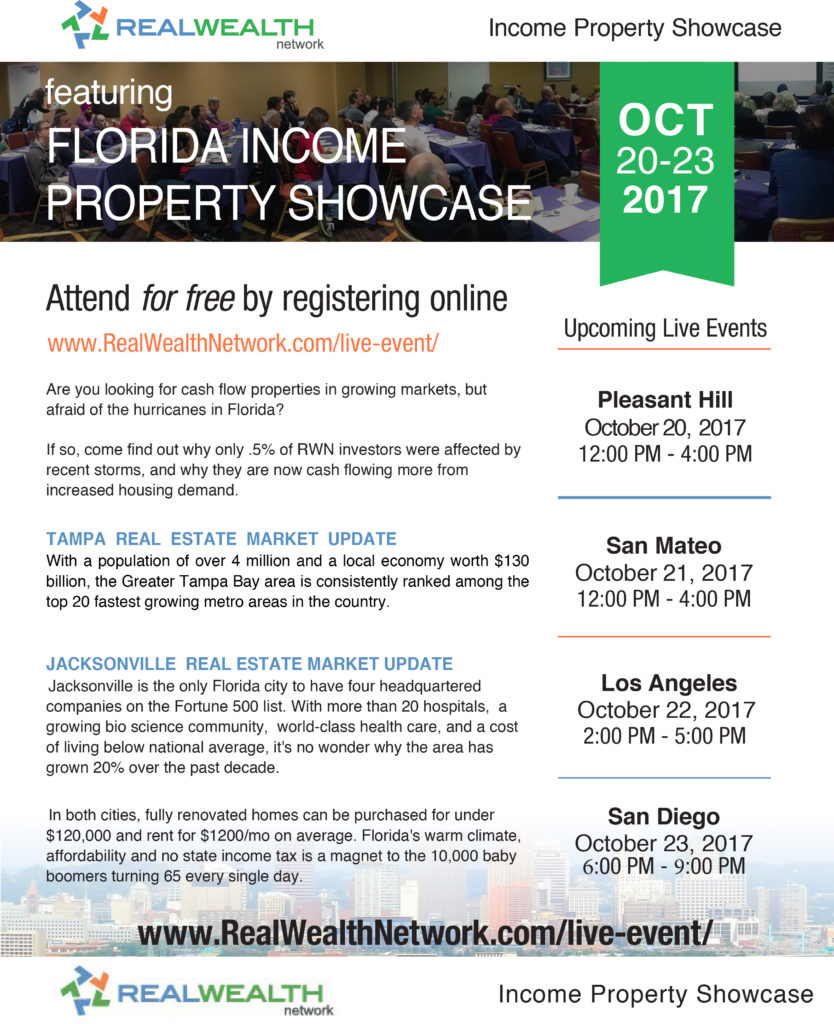

To close out the remainder year, Realty411 will host five more live events in three states: California, Georgia and Florida. Florida, a favorite investor destination, saw a total of three Realty411 events this year alone reaching hundreds of people each time.

Although 2017 was a special year marking the 10-year anniversary of Realty411‘s commencement in media, the company plans on continuing the pace for next year to ensure continued growth and prominence in an industry where investors often fall by the wayside. Many also quickly lose enthusiasm after realizing investing in real estate is a long-term endeavor, which requires planning, research and management to ensure success.

“Some investors lose focus,” admits Linda Pliagas, founder and publisher, “money and motivation are the key factors. They run out of money for their deals or they lose motivation because it’s more difficult than they thought it would be.”

According to Pliagas, her job and the goal of Realty411 is to ensure they stay in the game by giving them access to both: funding and plenty of support.

An active investor, Pliagas recently explained her most recent Fall 2017 transaction to a group in Portland, Oregon. “I am making money simply by purchasing the property,” she stated, “Simply by buying a distressed asset and rehabbing it. Then, I can decide do I want to sell it and do a 1031 exchange, or shall I pay my private lender off by obtaining a 30-year mortgage? Either way, I already made money when I bought it.”

She went on to explain the full details of the simple transaction she is currently engaged in: It is a $160,000 condo in an area where her family owns four other properties already. The ARV is $225,000 and the rehab costs will be about $12,000. She is utilizing zero of her own funds, as the purchase and rehab funds were obtained by a private money lender who she frequently does business with. The property was on the market one day before she swooped in.

She went on to explain the full details of the simple transaction she is currently engaged in: It is a $160,000 condo in an area where her family owns four other properties already. The ARV is $225,000 and the rehab costs will be about $12,000. She is utilizing zero of her own funds, as the purchase and rehab funds were obtained by a private money lender who she frequently does business with. The property was on the market one day before she swooped in.

She is using another property as collateral to obtain a $200,000 loan to do the entire transaction. She plans on paying herself for the purchase and rehab management $25,000, tax free. (The funds are actually equity from her other property, used as collateral for this purchase, so it is tax-free income).

She is leaning towards to then securing a traditional 30-year mortgage on the property purchased to pay off the private lender on the other collateralized house. Whereas the new property will cash flow and still have equity going forward, and the other property will return to being owned free and clear… ready to be leveraged again!

It is these creative real estate nuggets that she and her columnists and educators at the events, freely share for people to learn. It is their personal testimonies of their first-hand investment endeavors throughout the many years in the industry.

Besides providing first-hand knowledge of creative and diverse real estate transactions, Realty411 offers a forum to learn business tips, knowledge of stocks, and FOREX (foreign-exchange).

Diversification and due diligence are always stressed at Realty411 events and within the pages of the publications they deliver. All savvy investors know real estate is cyclical and risky, but bills are not. Having multiple streams of income (MSI) is the new ROI for long-term real estate investors who know how to budget and balance their books, yet still live life to maximum capacity.

______________________________________________________________

Realty411 is currently working on two publications: REI Wealth Monthly featuring Propelio, and their staple, Realty411 featuring HomeVestors of America.

Additionally, Realty411 will host five more events before the close of 2017.

To learn more, please visit and explore their numerous websites, or phone Realty411 directly at 805.693.1497.

Please click below for direct links to our diverse websites.

http://Realty411.com

http://Realty411Expo.com

http://Realty411Guide.com

http://Realty411mag.com

r. Teresa R. Martin, Esq. is the founder of Real Estate Investors Association of NYC (REIA NYC). REIA NYC (www.reianyc.org) is a premier real estate investment association serving the New York City marketplace. Its primary focus and mission is “helping our members build, preserve, and harvest multi-generational wealth” in the areas of real estate investments, business ownership and personal development.

r. Teresa R. Martin, Esq. is the founder of Real Estate Investors Association of NYC (REIA NYC). REIA NYC (www.reianyc.org) is a premier real estate investment association serving the New York City marketplace. Its primary focus and mission is “helping our members build, preserve, and harvest multi-generational wealth” in the areas of real estate investments, business ownership and personal development.

BY TIM HOUGHTEN – EXCLUSIVE REI WEALTH COVER FEATURE

BY TIM HOUGHTEN – EXCLUSIVE REI WEALTH COVER FEATURE

Plus, Kathy Fettke, co-CEO of Real Wealth Network, will share her year-end housing wrap up and predictions for 2018. This will be an all-day event held at a beautiful spa resort in Orlando, Florida. We have negotiated a discount if you wish to stay for the weekend. Rooms have been discounted to $129 for a single and $149 for a double. Details coming soon. (We will send you the hotel information and the discount link once you’ve registered.)

Plus, Kathy Fettke, co-CEO of Real Wealth Network, will share her year-end housing wrap up and predictions for 2018. This will be an all-day event held at a beautiful spa resort in Orlando, Florida. We have negotiated a discount if you wish to stay for the weekend. Rooms have been discounted to $129 for a single and $149 for a double. Details coming soon. (We will send you the hotel information and the discount link once you’ve registered.)